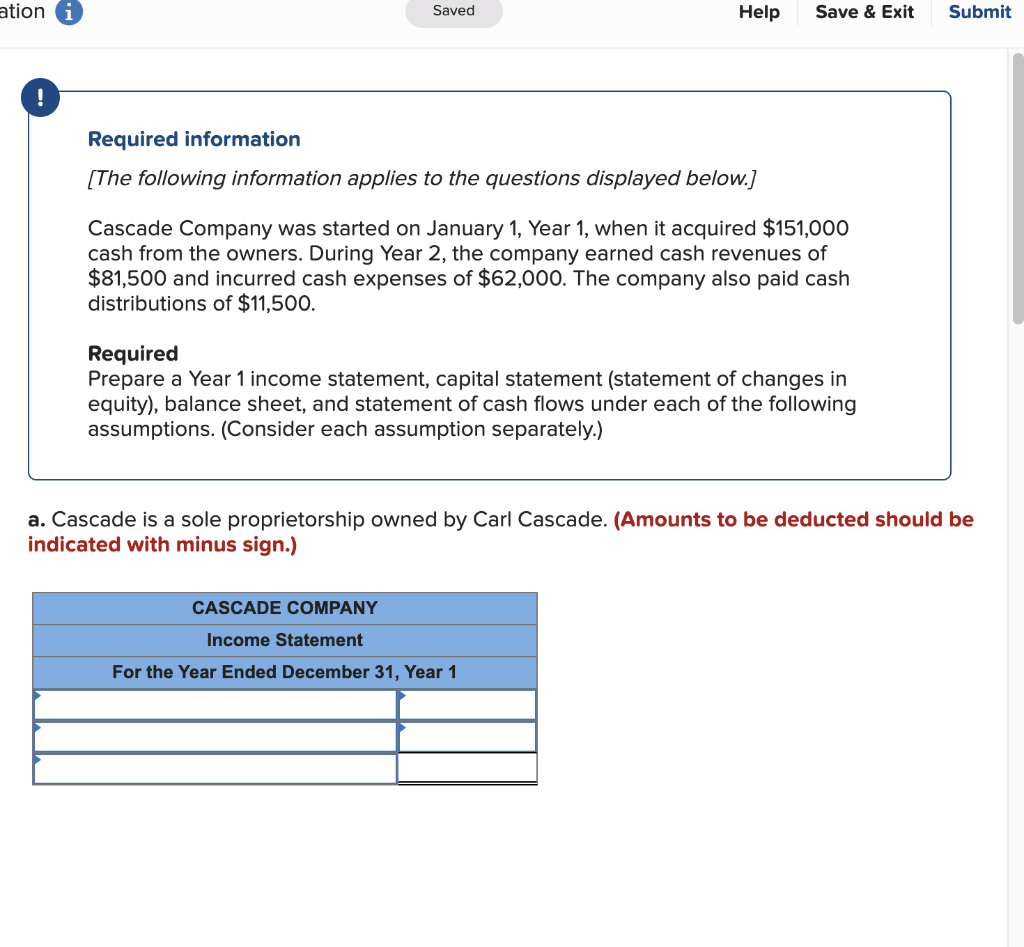

Question: ation i Save & Exit Submit Saved Help Required information [The following information applies to the questions displayed below.] Cascade Company was started on January

![following information applies to the questions displayed below.] Cascade Company was started](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e5356fbc6f0_45566e5356f50e64.jpg)

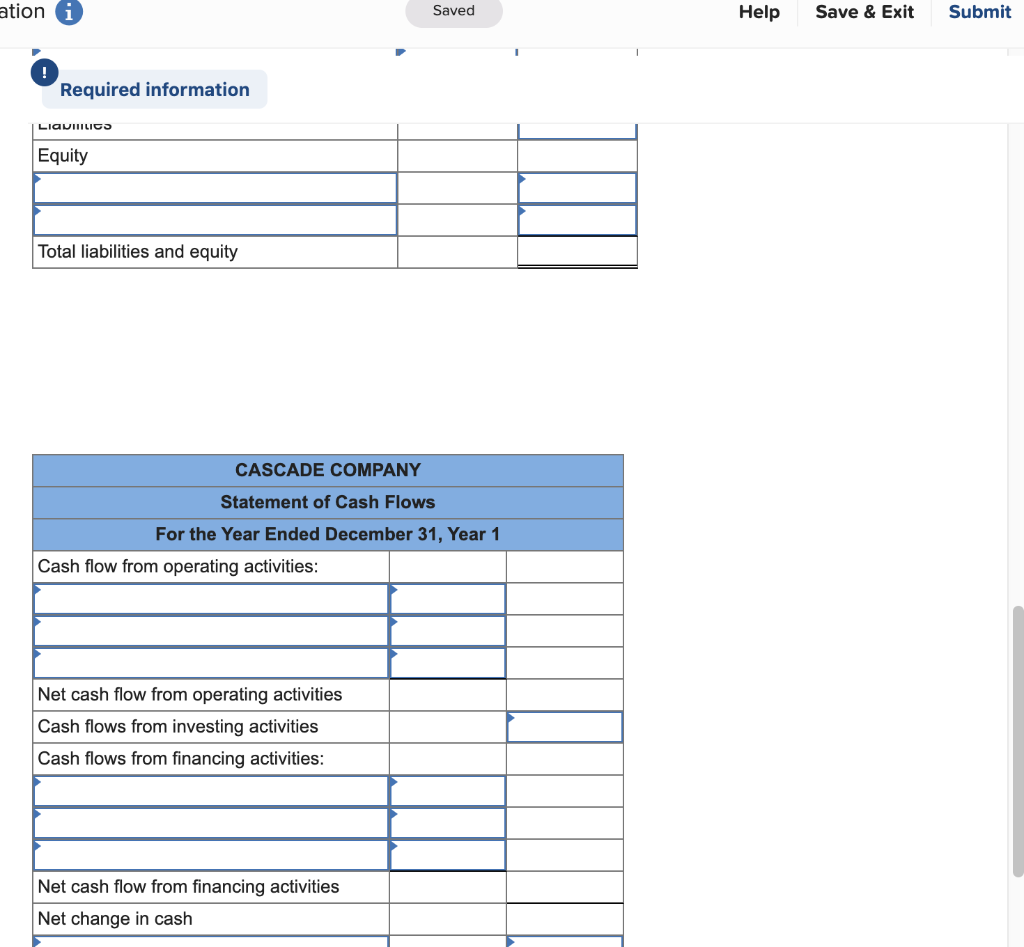

ation i Save & Exit Submit Saved Help Required information [The following information applies to the questions displayed below.] Cascade Company was started on January 1, Year 1, when it acquired $151,000 cash from the owners. During Year 2, the company earned cash revenues of $81,500 and incurred cash expenses of $62,000. The company also paid cash distributions of $11,500. Required Prepare a Year 1 income statement, capital statement (statement of changes in equity), balance sheet, and statement of cash flows under each of the following assumptions. (Consider each assumption separately.) a. Cascade is a sole proprietorship owned by Carl Cascade. (Amounts to be deducted should be indicated with minus sign.) CASCADE COMPANY Income Statement For the Year Ended December 31, Year 1 ation i Saved Help Save & Exit Submit Required information Capital Statement For the Year Ended December 31, Year 1 CASCADE COMPANY Balance Sheet As of December 31, Year 1 Assets Total Assets Liabilities Equity ation i Saved Help Save & Exit Submit Required information Liauilmieo Equity Total liabilities and equity CASCADE COMPANY Statement of Cash Flows For the Year Ended December 31, Year 1 Cash flow from operating activities Net cash flow from operating activities Cash flows from investing activities Cash flows from financing activities: Net cash flow from financing activities Net change in cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts