Question: Auditing Non current liabilities Please round off to the nearest peso ( in amortization table) except for PV factors CASE 3 (15 points) In the

Auditing

Non current liabilities

Please round off to the nearest peso ( in amortization table) except for PV factors

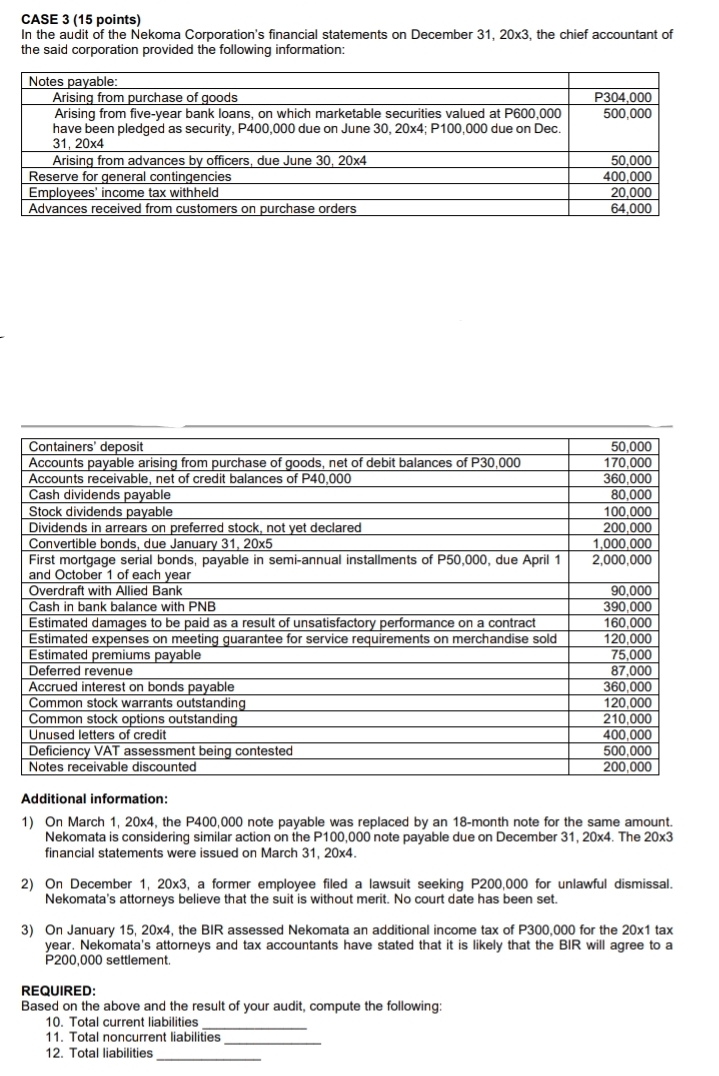

CASE 3 (15 points) In the audit of the Nekoma Corporation's financial statements on December 31, 20x3, the chief accountant of the said corporation provided the following information: Notes payable: Arising from purchase of goods P304,000 Arising from five-year bank loans, on which marketable securities valued at P600,000 500,000 have been pledged as security, P400,000 due on June 30, 20x4; P100,000 due on Dec. 31, 20x4 Arising from advances by officers, due June 30, 20x4 50,000 Reserve for general contingencies 400,000 Employees' income tax withheld 20,000 Advances received from customers on purchase orders 64,000 Containers' deposit 50,000 Accounts payable arising from purchase of goods, net of debit balances of P30,000 170,000 Accounts receivable, net of credit balances of P40,000 360,000 Cash dividends payable 80,000 Stock dividends payable 100,000 Dividends in arrears on preferred stock, not yet declared 200,000 Convertible bonds, due January 31, 20x5 1,000,000 First mortgage serial bonds, payable in semi-annual installments of P50,000, due April 1 2,000,000 and October 1 of each year Overdraft with Allied Bank 90,000 Cash in bank balance with PNB 390,000 Estimated damages to be paid as a result of unsatisfactory performance on a contract 160,000 Estimated expenses on meeting guarantee for service requirements on merchandise sold 120,000 Estimated premiums payable 75,000 Deferred revenue 87,000 Accrued interest on bonds payable 360,000 Common stock warrants outstanding 120,000 Common stock options outstanding 210,000 Unused letters of credit 400,000 Deficiency VAT assessment being contested 500,000 Notes receivable discounted 200,000 Additional information: 1) On March 1, 20x4, the P400,000 note payable was replaced by an 18-month note for the same amount. Nekomata is considering similar action on the P100,000 note payable due on December 31, 20x4. The 20x3 financial statements were issued on March 31, 20x4. 2) On December 1, 20x3, a former employee filed a lawsuit seeking P200,000 for unlawful dismissal. Nekomata's attorneys believe that the suit is without merit. No court date has been set. 3) On January 15, 20x4, the BIR assessed Nekomata an additional income tax of P300,000 for the 20x1 tax year. Nekomata's attorneys and tax accountants have stated that it is likely that the BIR will agree to a P200,000 settlement. REQUIRED: Based on the above and the result of your audit, compute the following: 10. Total current liabilities 11. Total noncurrent liabilities 12. Total liabilities