Question: Attempts: Keep the Highest:/4 8. More on ratio analysis Aa Aa Analysts and investors often use return on equity (ROE) to compare profitability of a

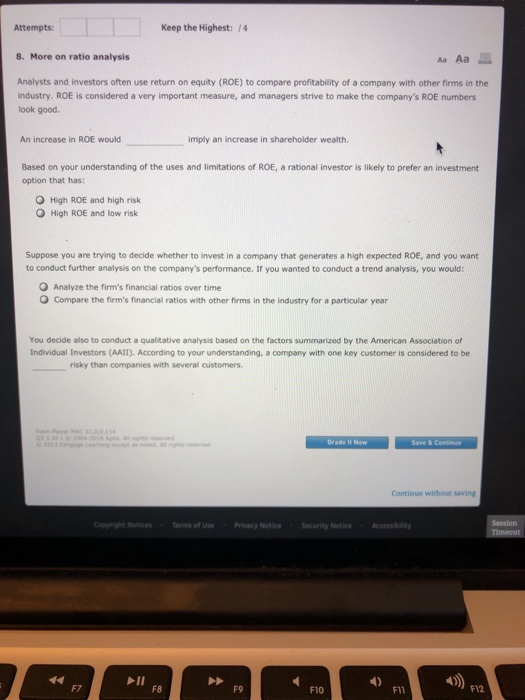

Attempts: Keep the Highest:/4 8. More on ratio analysis Aa Aa Analysts and investors often use return on equity (ROE) to compare profitability of a company with other firms in the industry. ROE is considered a very important measure, and managers strive to make the company's ROE numbers look good. An increase in ROE would imply an increase in shareholder wealth. Based on your understanding of the uses and limitations of ROE, a rational investor is likely to prefer an investment option that has: O High ROE and high risk O High ROE and low risk Suppose you are trying to decide whether to invest in a company that generates a high expected ROE, and you want to conduct further analysis on the company's performance. If you wanted to conduct a trend analysis, you would: O Analyze the firm's financial ratios over time O Compare the firm's financial ratios with other firms in the industry for a particular year You decide also to conduct a qualitative analysis based on the factors summarized by the American Association of risky than companies with several customers Continue without saving opyright Notices m of Use Privacy Notice Security Notice 4) 45) F7 F8 F9 F10 F11 F12

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts