Question: Ch 17: Assignment. Multinational Financial Management Attempts Average/2 4. Interest rate parity The rise of globalization is due to the many companies that have become

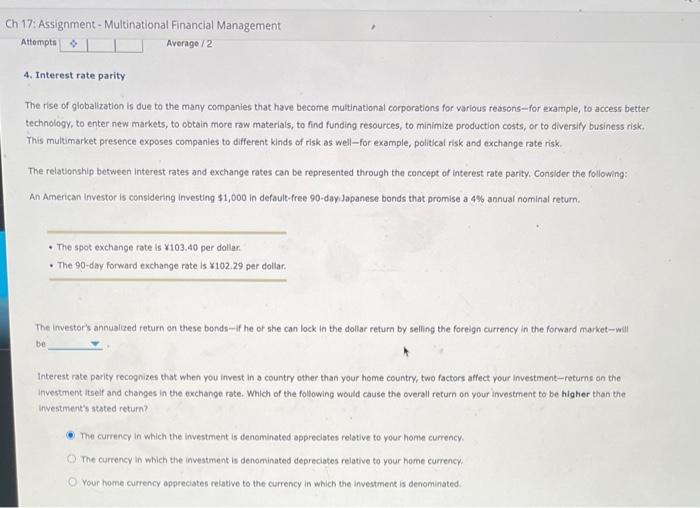

Ch 17: Assignment. Multinational Financial Management Attempts Average/2 4. Interest rate parity The rise of globalization is due to the many companies that have become multinational corporations for various reasons--for example, to access better technology, to enter new markets, to obtain more raw materials, to find funding resources, to minimize production costs, or to diversity business risk This multimarket presence exposes companies to different kinds of risk as well-for example, political risk and exchange rate risk The relationship between interest rates and exchange rates can be represented through the concept of interest rate parity. Consider the following: An American Investor is considering Investing $1,000 in default-free 90-day Japanese bonds that promise a 4% annual nominal return. The spot exchange rate is 103.40 per dollar The 90-day forward exchange rate is 102.29 per dollar. The investor's annualized return on these bonds-It he or she can lock in the dollar return by selling the foreign currency in the forward market will be Interest rate party recognizes that when you invest in a country other than your home country, two factors affect your investment-returns on the Investment itself and changes in the exchange rate. Which of the following would cause the overall return on your investment to be higher than the Investment's stated return The currency in which the investment is denominated appreciates relative to your home currency The currency in which the investment is denominated depreciates relative to your home currency Your home currency appreciates relative to the currency in which the investment is denominated

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts