Question: At year end, the TOTES accountant prepares a summary of production and inventory data for the year (Exhibit 3-B) and a partial income statement

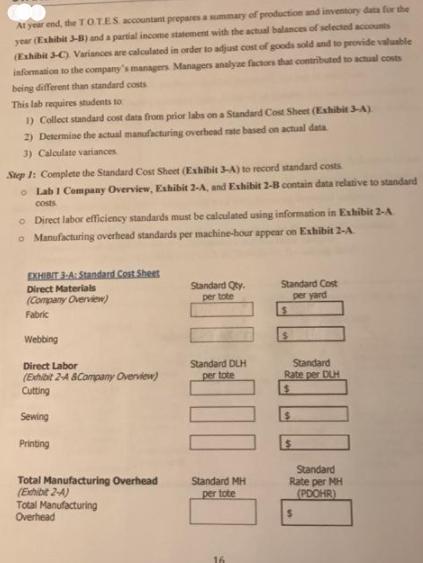

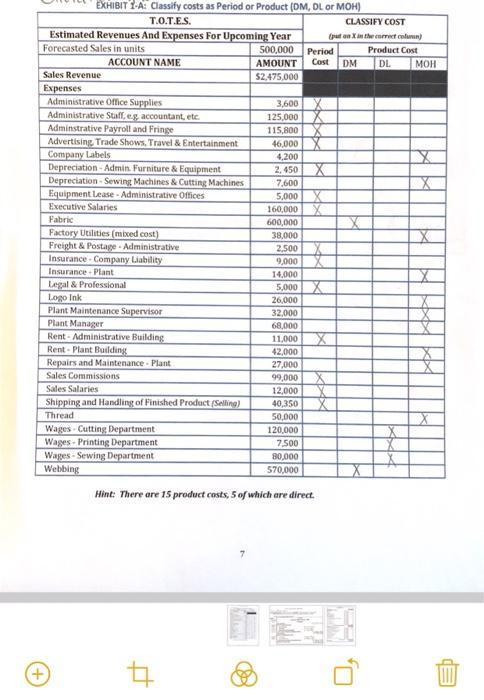

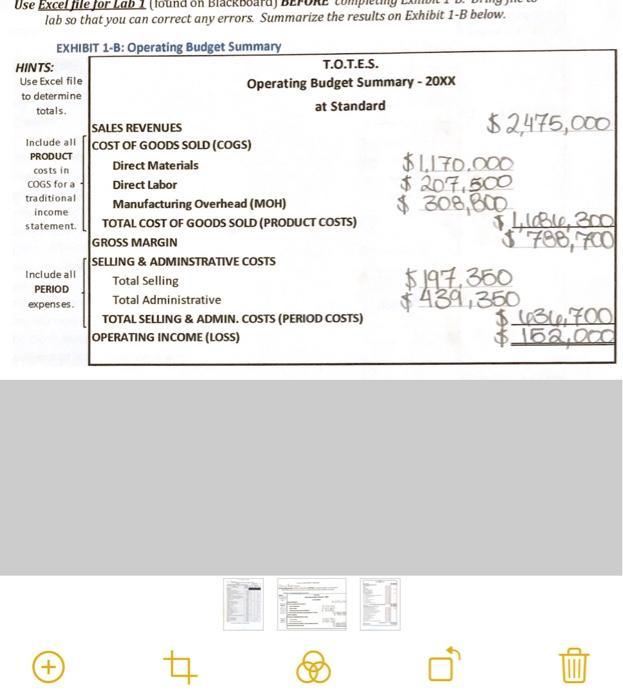

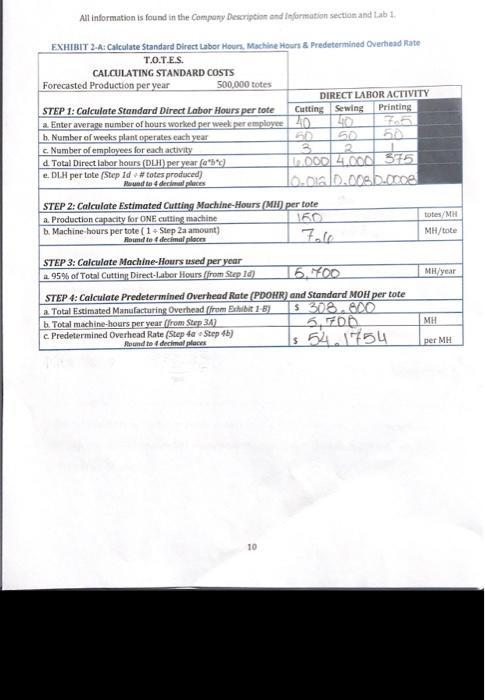

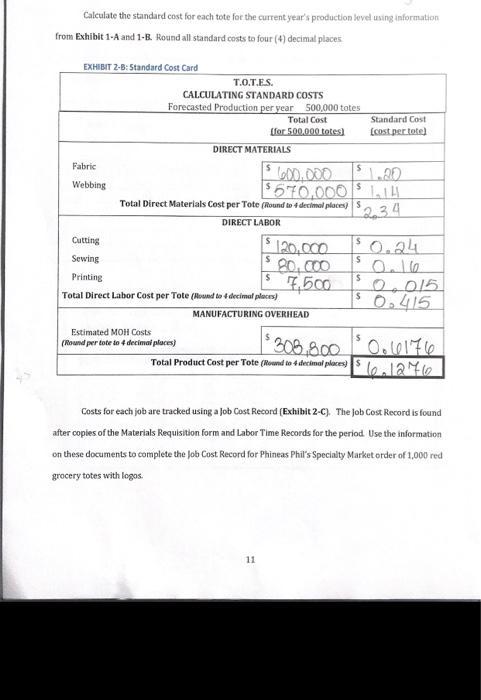

At year end, the TOTES accountant prepares a summary of production and inventory data for the year (Exhibit 3-B) and a partial income statement with the actual balances of selected accounts (Exhibit 3-C). Variances are calculated in order to adjust cost of goods sold and to provide valuable information to the company's managers Managers analyze factors that contributed to actual costs being different than standard costs This lab requires students to 1) Collect standard cost data from prior labs on a Standard Cost Sheet (Exhibit 3-A). 2) Determine the actual manufacturing overhead rate based on actual data. 3) Calculate variances Step 1: Complete the Standard Cost Sheet (Exhibit 3-A) to record standard costs o Lab 1 Company Overview, Exhibit 2-A, and Exhibit 2-B contain data relative to standard costs o Direct labor efficiency standards must be calculated using information in Exhibit 2-A o Manufacturing overhead standards per machine-hour appear on Exhibit 2-A EXHIBIT 3-A: Standard Cost Sheet Direct Materials (Company Overview) Fabric Webbing Direct Labor (Exhibit 2-A &Company Overview) Cutting Sewing Printing Total Manufacturing Overhead (Exhibit 2-A) Total Manufacturing Overhead Standard Qty. per tote Standard DLH per tote Standard MH per tote 16 1000004 Standard Cost per yard Standard Rate per DLH Standard Rate per MH $ (PDOHR) Step 2: Read the lab carefully. Step 3: Complete Exhibit 3-A, the Standard Cost Card. Data will be found in multiple locations as stated in the lab instructions. Carry data to four (4) decimal places. EXHIBIT 1-A: Classify costs as Period or Product (DM, DL or MOH) T.O.T.E.S. + Estimated Revenues And Expenses For Upcoming Year Forecasted Sales in units 500,000 ACCOUNT NAME Sales Revenue Expenses Administrative Office Supplies Administrative Staff, eg, accountant, etc. Adminstrative Payroll and Fringe Advertising, Trade Shows, Travel & Entertainment Company Labels Depreciation Admin. Furniture & Equipment Depreciation Sewing Machines & Cutting Machines Equipment Lease-Administrative Offices Executive Salaries Fabric Factory Utilities (mixed cost) Freight & Postage-Administrative. Insurance Company Liability Insurance Plant Legal & Professional Logo Ink Plant Maintenance Supervisor Plant Manager Rent Administrative Building Rent-Plant Building Repairs and Maintenance - Plant Sales Commissions Sales Salaries Shipping and Handling of Finished Product (Selling) Thread Wages Cutting Department Wages Printing Department Wages-Sewing Department Webbing 4 Period AMOUNT Cost DM $2,475,000 3,600X 125,000 X 115,800 X 46,000 X 4,200 2,450 X 7,600 5,000 X 160,000 X 600,000 38,000 2,500 9,000 14,000 XXXX X CLASSIFY COST (put on Xin the correct column) Product Cost 5,000 26,000 32,000 68,000 11,000 X 42,000 27,000 99,000 12,000 40,350 50,000 120,000 7,500 80,000 570,000 Hint: There are 15 product costs, 5 of which are direct. X X X X DL MOH X X X X X Use Excel file for Lab 1 (found on Blackboard) lab so that you can correct any errors. Summarize the results on Exhibit 1-B below. EXHIBIT 1-B: Operating Budget Summary HINTS: Use Excel file to determine totals. Include all PRODUCT costs in COGS for a traditional income statement. Include all PERIOD expenses. + SALES REVENUES COST OF GOODS SOLD (COGS) Direct Materials Direct Labor Manufacturing Overhead (MOH) TOTAL COST OF GOODS SOLD (PRODUCT COSTS) GROSS MARGIN SELLING & ADMINSTRATIVE COSTS Total Selling Total Administrative T.O.T.E.S. Operating Budget Summary - 20XX at Standard TOTAL SELLING & ADMIN. COSTS (PERIOD COSTS) OPERATING INCOME (LOSS) 4 $2,475,000 $1.170.000 $207,500 $308,800 0 $Lilable, 300 3 788,700 $197.350 $439,350 $636,700 $152,000 All information is found in the Company Description and Information section and Lab 1, EXHIBIT 2-A: Calculate Standard Direct Labor Hours, Machine Hours & Predetermined Overhead Rate T.O.T.E.S. CALCULATING STANDARD COSTS Forecasted Production per year 500,000 totes STEP 1: Calculate Standard Direct Labor Hours per tote a. Enter average number of hours worked per week per employee h. Number of weeks plant operates each year c. Number of employees for each activity d. Total Direct labor hours (DLH) per year (a*b*c) e. DLH per tote (Step 1d # totes produced) Round to 4 decimal places STEP 3: Calculate Machine-Hours used per year a 95% of Total Cutting Direct-Labor Hours (from Step 14) DIRECT LABOR ACTIVITY Cutting Sewing Printing 40 40 7.5 STEP 2: Calculate Estimated Cutting Machine-Hours (MH) per tote a. Production capacity for ONE cutting machine b. Machine-hours per tote (1+ Step 2a amount) Round to 4 decimal places Fale 10 50 50 3 10.000 4.000 375 10-016/0.0080.000e 16.700 STEP 4: Calculate Predetermined Overhead Rate (PDOHR) and Standard MOH per tote a Total Estimated Manufacturing Overhead (from Exhibit 1-8) b. Total machine-hours per year (from Step 3A) $ 308.800 5,700 $ 54.1754 c. Predetermined Overhead Rate (Step 4a Step 4b) Round to 4 decimal places totes/Mi MH/tote MH/year MH per MH Calculate the standard cost for each tote for the current year's production level using information from Exhibit 1-A and 1-B. Round all standard costs to four (4) decimal places EXHIBIT 2-8: Standard Cost Card Fabric Webbing Cutting Sewing Printing T.O.T.E.S. CALCULATING STANDARD COSTS Forecasted Production per year 500,000 totes Total Cost (for 500.000 totes) DIRECT MATERIALS Total Direct Materials Cost per Tote (Round to 4 decimal places) S DIRECT LABOR $ Estimated MOH Costs (Round per tote to 4 decimal places) 600,000 $570,000 $1,14 $234 $ $ Total Direct Labor Cost per Tote (Round to 4 decimal places) 80,000 7,500 MANUFACTURING OVERHEAD 11 Standard Cost [cost per tote) $ 0.24 $ S 0.015 1$ 0.415 308,8.00 0.6176 Total Product Cost per Tote (Round to 4 decimal places) $0.1276 Costs for each job are tracked using a Job Cost Record (Exhibit 2-C). The Job Cost Record is found after copies of the Materials Requisition form and Labor Time Records for the period. Use the information on these documents to complete the Job Cost Record for Phineas Phil's Specialty Market order of 1,000 red grocery totes with logos.

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Standard rate per DLH total labour expenses for that departmenttotal number of h... View full answer

Get step-by-step solutions from verified subject matter experts