Question: Attempts: Keep the Highest: /2 8. Problem 10.08 Click here to read the eBook: Basic Definitions Click here to read the eBook: The Cost of

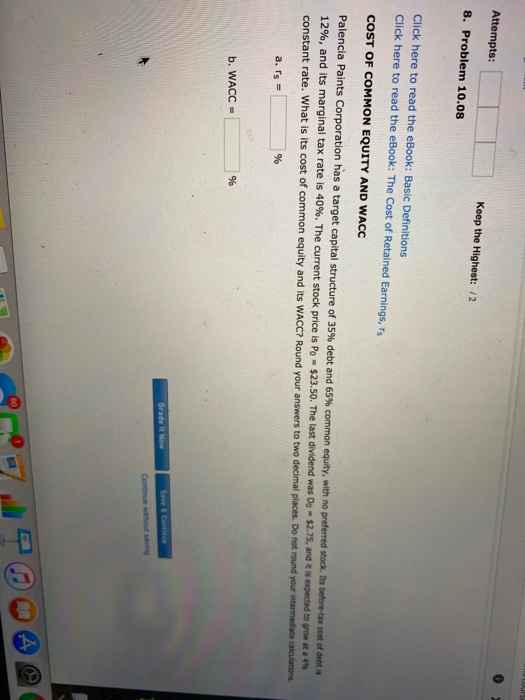

Attempts: Keep the Highest: /2 8. Problem 10.08 Click here to read the eBook: Basic Definitions Click here to read the eBook: The Cost of Retained Earnings, 's COST OF COMMON EQUITY AND WACC Palencia Paints Corporation has a target capital structure of 35% debt and 65% common equity, with no preferred stock. Its before-tax cost of debt is 12%, and its marginal tax rate is 40%. The current stock price is Po = $23.50. The last dividend was Do - $2.75, and it is expected to grow constant rate. What is its cost of common equity and its WACC? Round your answers to two decimal places. Do not round your intermediate calculations. a. Is = b. WACC = Grade New Save Cance Continue without sig

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts