Question: ATC 1 1 - 1 Business pplications Operating Leverage SPECIAL NOTE: The case requires the calculation of operating leverage for 2 companies and a comparison.

ATC Business pplications Operating Leverage

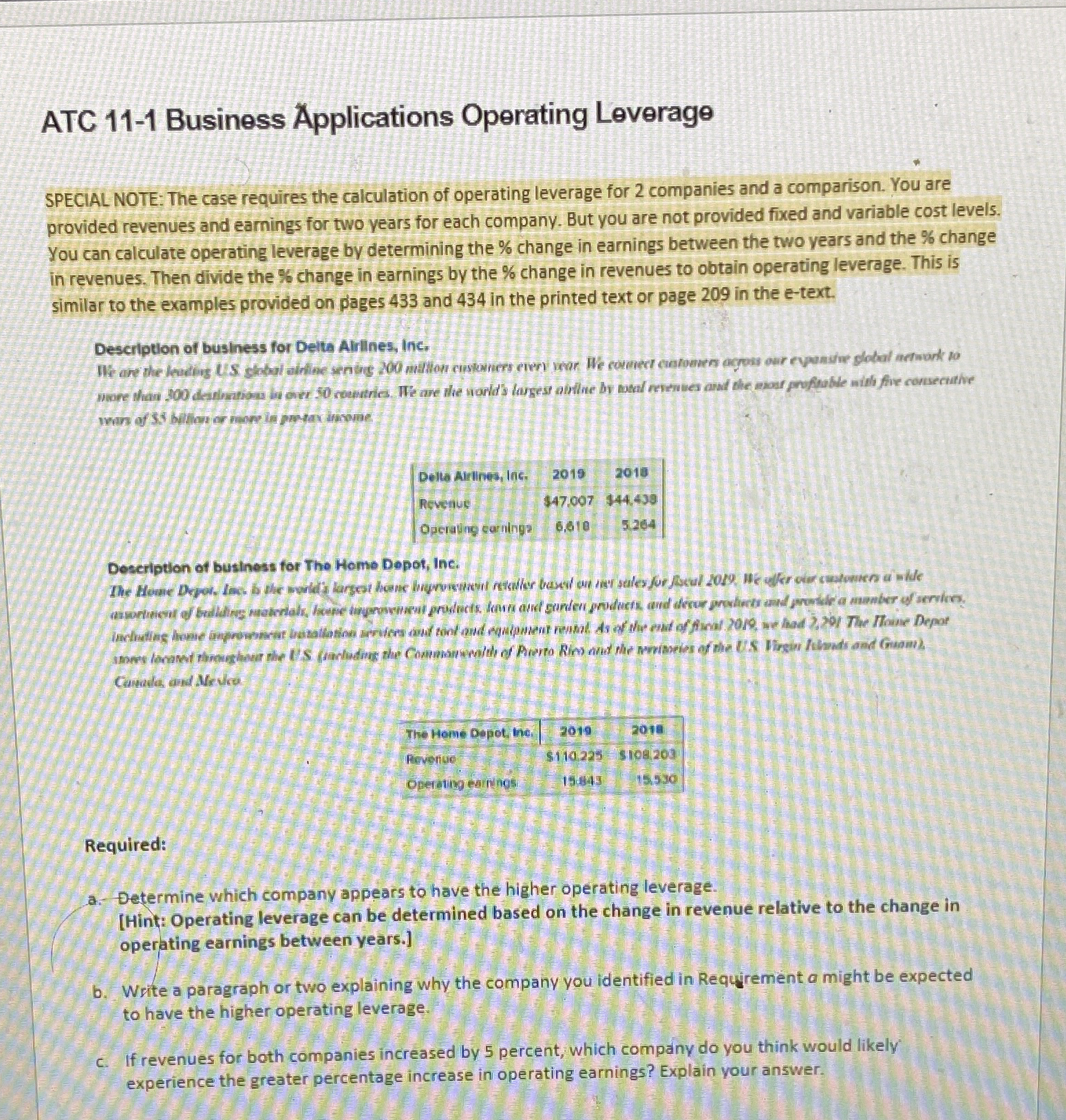

SPECIAL NOTE: The case requires the calculation of operating leverage for companies and a comparison. You are provided revenues and earnings for two vears for each company. But you are not provided fixed and variable cost levels. You can calculate operating leverage by determining the change in earnings between the two years and the change in revenues. Then divide the change in earnings by the change in revenues to obtain operating leverage. This is similar to the examples provided on pages and in the printed text or page in the etext.

Description of business for Delta Alilines, Inc.

tableDella Aritlines, lac Reverueoperaving euninge,

Deseription of business for The Home Depot, Ine. Canade and Mrula.

tableThe Hom Depot the,Piverituestol Operatugeatringes

Required:

a Determine which company appears to have the higher operating leverage.

Hint: Operating leverage can be determined based on the change in revenue relative to the change in operating earnings between years.

b Write a paragraph or two explaining why the company you identified in Requirement a might be expected to have the higher operating leverage.

If revenues for both companies increased by percent, which company do you think would likely experience the greater percentage increase in operating earnings? Explain your answer.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock