Question: Attempts 0 Keep the Highest 0/2 4. Interest rate parity The rise of globalization is due to the many companies that have become multinational corporations

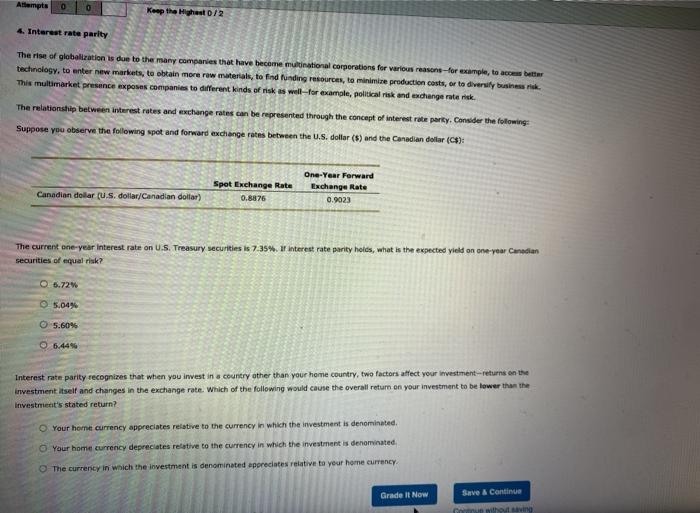

Attempts 0 Keep the Highest 0/2 4. Interest rate parity The rise of globalization is due to the many companies that have become multinational corporations for various reasons-for example, to be technology to enter new markets, to obtain more row materials, to find funding resources, to minimire production costs, or to diversity business This multimarket presence exposes companies to different kinds of risks well-formole, political risk and exchange rate is The relationship between interest rates and exchange rates can be represented through the concept of interest rate party. Consider the following: Suppose you observe the following spot and forward exchange rates between the U.S. dollar ($) and the Canadian dollar (C$): One-Year Forward Exchange Rate 0.9023 Spot Exchange Rate 0.8876 Canadian dollar (U.S. dollar/Canadian dollar) The current one year interest rate on us. Treasury securities is 7.35% ir interest rate parity holds, what is the expected yield on one year Canadian securities of equal risk? O 6.72 5.0496 0 5.60% 6.4446 Interest rate parity recognizes that when you invest in a country ather than your home country, two factors affect your investment-returns on the investment itself and changes in the exchange rate. Which of the following would cause the overall return on your investment to be lower than the Investment's stated return? Your home currency appreciates relative to the currency in which the investment is denominated Your home currency depreciates relative to the currency in which the investment is denominated The currency in which the investment is denominated appreciates relative to your home currency Grade It Now Save & Continue up without in

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts