Question: Attached below is what i previosuly got wrong they show you the formula to follow then the second picture is what i need solving. thanks

Attached below is what i previosuly got wrong they show you the formula to follow then the second picture is what i need solving. thanks

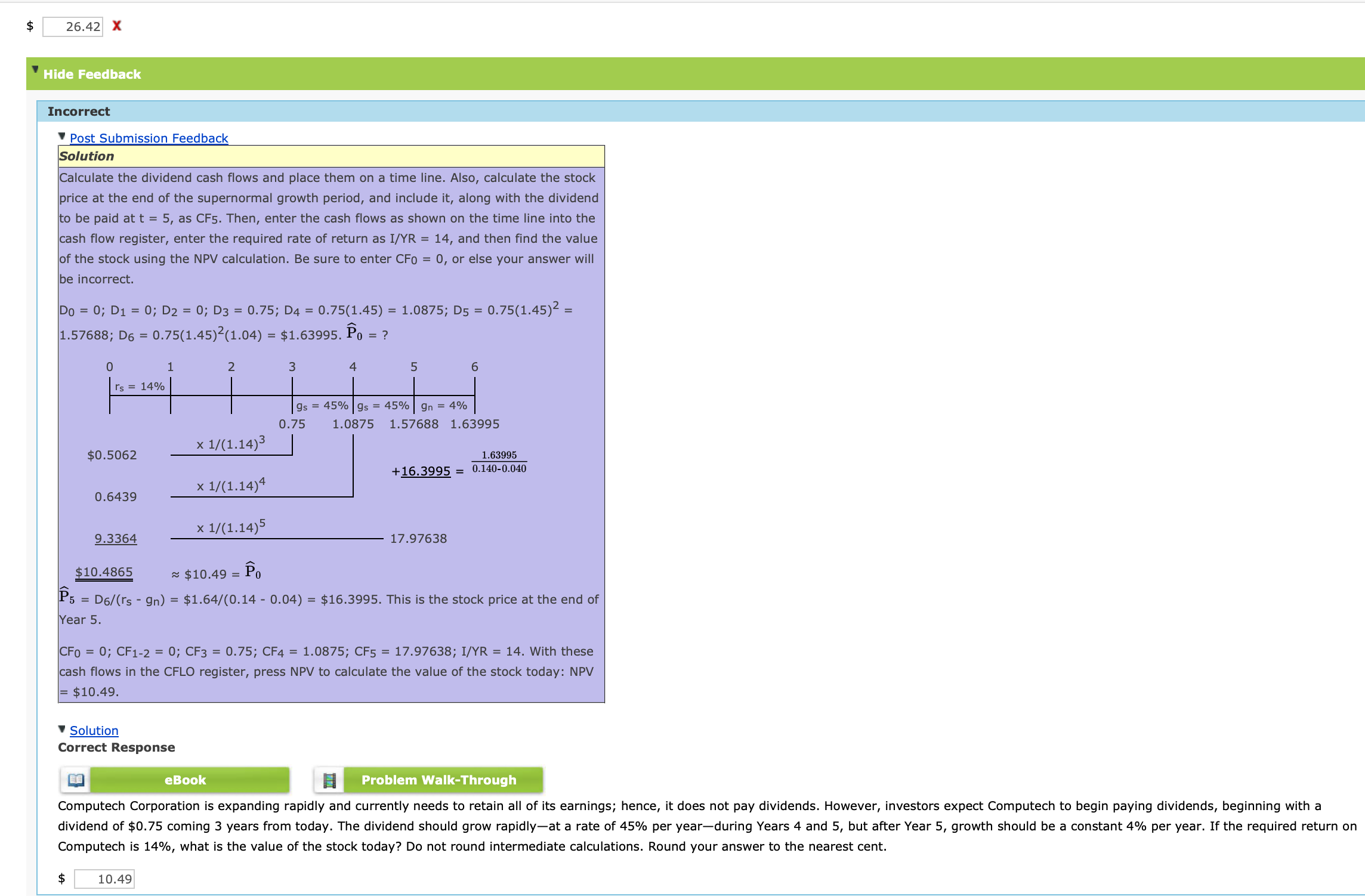

Calculate the dividend cash flows and place them on a time line. Also, calculate the stock price at the end of the supernormal growth period, and include it, along with the dividend to be paid at t=5, as CF5. Then, enter the cash flows as shown on the time line into the cash flow register, enter the required rate of return as I/YR=14, and then find the value of the stock using the NPV calculation. Be sure to enter CFo =0, or else your answer will be incorrect. D0=0;D1=0;D2=0;D3=0.75;D4=0.75(1.45)=1.0875;D5=0.75(1.45)2=1.57688;D6=0.75(1.45)2(1.04)=$1.63995.P0=? $10.4865$10.49=P0P5=D6/(rsgn)=$1.64/(0.140.04)=$16.3995.ThisisthestockpriceattheendofYear5.C0=0;CF12=0;CF3=0.75;CF4=1.0875;CF5=17.97638;I/YR=14.Withthese Solution Correct Response Computech is 14%, what is the value of the stock today? Do not round intermediate calculations. Round your answer to the nearest cent. $ the value of the stock today? Do not round intermediate calculations. Round your answer to the nearest cent. $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts