Question: Audit standards distinguish auditors' responsibility for planning procedures for detecting noncompliance with laws and regulations having a direct effect on financial statements versus planning procedures

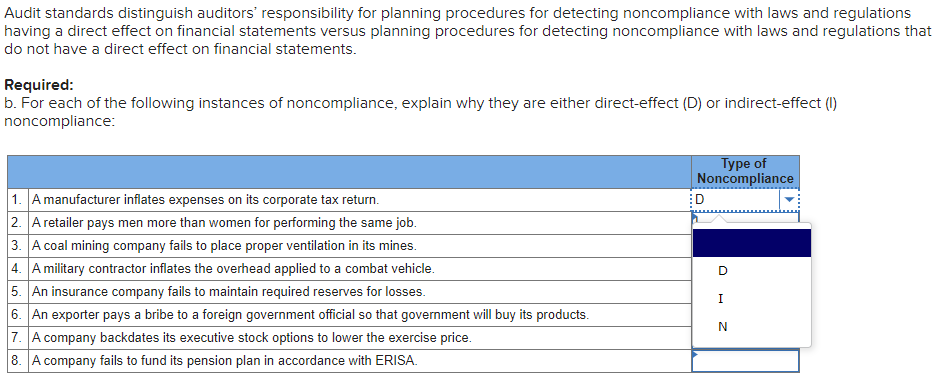

Audit standards distinguish auditors' responsibility for planning procedures for detecting noncompliance with laws and regulations having a direct effect on financial statements versus planning procedures for detecting noncompliance with laws and regulations that do not have a direct effect on financial statements. Required: b. For each of the following instances of noncompliance, explain why they are either direct-effect (D) or indirect-effect (1) noncompliance Type of Noncompliance :D D 1. A manufacturer inflates expenses on its corporate tax return. 2. A retailer pays men more than women for performing the same job. 3. A coal mining company fails to place proper ventilation in its mines. 4. A military contractor inflates the overhead applied to a combat vehicle. 5. An insurance company fails to maintain required reserves for losses. 6. An exporter pays a bribe to a foreign government official so that government will buy its products. 7. A company backdates its executive stock options to lower the exercise price. 8. A company fails to fund its pension plan in accordance with ERISA. I N

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts