Question: ATTEMPT ANY TWO QUESTIONS ( MAF 9 4 1 ADVANCED TAXATION ) QUESTION ONE The BOOK PROFIT is the accounting profit found in the income

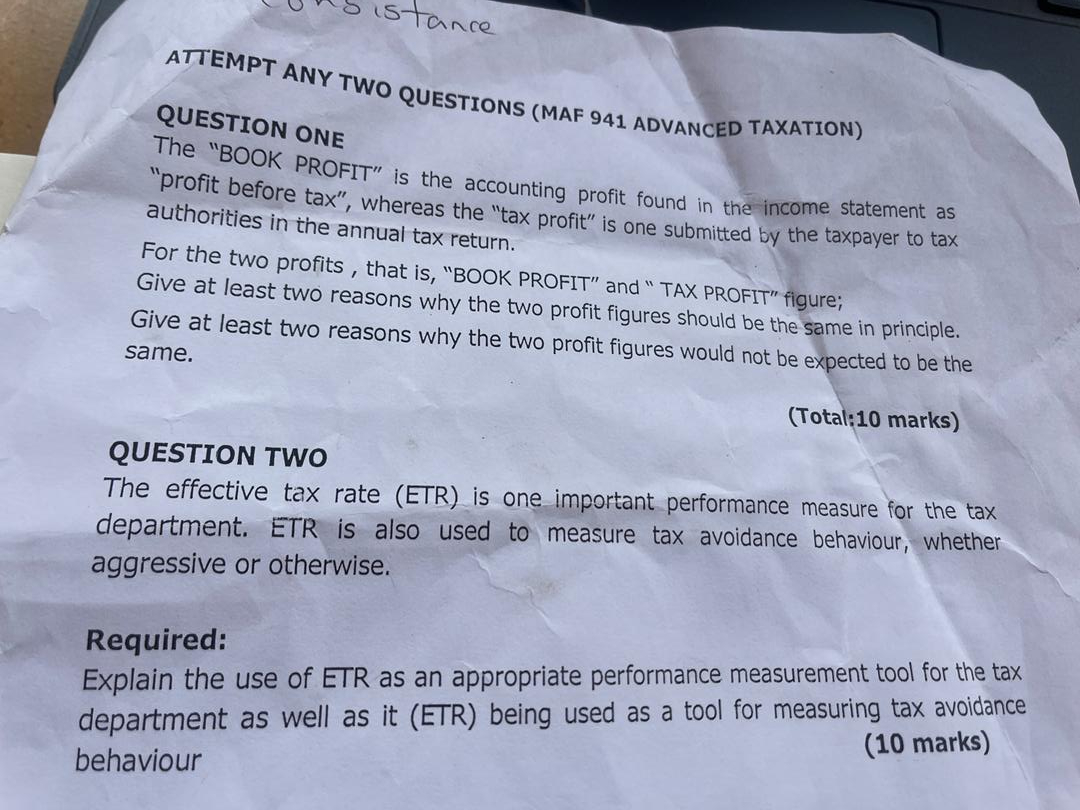

ATTEMPT ANY TWO QUESTIONS MAF ADVANCED TAXATION

QUESTION ONE

The "BOOK PROFIT" is the accounting profit found in the income statement as "profit before tax", whereas the "tax profit" is one submitted by the taxpayer to tax authorities in the annual tax return.

For the two profits, that is "BOOK PROFIT" and "TAX PROFIT" figure; Give at least two reasons why the two profit figures should be the same in principle. Give at least two reasons why the two profit figures would not be expected to be the same.

QUESTION TWO

The effective tax rate ETR is one important performance measure for the tax department. ETR is also used to measure tax avoidance behaviour, whether aggressive or otherwise.

Required:

Explain the use of ETR as an appropriate performance measurement tool for the tax department as well as it ETR being used as a tool for measuring tax avoidance behaviour

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock