Question: Attached below is what i previosuly got wrong they show you the formula to follow then the second picture is what i need solving. thanks

Attached below is what i previosuly got wrong they show you the formula to follow then the second picture is what i need solving. thanks

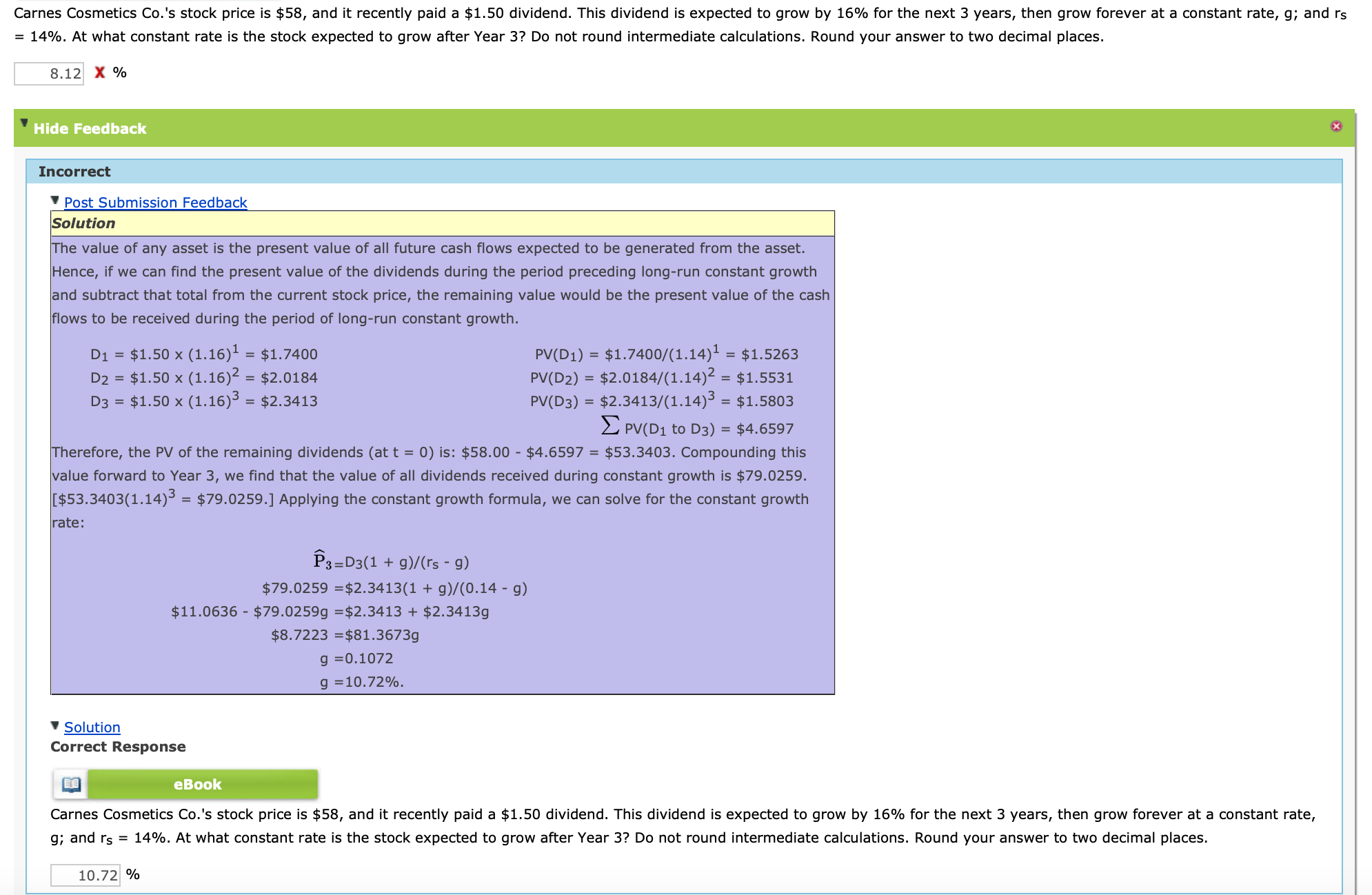

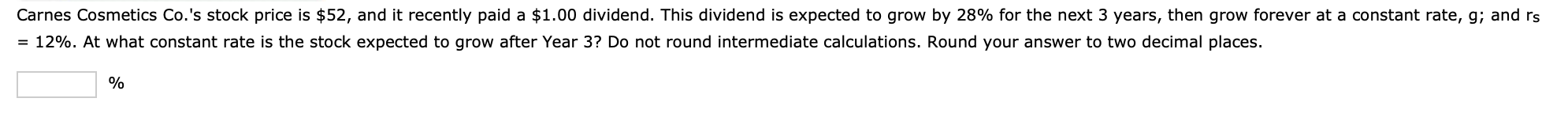

Carnes Cosmetics Co. 's stock price is $58, and it recently paid a $1.50 dividend. This dividend is expected to grow by 16% for the next 3 years, then grow forever at a constant rate, g; and r s =14%. At what constant rate is the stock expected to grow after Year 3 ? Do not round intermediate calculations. Round your answer to two decimal places. x% V Hide Feedback Incorrect Post Submission Feedback Solution The value of any asset is the present value of all future cash flows expected to be generated from the asset. Hence, if we can find the present value of the dividends during the period preceding long-run constant growth and subtract that total from the current stock price, the remaining value would be the present value of the cash flows to be received during the period of long-run constant growth. D1=$1.50(1.16)1=$1.7400D2=$1.50(1.16)2=$2.0184D3=$1.50(1.16)3=$2.3413PV(D1)=$1.7400/(1.14)1=$1.5263PV(D2)=$2.0184/(1.14)2=$1.5531PV(D3)=$2.3413/(1.14)3=$1.5803LV(D1toD3)=$4.6597 Therefore, the PV of the remaining dividends (at t=0 ) is: $58.00$4.6597=$53.3403. Compounding this value forward to Year 3 , we find that the value of all dividends received during constant growth is $79.0259. [$53.3403(1.14)3=$79.0259.] Applying the constant growth formula, we can solve for the constant growth rate: P3$79.0259$11.0636$79.0259g$8.7223gg=D3(1+g)/(rsg)=$2.3413(1+g)/(0.14g)=$2.3413+$2.3413g=$81.3673g=0.1072=10.72%. Solution Correct Response Carnes Cosmetics Co.'s stock price is $58, and it recently paid a $1.50 dividend. This dividend is expected to grow by 16% for the next 3 years, then grow forever at a constant rate, g; and rs=14%. At what constant rate is the stock expected to grow after Year 3 ? Do not round intermediate calculations. Round your answer to two decimal places. % Carnes Cosmetics Co.'s stock price is $52, and it recently paid a $1.00 dividend. This dividend is expected to grow by 28% for the next 3 years, then grow forever at a constant rate, g; and r s =12%. At what constant rate is the stock expected to grow after Year 3 ? Do not round intermediate calculations. Round your answer to two decimal places. %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts