Question: Attempts: Keep the Highest: /1.5 4. Problem 3.08 (Personal Taxes) eBook Problem Walk-Through Susan and Stan Britton are a married couple who file a joint

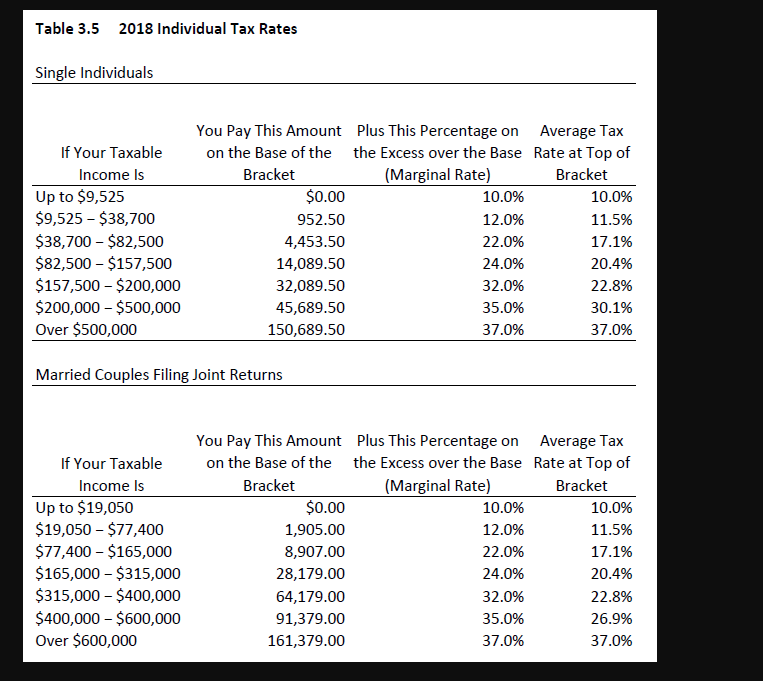

Attempts: Keep the Highest: /1.5 4. Problem 3.08 (Personal Taxes) eBook Problem Walk-Through Susan and Stan Britton are a married couple who file a joint income tax return, where the tax rates are based on the tax table 3.5. Assume that their taxable income this year was $193,000. Do not round intermediate calculation. a. What is their federal tax liability? Round your answer to the nearest dollar. b. What is their marginal tax rate? Round your answer to the nearest whole number. % C. What is their average tax rate? Round your answer to two decimal places. % Table 3.5 2018 Individual Tax Rates Single Individuals If Your Taxable Income is Up to $9,525 $9,525 - $38,700 $38,700 - $82,500 $82,500 - $157,500 $157,500 - $200,000 $200,000 - $500,000 Over $500,000 You Pay This Amount Plus This Percentage on Average Tax on the Base of the the Excess over the Base Rate at Top of Bracket (Marginal Rate) Bracket $0.00 10.0% 10.0% 952.50 12.0% 11.5% 4,453.50 22.0% 17.1% 14,089.50 24.0% 20.4% 32,089.50 32.0% 22.8% 45,689.50 35.0% 30.1% 150,689.50 37.0% 37.0% Married couples Filing Joint Returns If Your Taxable Income is Up to $19,050 $19,050 - $77,400 $77,400 - $165,000 $165,000 - $315,000 $315,000 - $400,000 $400,000 - $600,000 Over $600,000 You Pay This Amount Plus This Percentage on Average Tax on the base of the the Excess over the Base Rate at Top of Bracket (Marginal Rate) Bracket $0.00 10.0% 10.0% 1,905.00 12.0% 11.5% 8,907.00 22.0% 17.1% 28,179.00 24.0% 20.4% 64,179.00 32.0% 22.8% 91,379.00 35.0% 26.9% 161,379.00 37.0% 37.0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts