Question: Attempts Average / 2 4. Leverage, return on investment, and loan-to-value ratio for real estate investments Lei is going to buy real estate as an

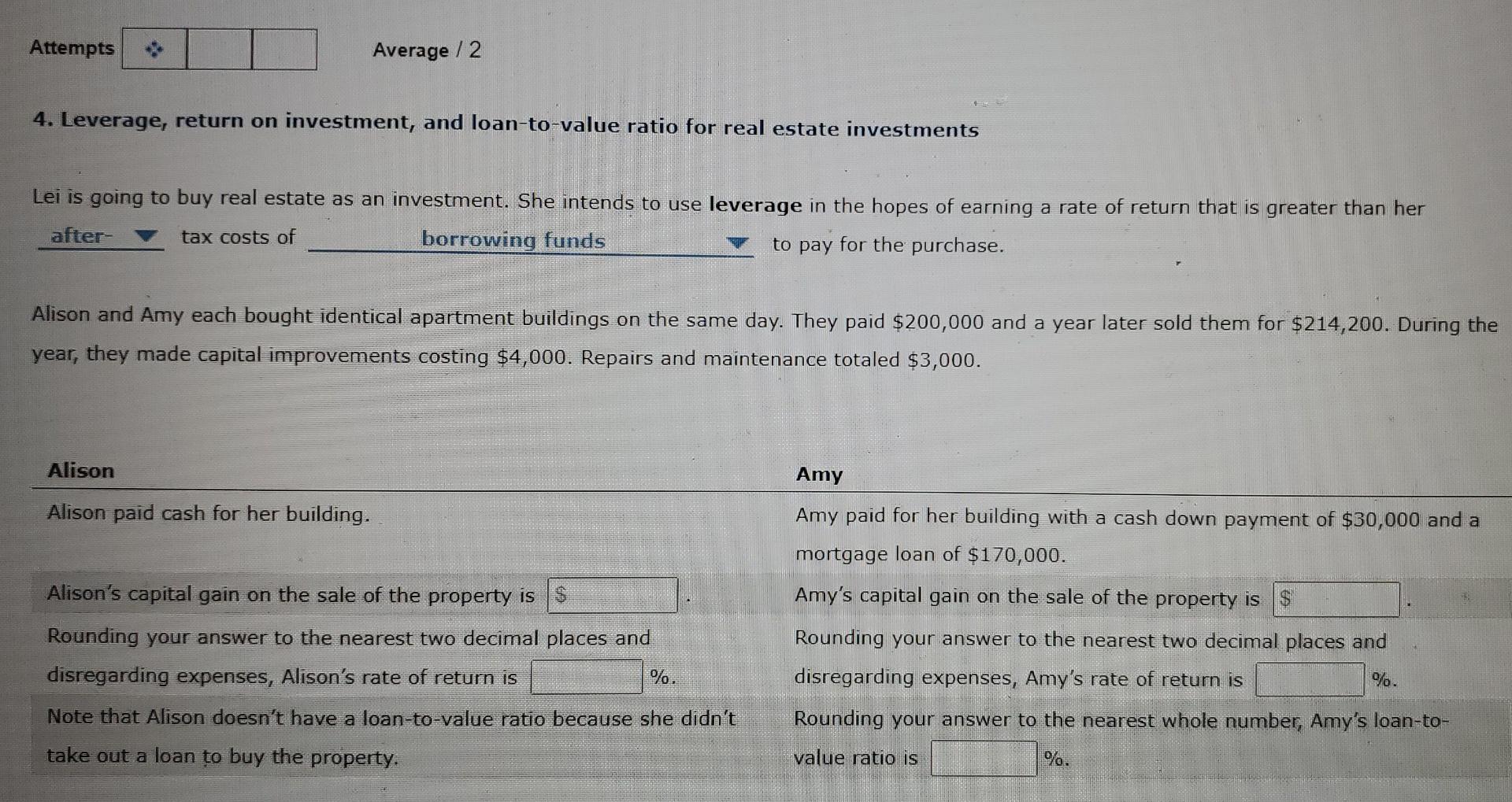

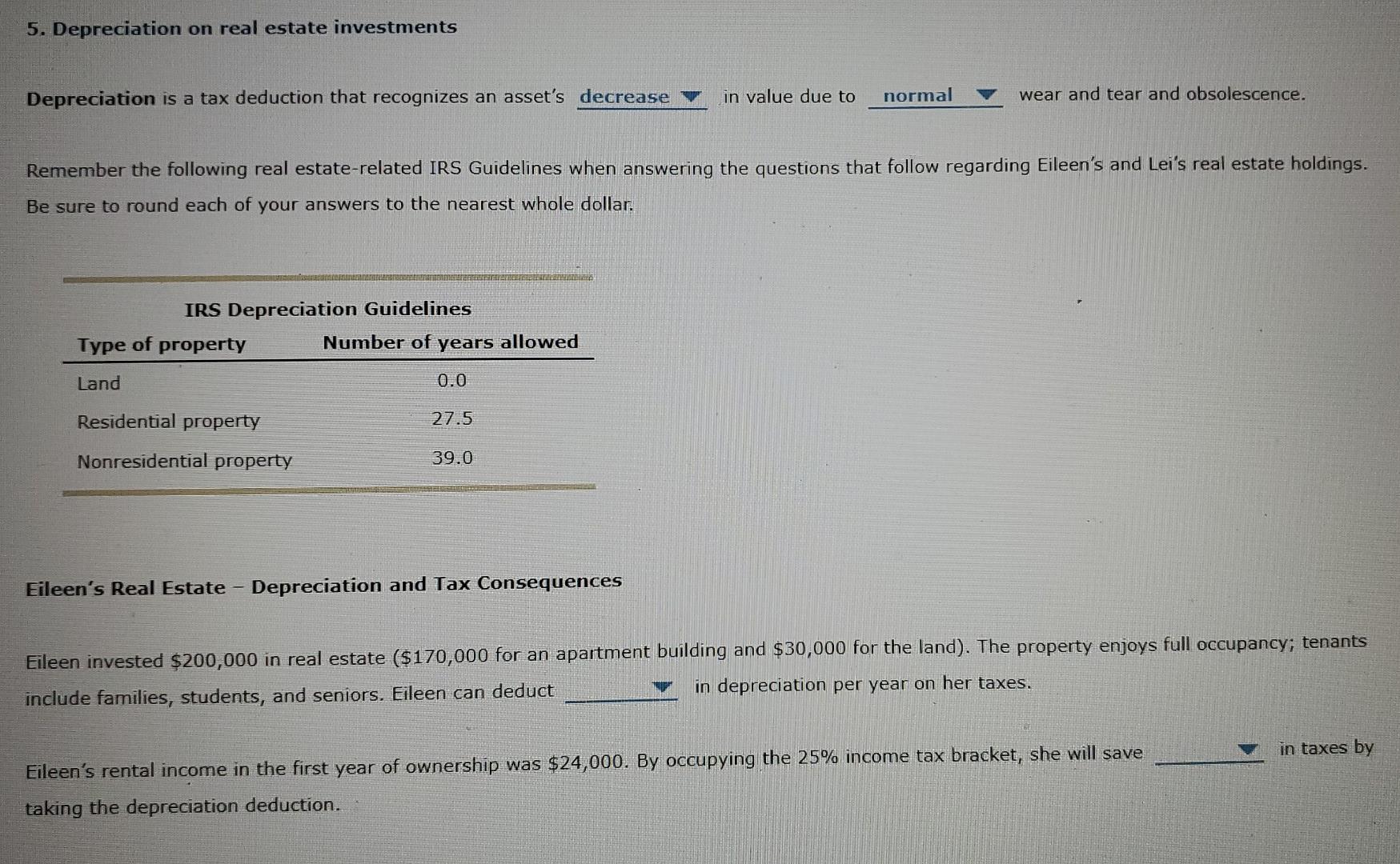

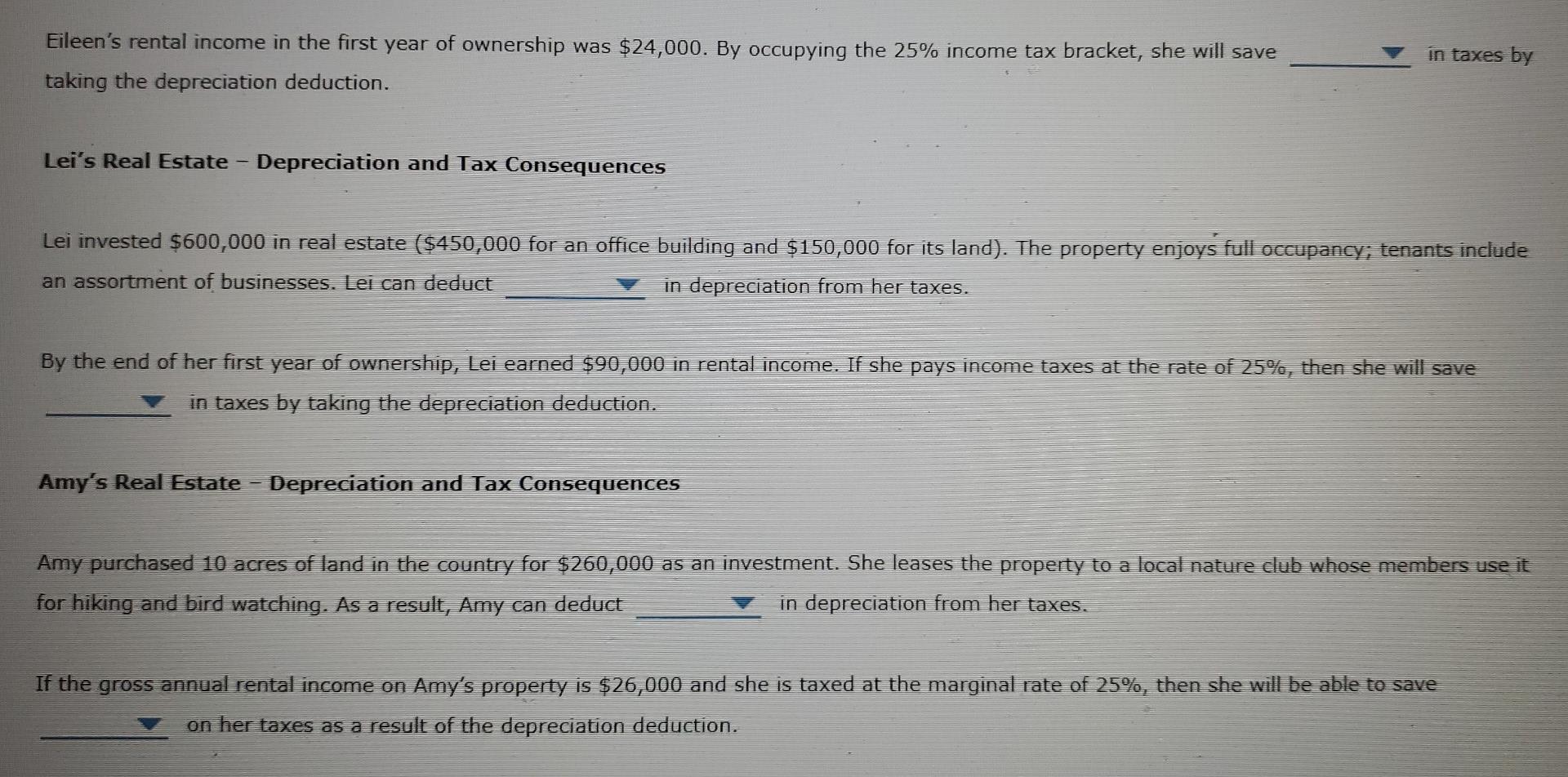

Attempts Average / 2 4. Leverage, return on investment, and loan-to-value ratio for real estate investments Lei is going to buy real estate as an investment. She intends to use leverage in the hopes of earning a rate of return that is greater than her after- tax costs of borrowing funds to pay for the purchase. Alison and Amy each bought identical apartment buildings on the same day. They paid $200,000 and a year later sold them for $214,200. During the year, they made capital improvements costing $4,000. Repairs and maintenance totaled $3,000. Alison Amy Alison paid cash for her building. Amy paid for her building with a cash down payment of $30,000 and a mortgage loan of $170,000. Amy's capital gain on the sale of the property is $ Alison's capital gain on the sale of the property is $ Rounding your answer to the nearest two decimal places and disregarding expenses, Alison's rate of return is %. Note that Alison doesn't have a loan-to-value ratio because she didn't Rounding your answer to the nearest two decimal places and disregarding expenses, Amy's rate of return is %. Rounding your answer to the nearest whole number, Amy's loan-to- take out a loan to buy the property. value ratio is %. 5. Depreciation on real estate investments Depreciation is a tax deduction that recognizes an asset's decrease in value due to normal wear and tear and obsolescence. Remember the following real estate-related IRS Guidelines when answering the questions that follow regarding Eileen's and Lei's real estate holdings. Be sure to round each of your answers to the nearest whole dollar. IRS Depreciation Guidelines Type of property Number of years allowed Land 0.0 Residential property 27.5 Nonresidential property 39.0 Eileen's Real Estate - Depreciation and Tax Consequences Eileen invested $200,000 in real estate ($170,000 for an apartment building and $30,000 for the land). The property enjoys full occupancy; tenants include families, students, and seniors. Eileen can deduct in depreciation per year on her taxes. in taxes by Eileen's rental income in the first year of ownership was $24,000. By occupying the 25% income tax bracket, she will save taking the depreciation deduction. Eileen's rental income in the first year of ownership was $24,000. By occupying the 25% income tax bracket, she will save taking the depreciation deduction. in taxes by Lei's Real Estate Depreciation and Tax Consequences Lei invested $600,000 in real estate ($450,000 for an office building and $150,000 for its land). The property enjoys full occupancy; tenants include an assortment of businesses. Lei can deduct in depreciation from her taxes. By the end of her first year of ownership, Lei earned $90,000 in rental income. If she pays income taxes at the rate of 25%, then she will save in taxes by taking the depreciation deduction. Amy's Real Estate Depreciation and Tax Consequences Amy purchased 10 acres of land in the country for $260,000 as an investment. She leases the property to a local nature club whose members use it for hiking and bird watching. As a result, Amy can deduct in depreciation from her taxes. If the gross annual rental income on Amy's property is $26,000 and she is taxed at the marginal rate of 25%, then she will be able to save on her taxes as a result of the depreciation deduction. Attempts Average / 2 4. Leverage, return on investment, and loan-to-value ratio for real estate investments Lei is going to buy real estate as an investment. She intends to use leverage in the hopes of earning a rate of return that is greater than her after- tax costs of borrowing funds to pay for the purchase. Alison and Amy each bought identical apartment buildings on the same day. They paid $200,000 and a year later sold them for $214,200. During the year, they made capital improvements costing $4,000. Repairs and maintenance totaled $3,000. Alison Amy Alison paid cash for her building. Amy paid for her building with a cash down payment of $30,000 and a mortgage loan of $170,000. Amy's capital gain on the sale of the property is $ Alison's capital gain on the sale of the property is $ Rounding your answer to the nearest two decimal places and disregarding expenses, Alison's rate of return is %. Note that Alison doesn't have a loan-to-value ratio because she didn't Rounding your answer to the nearest two decimal places and disregarding expenses, Amy's rate of return is %. Rounding your answer to the nearest whole number, Amy's loan-to- take out a loan to buy the property. value ratio is %. 5. Depreciation on real estate investments Depreciation is a tax deduction that recognizes an asset's decrease in value due to normal wear and tear and obsolescence. Remember the following real estate-related IRS Guidelines when answering the questions that follow regarding Eileen's and Lei's real estate holdings. Be sure to round each of your answers to the nearest whole dollar. IRS Depreciation Guidelines Type of property Number of years allowed Land 0.0 Residential property 27.5 Nonresidential property 39.0 Eileen's Real Estate - Depreciation and Tax Consequences Eileen invested $200,000 in real estate ($170,000 for an apartment building and $30,000 for the land). The property enjoys full occupancy; tenants include families, students, and seniors. Eileen can deduct in depreciation per year on her taxes. in taxes by Eileen's rental income in the first year of ownership was $24,000. By occupying the 25% income tax bracket, she will save taking the depreciation deduction. Eileen's rental income in the first year of ownership was $24,000. By occupying the 25% income tax bracket, she will save taking the depreciation deduction. in taxes by Lei's Real Estate Depreciation and Tax Consequences Lei invested $600,000 in real estate ($450,000 for an office building and $150,000 for its land). The property enjoys full occupancy; tenants include an assortment of businesses. Lei can deduct in depreciation from her taxes. By the end of her first year of ownership, Lei earned $90,000 in rental income. If she pays income taxes at the rate of 25%, then she will save in taxes by taking the depreciation deduction. Amy's Real Estate Depreciation and Tax Consequences Amy purchased 10 acres of land in the country for $260,000 as an investment. She leases the property to a local nature club whose members use it for hiking and bird watching. As a result, Amy can deduct in depreciation from her taxes. If the gross annual rental income on Amy's property is $26,000 and she is taxed at the marginal rate of 25%, then she will be able to save on her taxes as a result of the depreciation deduction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts