Question: at Time: 10:31 AM / Remaining 23 min. Additional Problem 05 The following information is taken from the accounting records of Pharoah Corporation, a Canadian

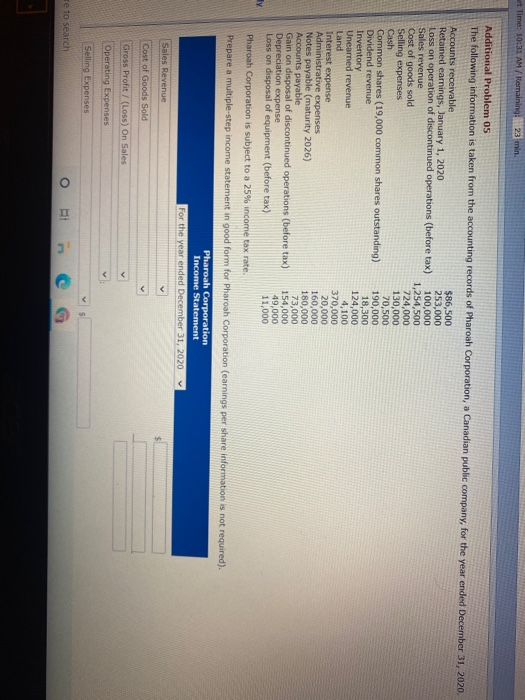

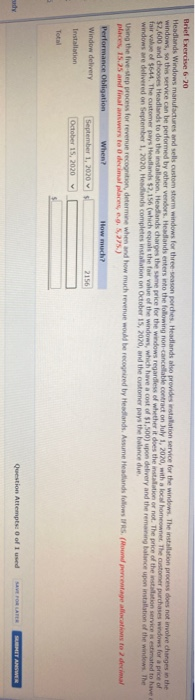

at Time: 10:31 AM / Remaining 23 min. Additional Problem 05 The following information is taken from the accounting records of Pharoah Corporation, a Canadian public company, for the year ended December 31, 2020. Accounts receivable $86,500 Retained earnings, January 1, 2020 253,000 Loss on operation of discontinued operations (before tax) 100,000 Sales revenue 1,254,500 Cost of goods sold 724,000 Selling expenses 130,000 Cash 70,500 Common shares (19,000 common shares outstanding) 190,000 Dividend revenue 18,300 Inventory 124,000 Unearned revenue 4,100 Land 370,000 Interest expense 20,000 Administrative expenses 160,000 Notes payable (maturity 2026) 180,000 Accounts payable 73,000 Gain on disposal of discontinued operations (before tax) 154,000 Depreciation expense 49,000 Loss on disposal of equipment (before tax) 11,000 Pharoah Corporation is subject to a 25% income tax rate. Prepare a multiple-step income statement in good form for Pharoah Corporation (earnings per share information is not required) Pharoah Corporation Income Statement For the year ended December 31, 2020 ly Sales Revenue Cost of Goods Sold Gross Profit/ (Loss) On Sales Operating Expenses Selling Expenses Te to search O II c G Brief Exercise 6-20 Headlands Windows manufactures and sells custom storm windows for three season porches. Headlands also provides installation service for the windows. The installation process does not involve changes in the windows, so this service can be performed by other vendors. Headlands enters into the following non-cancellable contract on July 1, 2020, with a local homeowner. The customer purchases windows for a price of $2,600 and chooses Headlands to do the installation. Headlands charges the same price for the windows regardless of whether it does the installation or not. The price of the installation service is estimated to have fair value of $614. The customer pays Headlands $2,156 (which equals the fair value of the windows, which have a cost of $1,500) upon delivery and the remaining balance upon installation of the windows. The windows we delivered on September 1, 2020, Headlands completes installation on October 15, 2020, and the customer pays the balance de Using the five step process for revenue recognition determine when and how much revenue would be recognized by Headlands. Asume Headlands follows IFRS. (Rounderstage allocations to decima places, 15.25 and final answers to decimal plans, 275) Performance Obligation When? How much? Window delivery September 1, 2020 2156 Installation October 15, 2020 Total uy Question Attempts of I used E POLAR SUMMET

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts