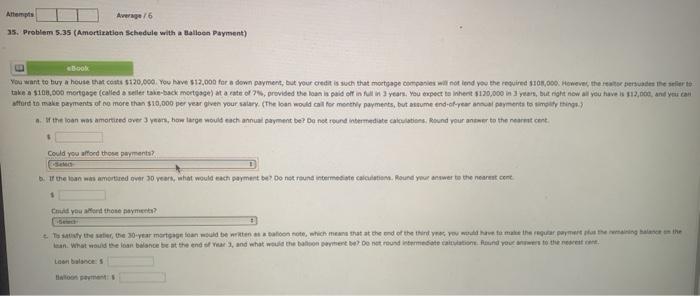

Question: Attempts Average/6 35. Problem 5.35 (Amortization Schedule with a Balloon Payment) Book You want to buy a house that costs $120,000. You have $12,000 for

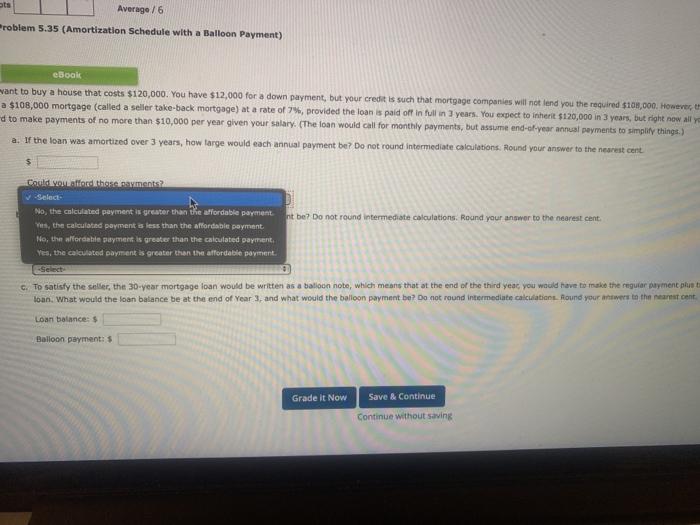

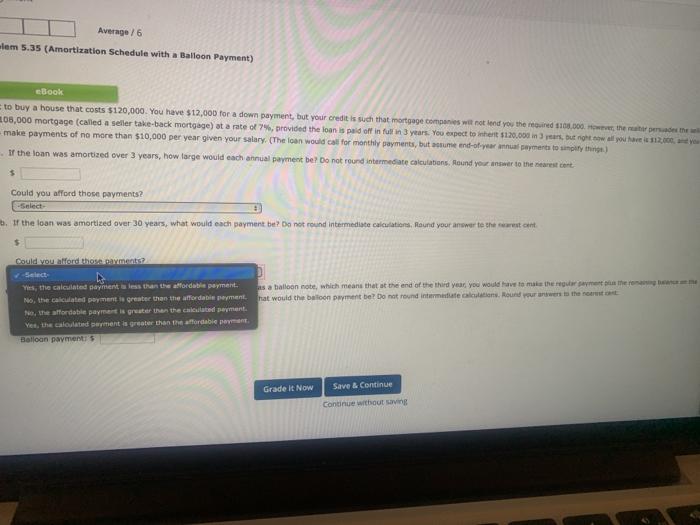

Attempts Average/6 35. Problem 5.35 (Amortization Schedule with a Balloon Payment) Book You want to buy a house that costs $120,000. You have $12,000 for a down payment, but your credit is such that mortgage companies will not ind you the required $20,000. However, the restore the to take a $100.000 mortgese (called a seller take-back mortgage) at a cate of provided the loan is paid in 3 years. You expect to inherit $120,000 in years, but right now all you have $12,000, and you can atford to make payments of more than $10,000 per year give your salary. (The loan would call for monthly payments, but astme end-of-year anal payments to my things of the loan was amortired over 3 years, how large would each annual payment be? Do not round intermediate cartoons, Round your antwer to the nearest cont. Could you afford those payments? bune on es red over 30 years, what would each payment be? Do not round intermediate calculations. Round your answer to the nearest come 1 To the the 30-year martage loan would be written on note, which means that at the end of the thing you will have to make the rear og hans the Ian What would be loan bilance beat the end of years, and what would the entround to and you to the Laon bales Average/6 Problem 5.35 (Amortization Schedule with a Balloon Payment) eBook want to buy a house that costs $120,000. You have $12,000 for a down payment, but your credit is such that mortgage companies will not lend you the required $100,000. However, a $108,000 mortgage called a seller take-back mortgage) at a rate of 7%, provided the loan is paid off in full in 3 years. You expect to inherit $120,000 in 3 years, but right now all y d to make payments of no more than $10,000 per year given your salary. (The loan would call for monthly payments, but assume end-of-year annual payments to simplify things) a. If the loan was amortized over 3 years, how large would each annual payment be? Do not round intermediate calculations. Round your answer to the nearest cent Could you for those payments Select No, the calculated payment is greater than the affordable payment Yes, the calculated payment is less than the affordable payment No, the affordable payment is greater than the calculated payment Yes, the calculated payment is greater than the affordable payment. nt be? Do not round intermediate calculations. Round your answer to the nearest cent c. To satisfy the seller, the 30-year mortgage loan would be written as a balloon note, which means that at the end of the third year you would have to make the regular payment plus loan. What would the loan balance be at the end of Year 3, and what would the balloon payment be? Do not round intermediate calculation Round your answers to the nearest cent Loan balance: Balloon payment: Grade it Now Save & Continue Continue without saving Average / 6 lem 5.35 (Amortization Schedule with a Balloon Payment) Book to buy a house that costs $120,000. You have $12,000 for a down payment, but your credit is such that mortgage companies wit not lend you the moured 1160,000. However, the rate the 205,000 mortgage called a seller take-back mortgage) at a rate of provided the loan is paid off in 3 years. You expect to whert 5120.000 in 3 years, but now all you 12,000, you make payments of no more than $10,000 per year given your salary. (The loan would call for monthly payments, but we end-of-year stymerta to simply thing) If the loan was amortized over 3 years, how large would each annual payment be? Do not round intermediate calculations, Round your insor to the nearest cont Could you afford those payments? Select b. If the loan was amortized over 30 years, what would each payment be? Do not round intermediate calculation Round your answer to the westent Could you afford those payments? as a balloon note, which means that at the end of the third year you would have to mais em hat would the balloon payment be? Do not round intermediate actions. Round your answer to the most Yes, the calculated payment is than the affordable payment. No, the calculated payment is greater than the affordable prement Ne, the affordable payment is greater than the child sement Yes, the calculated payment is greater than the affordable pret Balloan payments Grade It Now Save & Continue Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts