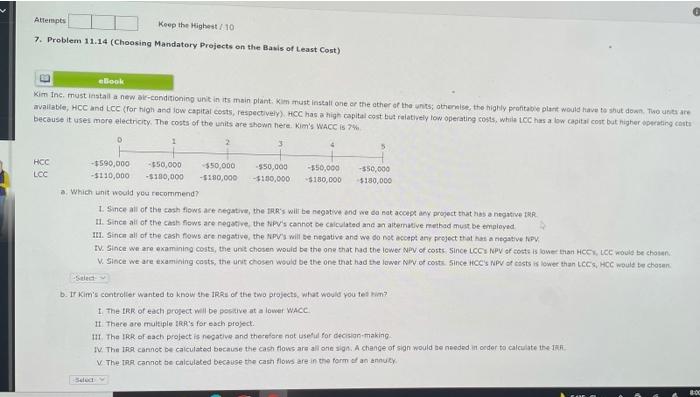

Question: Attempts Keep the Highest / 10 7. Problem 11.14 (Choosing Mandatory Projects on the Basis of Least Cost) eBook Kim Inc. must install a new

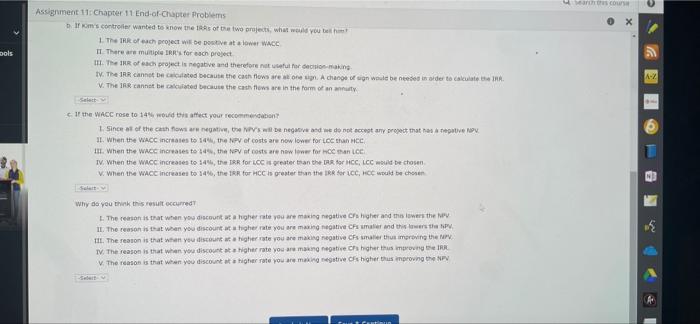

Attempts Keep the Highest / 10 7. Problem 11.14 (Choosing Mandatory Projects on the Basis of Least Cost) eBook Kim Inc. must install a new air-conditioning unit in its main plant. Kim must install one or the other of the units; otherwise, the highly profitable plant would have to shut down. The units are available, HCC and LCC (for high and low capital costs, respectively). HOC has a high capital cost but relatively low operating costs, while LCC has a low capital cost but higher eating costs because it uses more electricity. The costs of the units are shown here: Kim's WACC S7% D HCC LOC -590,000 -550,000 $50,000 -550,000 -550,000 -550,000 -$110,000 -$100,000 -5180,000 -$150,000 $180,000 $180,000 a. Which unit would you recommend? 1. Since all of the cash flows are negative, ther's will be negative and we do not accept any project that has a negative RR 11. Since all of the cash flows are negative, the NPV's cannot be calculated and an alternative method must be employed III. Sinct all of the cash flows are negative, the NPV's will be negative and we do not accept any project that was a negative IV. Since we are examining costs, the unit chosen would be the one that had the lower NPV of costs. Since LCCNPV or costs is lower than HCC, LCC would be chosen V. Since we are examining costs, the unit chosen would be the one that had the lower of costs. Since HCC'S NPV of stes lower than LCC, HCC would be chosen Sale b. 1 Kim's controller wanted to know the IRR of the two projects, what would you tes rom> I The IRR of each project will be positive at a lower WACC I! There are multiple ERR's for each project II. The IRR of each project is negative and therefore not useful for decision-making IV. The IRR cannot be calculated because the cash flows are all one sign. A change of sign would be needed in order to calculate the V The IRR cannot be calculated because the cash flows are in the form of an annuty uc bols Assignment 11: Chapter 11 End-of-Chapter Problems Iom's controller wanted to know the IRR of the two projects what you 1.The Roach project we ovat a lower WACC IL There are multiple IRK's for each project The of each project is negative and therefore not for decision-making IV. The IRR cannot be calculated because the cath how we one in a change in would be nenader to calculate the V. The cannot be called because the cash flows are in the form of an annut A-Z I The IRR of each project will be positive at a lower WACC I! There are multiple ERR's for each project II. The IRR of each project is negative and therefore not useful for decision-making IV. The IRR cannot be calculated because the cash flows are all one sign. A change of sign would be needed in order to calculate the V The IRR cannot be calculated because the cash flows are in the form of an annuty uc bols Assignment 11: Chapter 11 End-of-Chapter Problems Iom's controller wanted to know the IRR of the two projects what you 1.The Roach project we ovat a lower WACC IL There are multiple IRK's for each project The of each project is negative and therefore not for decision-making IV. The IRR cannot be calculated because the cath how we one in a change in would be nenader to calculate the V. The cannot be called because the cash flows are in the form of an annut A-Z

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts