Question: atino Linotyp 10 - A A A A E 2! . I U dbx, * A-D A !. . . 1 Normal 1 No Spac...

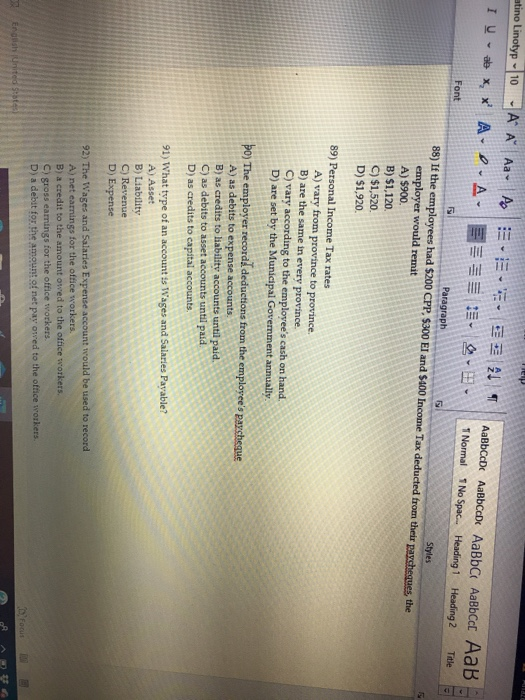

atino Linotyp 10 - A A A A E 2! . I U dbx, * A-D A !. . . 1 Normal 1 No Spac... Heading 1 Heading 2 Title Font Paragraph 88) If the employees had $200 CPP, $300 El and $400 Income Tax deducted from their paycheques the employer would remit Styles A) $900 B) $1,120. C) $1,520 D) $1,920 89) Personal Income Tax rates A) vary from province to province. B) are the same in every province C) vary according to the employee's cash on hand D) are set by the Municipal Government annually po) The employer records deductions from the employee's paychegue A) as debits to expense accounts. B) as credits to liability accounts until paid. C) as debits to asset accounts until paid D) as credits to capital accounts 91) What type of an account is Wages and Salaries Payable? A) Asset B) Liability C) Revenue D) Expense 92) The Wages and Salaries Expense account would be used to record A) net earnings for the office workers. B) a credit to the amount owed to the office workers. C) gross camings for the office workers. D) a debit for the amount of net pay owed to the office workers. 3 English (United States Focus AA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts