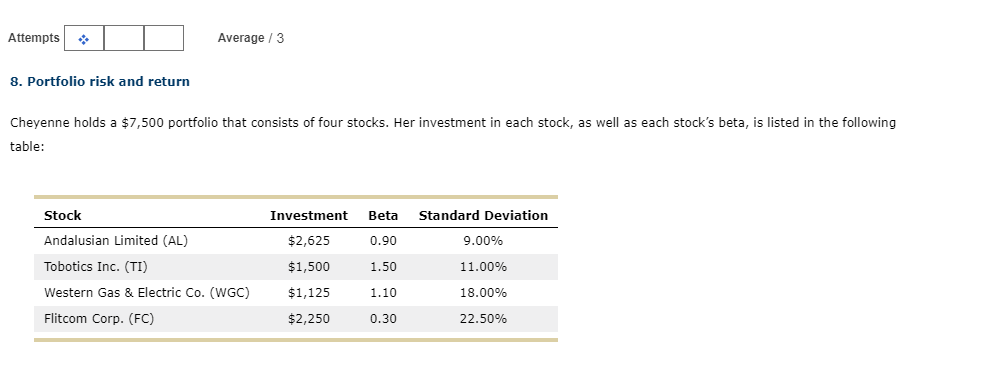

Question: Attempts Average / 3 8. Portfolio risk and return Cheyenne holds a $7,500 portfolio that consists of four stocks. Her investment in each stock, as

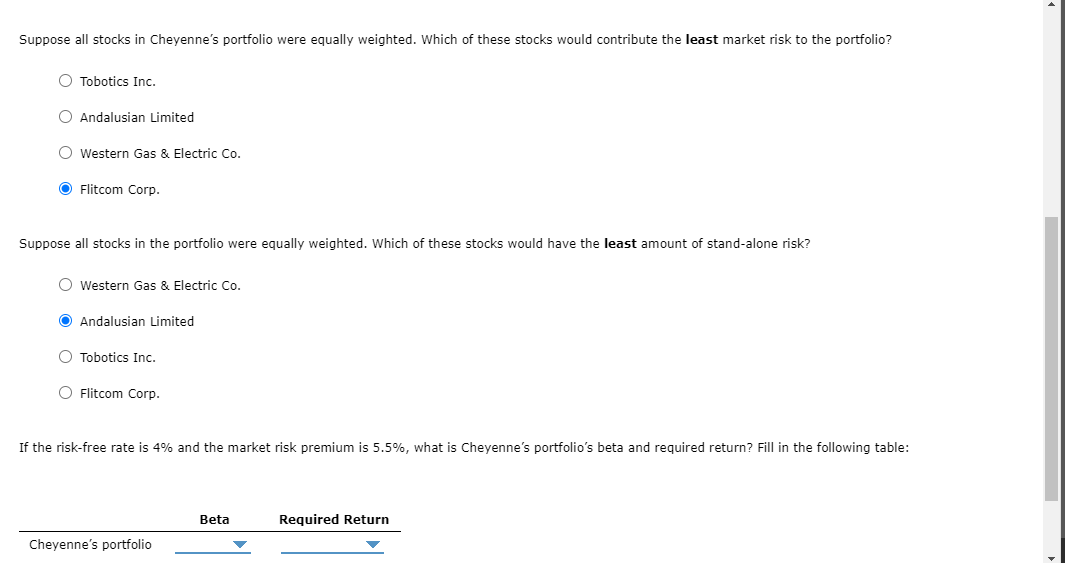

Attempts Average / 3 8. Portfolio risk and return Cheyenne holds a $7,500 portfolio that consists of four stocks. Her investment in each stock, as well as each stock's beta, is listed in the following table: Stock Investment Beta Standard Deviation Andalusian Limited (AL) $2,625 0.90 9.00% $1,500 1.50 11.00% Tobotics Inc. (TI) Western Gas & Electric Co. (WGC) Flitcom Corp. (FC) $1,125 1.10 18.00% $2,250 0.30 22.50% Suppose all stocks in Cheyenne's portfolio were equally weighted. Which of these stocks would contribute the least market risk to the portfolio? Tobotics Inc. O Andalusian Limited O Western Gas & Electric Co. O Flitcom Corp. Suppose all stocks in the portfolio were equally weighted. Which of these stocks would have the least amount of stand-alone risk? O Western Gas & Electric Co. O Andalusian Limited O Tobotics Inc. O Flitcom Corp. If the risk-free rate is 4% and the market risk premium is 5.5%, what is Cheyenne's portfolio's beta and required return? Fill in the following table: Beta Required Return Cheyenne's portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts