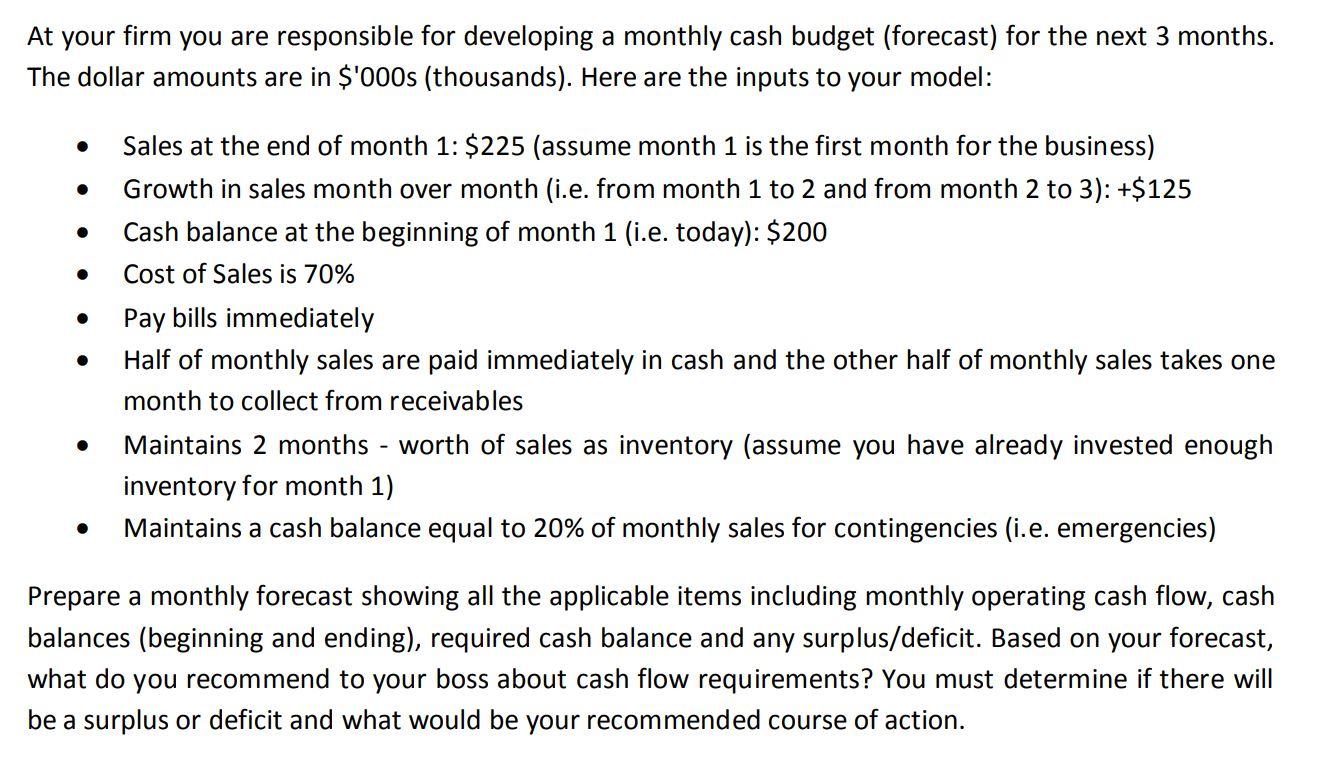

Question: At your firm you are responsible for developing a monthly cash budget (forecast) for the next 3 months. The dollar amounts are in $'000s

At your firm you are responsible for developing a monthly cash budget (forecast) for the next 3 months. The dollar amounts are in $'000s (thousands). Here are the inputs to your model: Sales at the end of month 1: $225 (assume month 1 is the first month for the business) Growth in sales month over month (i.e. from month 1 to 2 and from month 2 to 3): +$125 Cash balance at the beginning of month 1 (i.e. today): $200 Cost of Sales is 70% Pay bills immediately Half of monthly sales are paid immediately in cash and the other half of monthly sales takes one month to collect from receivables Maintains 2 months - worth of sales as inventory (assume you have already invested enough inventory for month 1) Maintains a cash balance equal to 20% of monthly sales for contingencies (i.e. emergencies) Prepare a monthly forecast showing all the applicable items including monthly operating cash flow, cash balances (beginning and ending), required cash balance and any surplus/deficit. Based on your forecast, what do you recommend to your boss about cash flow requirements? You must determine if there will be a surplus or deficit and what would be your recommended course of action.

Step by Step Solution

3.36 Rating (165 Votes )

There are 3 Steps involved in it

SOLUTION Based on the inputs provided here is the monthly cash budget forecast for the next 3 months ... View full answer

Get step-by-step solutions from verified subject matter experts