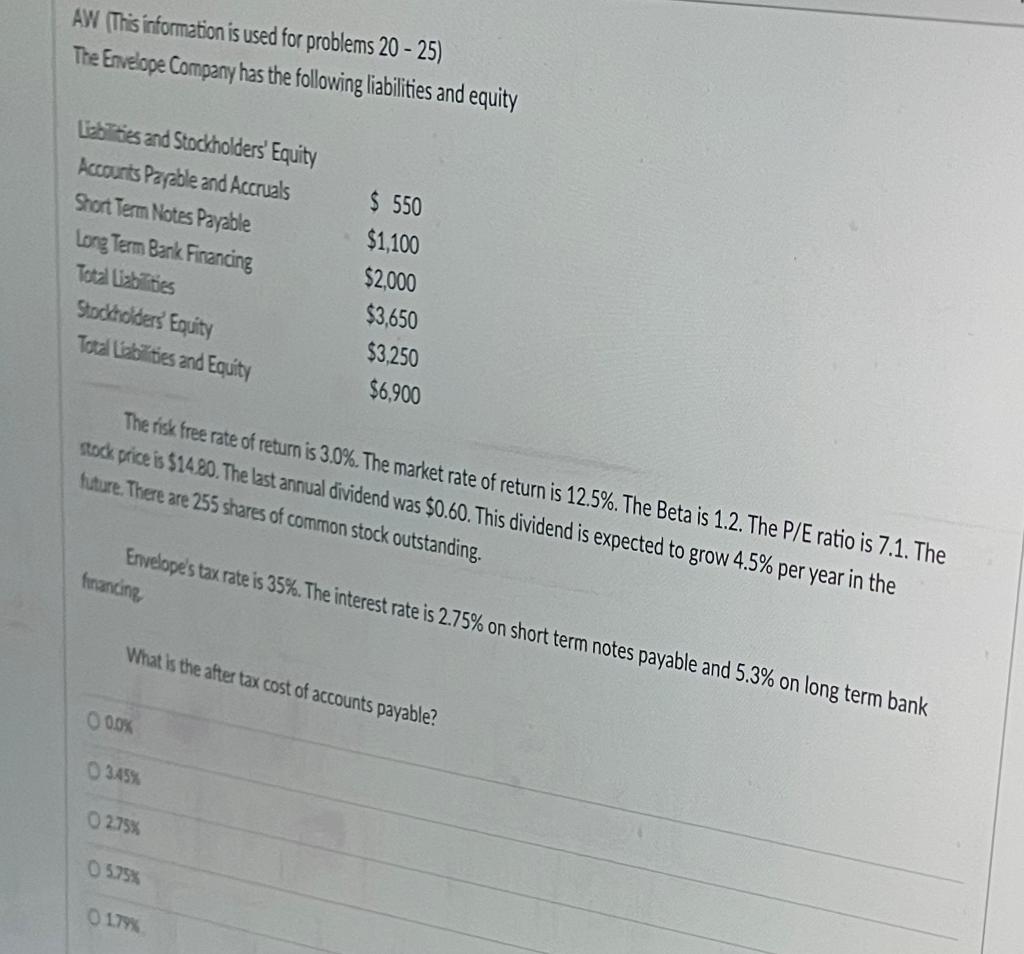

Question: AW (This information is used for problems 20 - 25) The Envelope Company has the following liabilities and equity Labtes and Stockholders' Equity Accounts Parable

AW (This information is used for problems 20 - 25) The Envelope Company has the following liabilities and equity Labtes and Stockholders' Equity Accounts Parable and Accruals Short Term Notes Payable Long Term Bank Financing Total ties Stocoders Equity Totalities and Equity $ 550 $1,100 $2,000 $3,650 $3,250 $6,900 The risk free rate of return is 3.0%. The market rate of return is 12.5%. The Beta is 1.2. The P/E ratio is 7.1. The stock price is $1480. The last annual dividend was $0.60. This dividend is expected to grow 4.5% per year in the future. There are 255 shares of common stock outstanding. Envelope's tax rate is 35%. The interest rate is 2.75% on short term notes payable and 5.3% on long term bank financing What is the after tax cost of accounts payable? 000% 345% 0275% 0575% 0179%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts