Question: Attempts Keep the Highest/ 9 3. Ch02 Financial Planning Exercise 6 eBook Chapter 2 Financial Planning Exercise 6 Calculating present and future values Use future

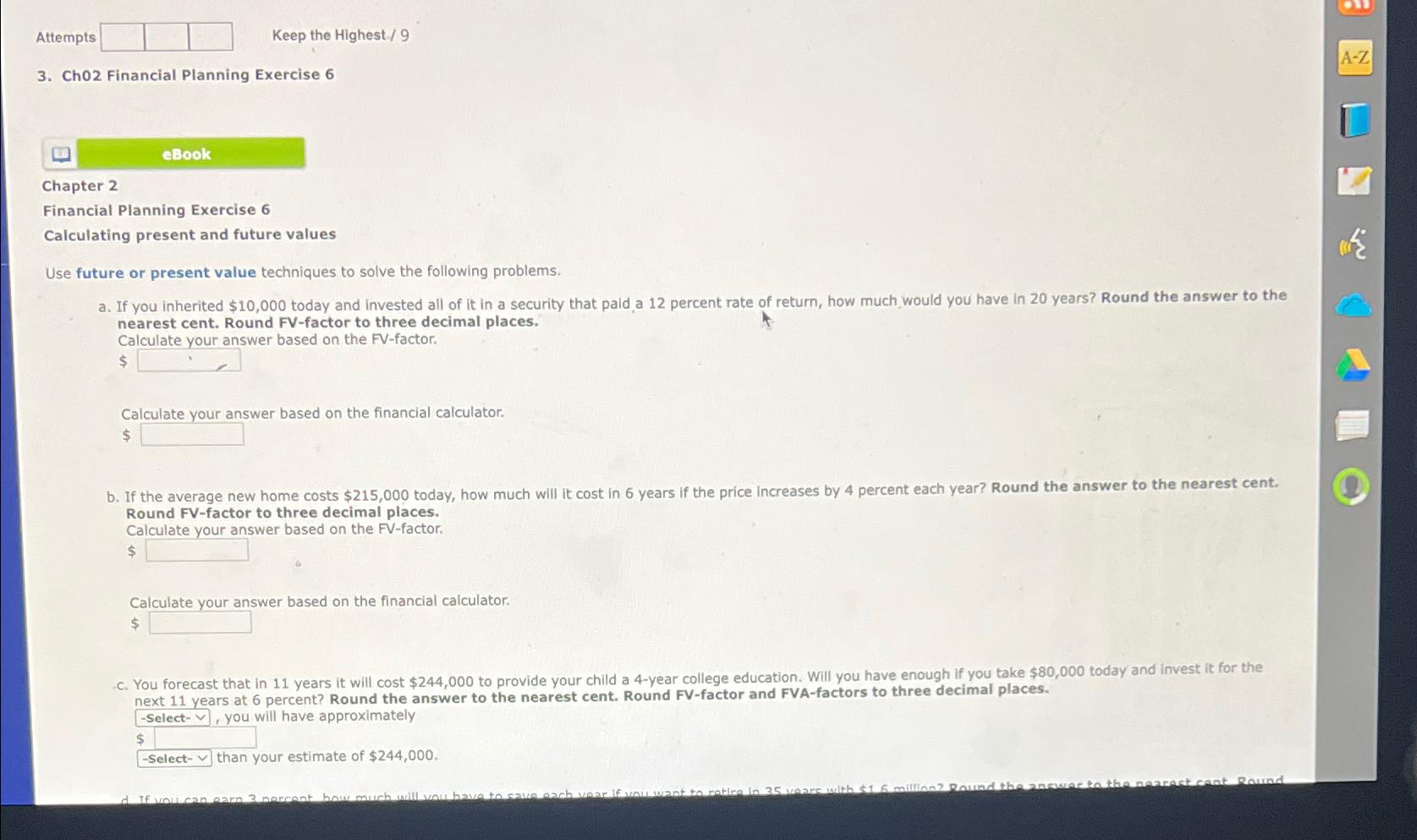

Attempts\ Keep the Highest/ 9\ 3. Ch02 Financial Planning Exercise 6\ eBook\ Chapter 2\ Financial Planning Exercise 6\ Calculating present and future values\ Use future or present value techniques to solve the following problems. nearest cent. Round FV-factor to three decimal places.\ Calculate your answer based on the FV-factor.\

$\ Calculate vour answer based on the financial calculator.\

$Round FV-factor to three decimal places.\ Calculate your answer based on the FV-factor:\

$\ Calculate your answer based on the financial calculator.\

$\ c. You forecast that in 11 years it will cost

$244,000to provide your child a 4-year college education. Will you have enough if you take

$80,000today and invest it for the next 11 years at 6 percent? Round the answer to the nearest cent. Round FV-factor and FVA-factors to three decimal places.\ -select-

, you will have approximately\ -Select-

than your estimate of

$244,000.

1apter 2 nancial Planning Exercise 6 alculating present and future values se future or present value techniques to solve the following problems. a. If you inherited $10,000 today and invested all of it in a security that pald a 12 percent rate of return, how much would you have in 20 years? Round the answer to the nearest cent. Round FV-factor to three decimal places. Calculate vour answer based on the FV-factor. $ Calculate vour answer based on the financial calculator. $ b. If the average new home costs $215,000 today, how much will it cost in 6 years if the price increases by 4 percent each year? Round the answer to the nearest cent. Round FV-factor to three decimal places. Calculate vour answer based on the FV-factor: $ Calculate vour answer based on the financial calculator. $ c. You forecast that in 11 years it will cost $244,000 to provide your child a 4 -year college education. Will you have enough if you take $80,000 today and invest it for the next 11 vears at 6 percent? Round the answer to the nearest cent. Round FV-factor and FVA-factors to three decimal places. you will have approximately than your estimate of $244,000. 1apter 2 nancial Planning Exercise 6 alculating present and future values se future or present value techniques to solve the following problems. a. If you inherited $10,000 today and invested all of it in a security that pald a 12 percent rate of return, how much would you have in 20 years? Round the answer to the nearest cent. Round FV-factor to three decimal places. Calculate vour answer based on the FV-factor. $ Calculate vour answer based on the financial calculator. $ b. If the average new home costs $215,000 today, how much will it cost in 6 years if the price increases by 4 percent each year? Round the answer to the nearest cent. Round FV-factor to three decimal places. Calculate vour answer based on the FV-factor: $ Calculate vour answer based on the financial calculator. $ c. You forecast that in 11 years it will cost $244,000 to provide your child a 4 -year college education. Will you have enough if you take $80,000 today and invest it for the next 11 vears at 6 percent? Round the answer to the nearest cent. Round FV-factor and FVA-factors to three decimal places. you will have approximately than your estimate of $244,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts