Question: Attempts Keep the Highest / 5 7 . The reserve requirement, open market operations, and the money supply Assume that banks do not hold excess

Attempts Keep the Highest

The reserve requirement, open market operations, and the money supply

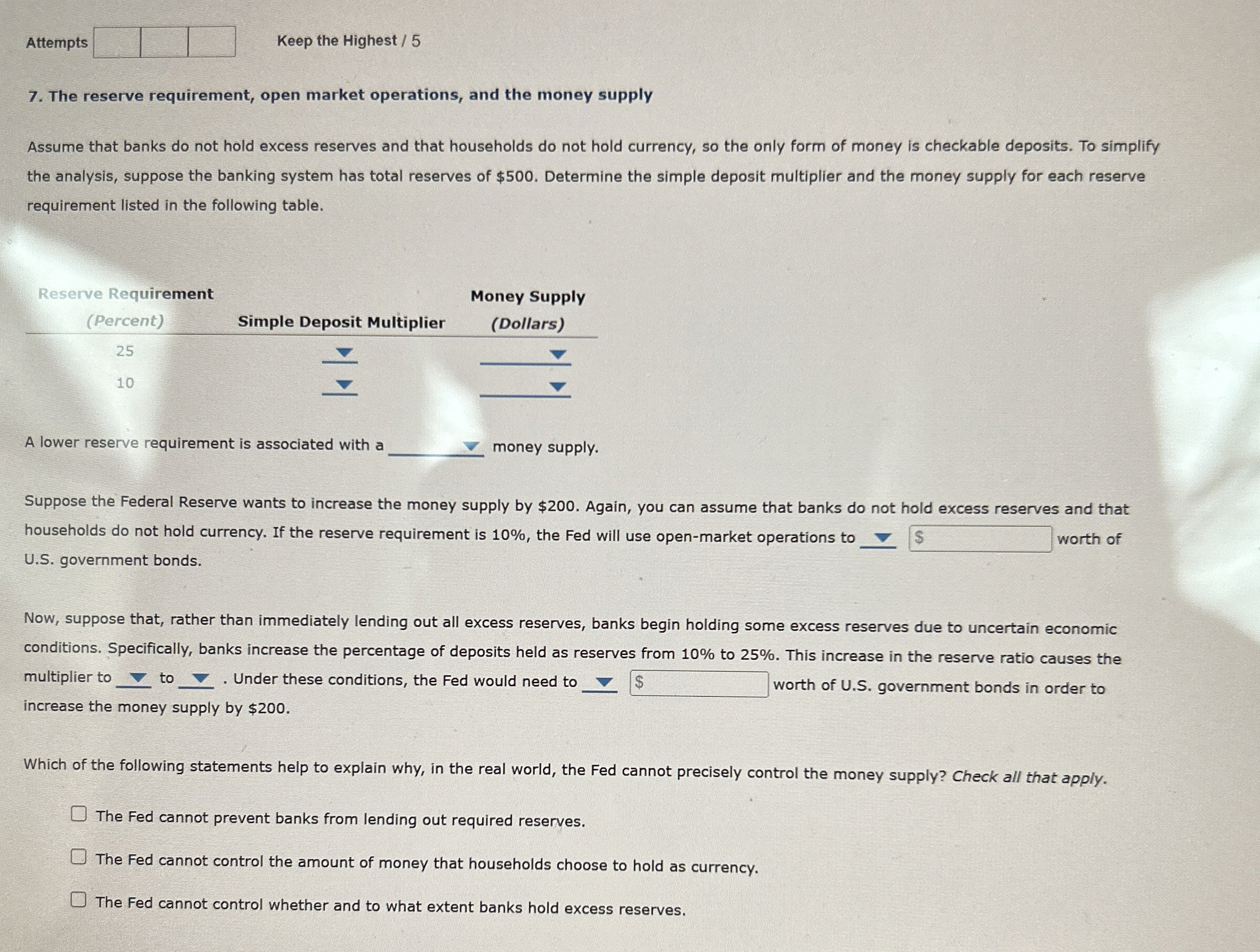

Assume that banks do not hold excess reserves and that households do not hold currency, so the only form of money is checkable deposits. To simplify the analysis, suppose the banking system has total reserves of $ Determine the simple deposit multiplier and the money supply for each reserve requirement listed in the following table.

Reserve Requirement

Money Supply

Percent

Simple Deposit Multiplier

Dollars

A lower reserve requirement is associated with a money supply.

Suppose the Federal Reserve wants to increase the money supply by $ Again, you can assume that banks do not hold excess reserves and that households do not hold currency. If the reserve requirement is the Fed will use openmarket operations to

worth of US government bonds.

Now, suppose that, rather than immediately lending out all excess reserves, banks begin holding some excess reserves due to uncertain economic conditions. Specifically, banks increase the percentage of deposits held as reserves from to This increase in the reserve ratio causes the multiplier to to Under these conditions, the Fed would need to

worth of US government bonds in order to increase the money supply by $

Which of the following statements help to explain why, in the real world, the Fed cannot precisely control the money supply? Check all that apply.

The Fed cannot prevent banks from lending out required reserves.

The Fed cannot control the amount of money that households choose to hold as currency.

The Fed cannot control whether and to what extent banks hold excess reserves.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock