Question: Attempts: Keep the Highest: 1.5 4. Excess capacity adjustments Aa Aa Three Waters Co. currently has $610,000 in total assets and sales of $1,400,000. Half

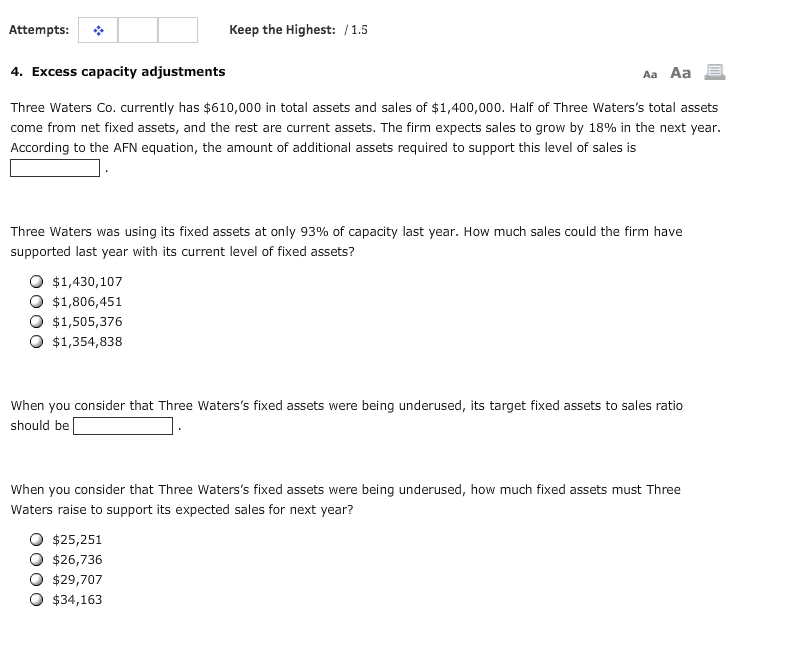

Attempts: Keep the Highest: 1.5 4. Excess capacity adjustments Aa Aa Three Waters Co. currently has $610,000 in total assets and sales of $1,400,000. Half of Three Waters's total assets come from net fixed assets, and the rest are current assets. The firm expects sales to grow by 18% in the next year. According to the AFN equation, the amount of additional assets required to support this level of sales is Three waters was using its fixed assets at only 93% of capacity last year. How much sales could the firm have supported last year with its current level of fixed assets? $1,430,107 $1,806,451 O $1,505,376 O $1,354,838 When you consider that Three Waters's fixed assets were being underused, its target fixed assets to sales ratio should be When you consider that Three Waters's fixed assets were being underused, how much fixed assets must Three Waters raise to support its expected sales for next year? $25,251 O $26,736 $29,707 O $34,163

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts