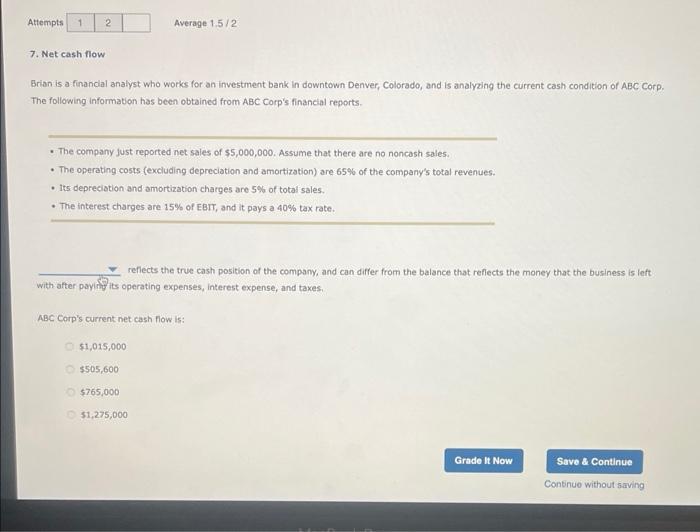

Question: Attempts 1 2 Average 1.5/2 7. Net cash flow Brian is a financial analyst who works for an investment bank in downtown Denver, Colorado, and

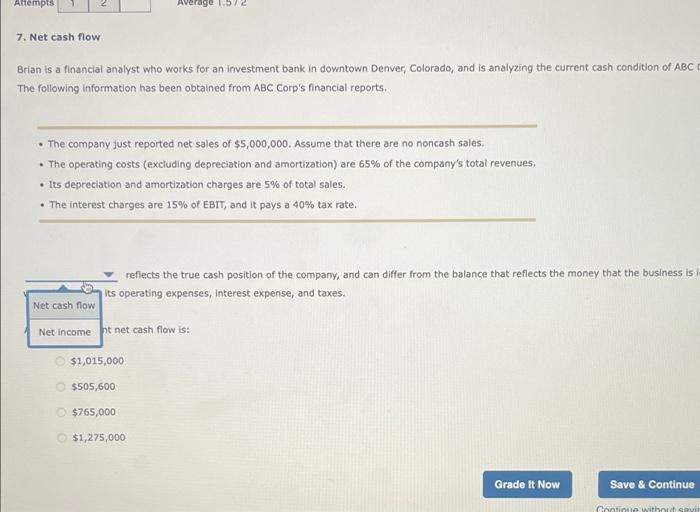

Attempts 1 2 Average 1.5/2 7. Net cash flow Brian is a financial analyst who works for an investment bank in downtown Denver, Colorado, and is analyzing the current cash condition of ABC Corp. The following information has been obtained from ABC Corp's financial reports. The company just reported net sales of $5,000,000. Assume that there are no noncash sales. The operating costs (excluding depreciation and amortization) are 65% of the company's total revenues. Its depreciation and amortization charges are 5% of total sales. The interest charges are 15% of EBIT, and it pays a 40% tax rate. reflects the true cash position of the company, and can differ from the balance that reflects the money that the business is left with after paying its operating expenses, interest expense, and taxes. ABC Corp's current net cash flow is: $1,015,000 $505,600 $765,000 $1,275,000 Grade It Now Save & Continue Continue without saving Attempts 7. Net cash flow Brian is a financial analyst who works for an investment bank in downtown Denver, Colorado, and is analyzing the current cash condition of ABC C The following information has been obtained from ABC Corp's financial reports. The company just reported net sales of $5,000,000. Assume that there are no noncash sales. The operating costs (excluding depreciation and amortization) are 65% of the company's total revenues. Its depreciation and amortization charges are 5% of total sales. The interest charges are 15% of EBIT, and it pays a 40% tax rate. reflects the true cash position of the company, and can differ from the balance that reflects the money that the business is l its operating expenses, interest expense, and taxes. Net cash flow Net income nt net cash flow is: $1,015,000 $505,600 $765,000 Grade It Now Save & Continue Continue without savir $1,275,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts