Question: Attempts Average / 2 1. Do the Math 9-2 eBook Do the Math 9-2 Mortgage Affordability Seth and Alexandra Moore of Elk Grove Village, Illinois

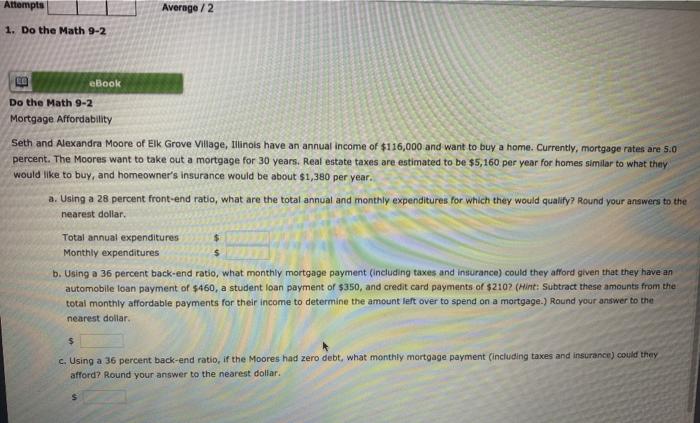

Attempts Average / 2 1. Do the Math 9-2 eBook Do the Math 9-2 Mortgage Affordability Seth and Alexandra Moore of Elk Grove Village, Illinois have an annual income of $116,000 and want to buy a home. Currently, mortgage rates are 5.0 percent. The Moores want to take out a mortgage for 30 years. Real estate taxes are estimated to be $5,160 per year for homes similar to what they would like to buy, and homeowner's Insurance would be about $1,380 per year. a. Using a 28 percent front-end ratio, what are the total annual and monthly expenditures for which they would qualify? Round your answers to the nearest dollar, Total annual expenditures $ Monthly expenditures $ b. Using a 36 percent back-end ratio, what monthly mortgage payment (including taxes and insurance) could they afford given that they have an automobile loan payment of $460, a student loan payment of $350, and credit card payments of $2102 (Hint: Subtract these amounts from the total monthly affordable payments for their income to determine the amount left over to spend on a mortgage.) Round your answer to the nearest dollar $ c. Using a 36 percent back-end ratio, if the Moores had zero debt, what monthly mortgage payment (including taxes and insurance) could they afford? Round your answer to the nearest dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts