Question: Please answer in detail. Thanks! Additional Problem 5 The following information is taken from the accounting records of Sunland Corporation, a Canadian public company, for

Please answer in detail. Thanks!

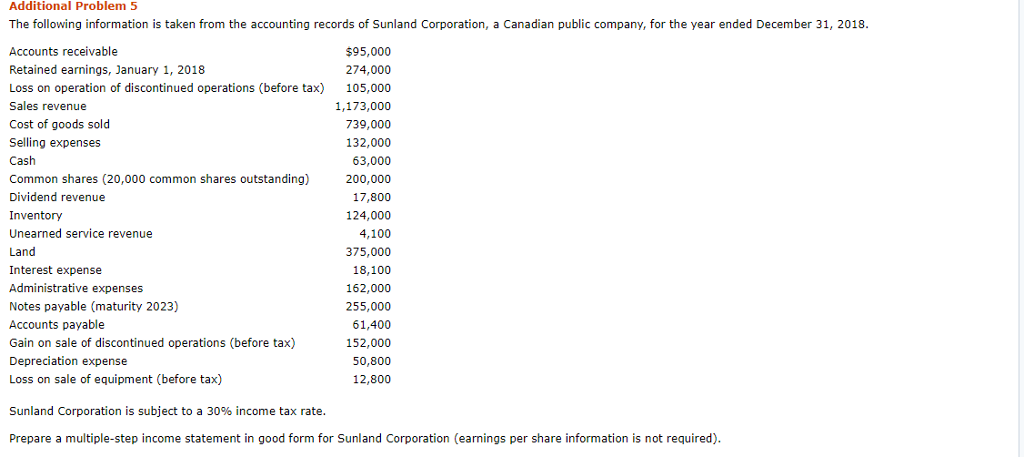

Additional Problem 5 The following information is taken from the accounting records of Sunland Corporation, a Canadian public company, for the year ended December 31, 2018. Accounts receivable Retained earnings, January 1, 2018 Loss on operation of discontinued operations (before tax) Sales revenue Cost of goods sold Selling expenses Cash Common shares (20,000 common shares outstanding) Dividend revenue Inventory Unearned service revenue Land Interest expense Administrative expenses Notes payable (maturity 2023) Accounts payable Gain on sale of discontinued operations (before tax) Depreciation expense Loss on sale of equipment (before tax) $95,000 274,000 105,000 1,173,000 739,000 132,000 63,000 200,000 17,800 124,000 4,100 375,000 18,100 162,000 255,000 61,400 152,000 50,800 12,800 Sunland Corporation is subject to a 30% income tax rate Prepare a multiple-step income statement in good form for Sunland Corporation (earnings per share information is not required)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts