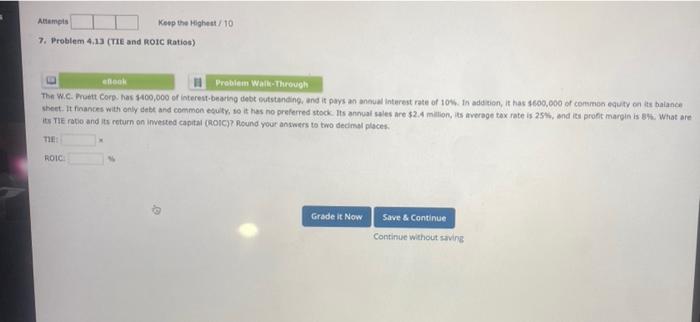

Question: Attempts Keep the Highest 10 7. Problem 4.13 (TIE and ROIC Ratios) cook Problem Walk-Through The W.C.Prett Corp. has $400,000 of interest-bearing debt outstanding, and

Attempts Keep the Highest 10 7. Problem 4.13 (TIE and ROIC Ratios) cook Problem Walk-Through The W.C.Prett Corp. has $400,000 of interest-bearing debt outstanding, and it pays an annual interest rate of 10%. In addition, it has 600,000 of common equity on its balance sheet. It finances with only debt and common culty, so it has no preferred stock. Its annual sales are $2.4 million, its average tax rate is 254, and its profit margin is 84. What are is the ratio and its return on invested capital (ROIC)? Round your answers to two decimal places THE ROIC Grade it Now Save & Continue & Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts