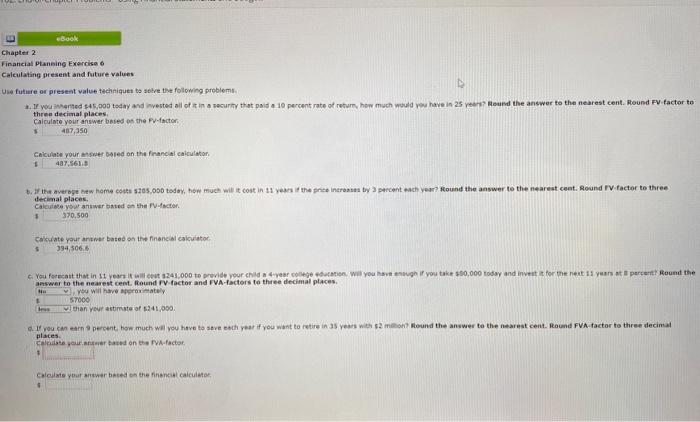

Question: chapter 2 financial planning exercise 6 calculating present and future value. please answer all and explain if possible. thanks aapter 2 nancial Ptansing Exercisa 6

aapter 2 nancial Ptansing Exercisa 6 alculating p resent and future values. future or present value twcheiques te selve the following problems. thren decimal places, threa decimal places; Calculate vour answer boied os the F-Aactor decimat places, decinat places, Caicuiate vout answer bisted oin the Fy-fscter. answen to the nearest cent. Hound IV-factor and FVA-factors to three decimal places. neu wil have appros = ately. rood than yeur actimate of 5241,000 . places. Caloulate vitut antwer beted on the finencial caicuibto. Instructions: To use this table, find the future value tactor that corresponds to both a given time period fyeart and an interest rate. For example, if you want the future value factor for 6 years and 10\%, move across from year 6 and down from 10% to the point at which the row and column intersect: 1.772 .0 ther illustrations: for 3 years and 15%, the proper future value factor is 1.521 ; for 30 years and 8%, it is 10.063 . Table of Future Vanue Annury ractors Instructions: To use this table, find the future value of annuity foctor that corresponds to both a given time period (year) and an interest rate. For example, if you want the future value of annuity factor for 6 years and 10%, move across from yoar 6 and down from 10% to the point at which the row and column intersect nstructions: To use this table, find the future value of annuity factor that corresponds to both a given time period tyear) and an interest rate. For examplo, if yo. vant the future value of annuity factor for 6 years and 10\%, move across from year 6 and down from. 10% to the point at which the row and column intersect 716. Other illustrations: for 3 years and 15\%, the proper future value of annuity factor is 3.473 ; for 30 years and 6%, it is 79,058 . Instructions: To use this table, find the present value factor that corresponds to both a given time period (reat) and an interest rate. For example, if you want the present value factor for 25 years and 7%, move across from year 25 and down from 7% to the point at which the row and column intersect: 184 . Other illustrations: for 3 years and 15%, the proper present value factor is . 658; for 30 years and 8%, it is. 099

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts