Question: ATC 11-1 Business Applications Operating Leverage SPECIAL NOTE: The case requires the calculation of operating leverage for 2 companies and a comparison. You are provided

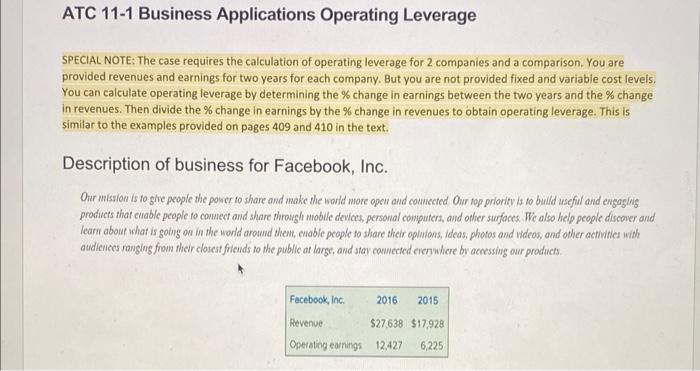

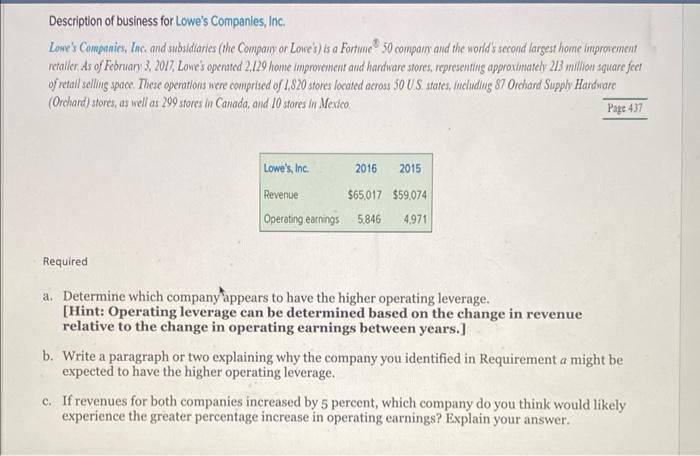

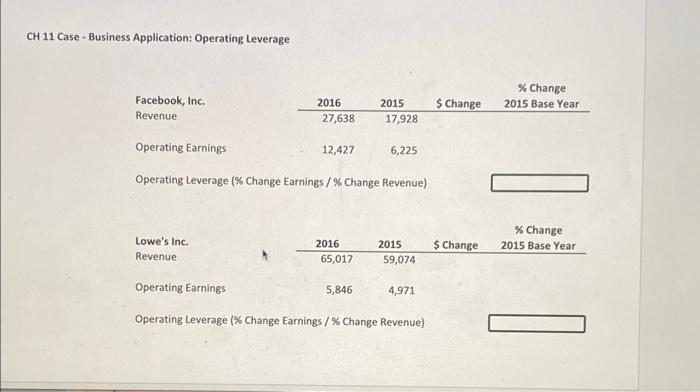

ATC 11-1 Business Applications Operating Leverage SPECIAL NOTE: The case requires the calculation of operating leverage for 2 companies and a comparison. You are provided revenues and earnings for two years for each company. But you are not provided fixed and variable cost levels. You can calculate operating leverage by determining the % change in earnings between the two years and the % change in revenues. Then divide the % change in earnings by the % change in revenues to obtain operating leverage. This is similar to the examples provided on pages 409 and 410 in the text. Description of business for Facebook, Inc. Our mission is to ghe people the poner to share and make the world more opoun and connected. Our top priority is to buld useful and ensaging products that enable people to covmect and share through mobile devices, personal computers, and other surfaces. We also help people discover and learn about what is going on in the world around thent, enable people to share their opinions, ideas, photos and videos, and other activitien with audiences ranging fromn their closest friends to the public at large, and stay connected eienwhere by aceessing our products Description of business for Lowe's Companies, Inc. Lone's Companies, Inc, and subsidiaries (the Company or Lone's) is a Fortucc 50 50 company and the norid's second largest home improeneunt retaller As of Februan 3, 2017, Lones operated 2.129 home improvement and hardware stores, representing approximately 213 million square feet of retail selling space. These operations were comprised of 1,520 stores located across 50 US states, including 87 Orchard Supply Hardware (Orchand) stores, as well as 299 stores in Canadd, and 10 stores in Mevico Page 437 Required a. Determine which company appears to have the higher operating leverage. [Hint: Operating leverage can be determined based on the change in revenue relative to the change in operating earnings between years.] b. Write a paragraph or two explaining why the company you identified in Requirement a might be expected to have the higher operating leverage. c. If revenues for both companies increased by 5 percent, which company do you think would likely experience the greater percentage increase in operating earnings? Explain your answer. CH 11 Case - Business Application: Operating Leverage uperating Leverage (\% Change Earnings / \% Change Revenue) Operating Leverage (\% Change Earnings / % Change Revenue)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts