Question: AU (This information is used for problems 20 - 25) The Envelope Company has the following liabilities and equity Labitsad Stockholders Equity kaunts Payable and

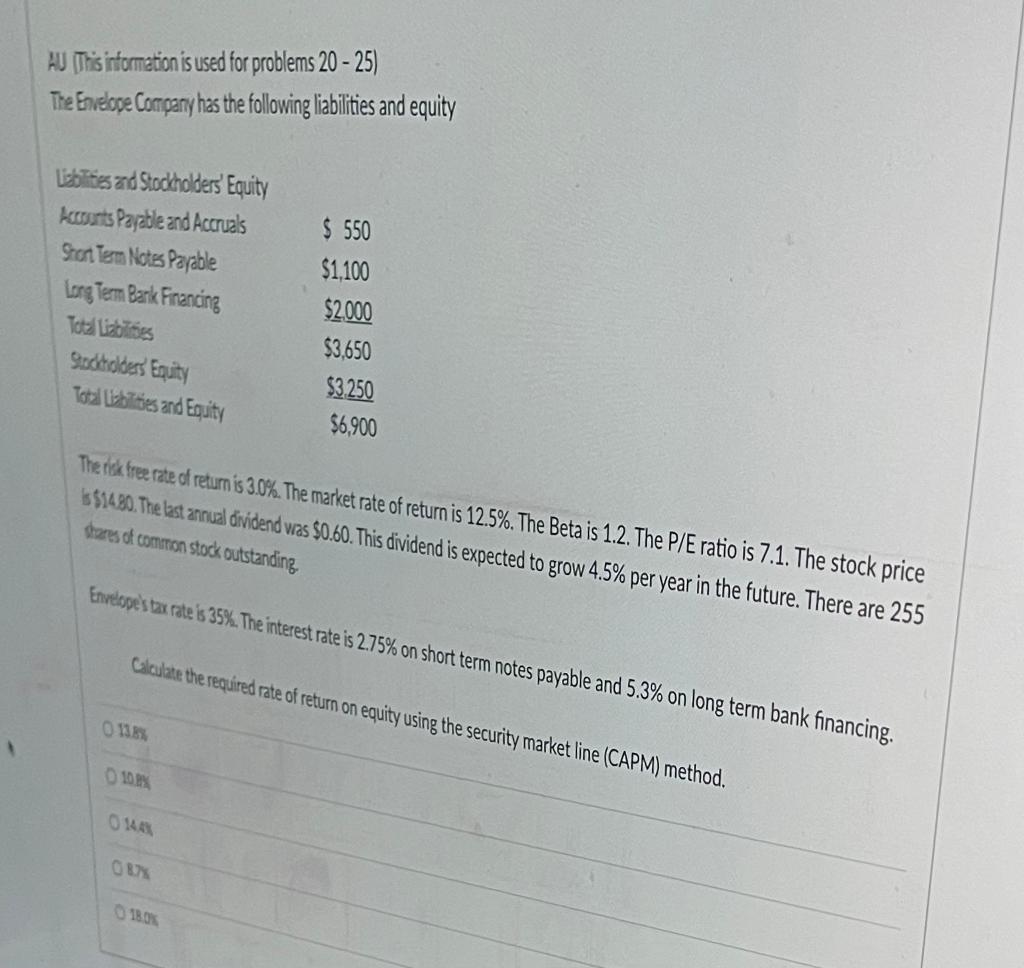

AU (This information is used for problems 20 - 25) The Envelope Company has the following liabilities and equity Labitsad Stockholders Equity kaunts Payable and Accruals San Term Notes Payable Long Term Bark Financing $ 550 $1,100 $2,000 $3,650 $3.250 $6,900 Saddles Equity Total sites and Equity The risk free rate of return is 3.0%. The market rate of return is 12.5%. The Beta is 1.2. The P/E ratio is 7.1. The stock price $14.80. The last annual dividend was $0.60. This dividend is expected to grow 4.5% per year in the future. There are 255 dares of common stock outstanding Envelope's tax rate 's 35%. The interest rate is 2.75% on short term notes payable and 5.3% on long term bank financing. Calculate the required rate of return on equity using the security market line (CAPM) method. 01333 10 0144 087% 1803

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts