Question: Attempts: Keep the Highest: /1 5. Problem 10.09 (WACC) eBook The Paulson Company's year-end balance sheet is shown below. Its cost of common equity is

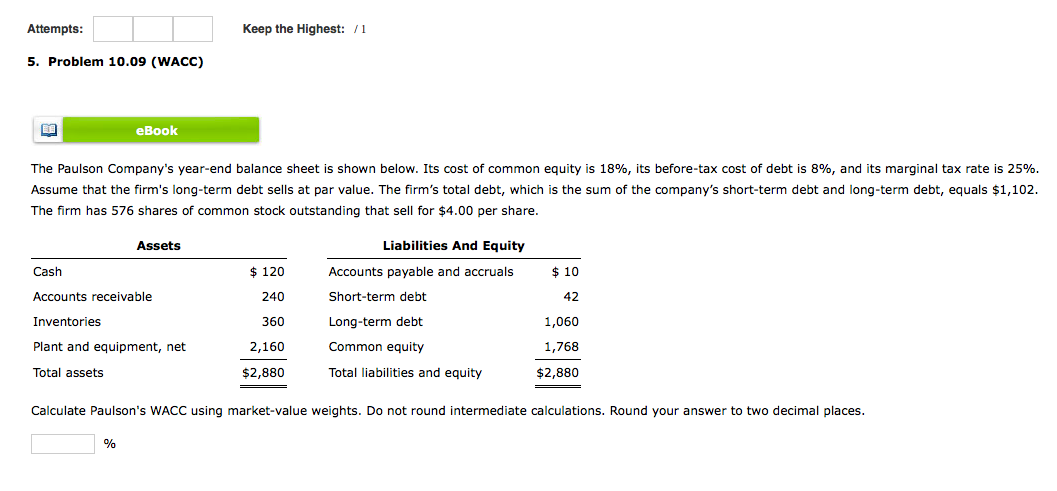

Attempts: Keep the Highest: /1 5. Problem 10.09 (WACC) eBook The Paulson Company's year-end balance sheet is shown below. Its cost of common equity is 18%, its before-tax cost of debt is 8%, and its marginal tax rate is 25%. Assume that the firm's long-term debt sells at par value. The firm's total debt, which is the sum of the company's short-term debt and long-term debt, equals $1,102. The firm has 576 shares of common stock outstanding that sell for $4.00 per share. Assets Liabilities And Equity Cash Accounts receivable Inventories $ 120 240 360 2,160 Accounts payable and accruals Short-term debt Long-term debt Common equity $ 10 42 1,060 1,768 Plant and equipment, net Total assets $2,880 Total liabilities and equity $2,880 Calculate Paulson's WACC using market value weights. Do not round intermediate calculations. Round your answer to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts