Question: Attempts Keep the Highest / 1 8. 8: Time Value of Money: Uneven Cash Flows Many financial decisions require the analysis of uneven, or nonconstant,

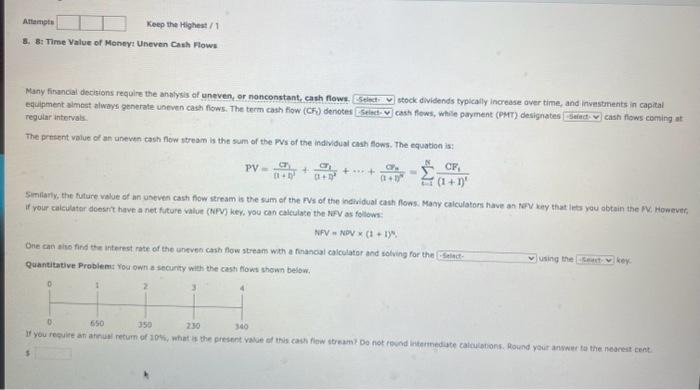

8. 8: Time Yalue of Monoy: Uneven Cash Hown Many financial decisions require the ahalysis of uneven, or nonconstant, cash fows. equipment almest always generate uneven cash fows. The term cash fiow (CF) denotes regular intervals. stock dividends typically increase over time, and investanents in capial cash fows, while payment (PMT) designates The protent value of an uneven cash now stream is the sum of the PVs of the individual cash flows. The equation is: If vour caiculator doesit have a net future value (NF) ker, you can calculate the hif as follows: NFV=NoV(1+1)N. One can sive find the interest rate of the uneven cash fow stream wh a fnancal calculater and solving for the Quantitative Problem: You own a security with the casti flows shown below

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts