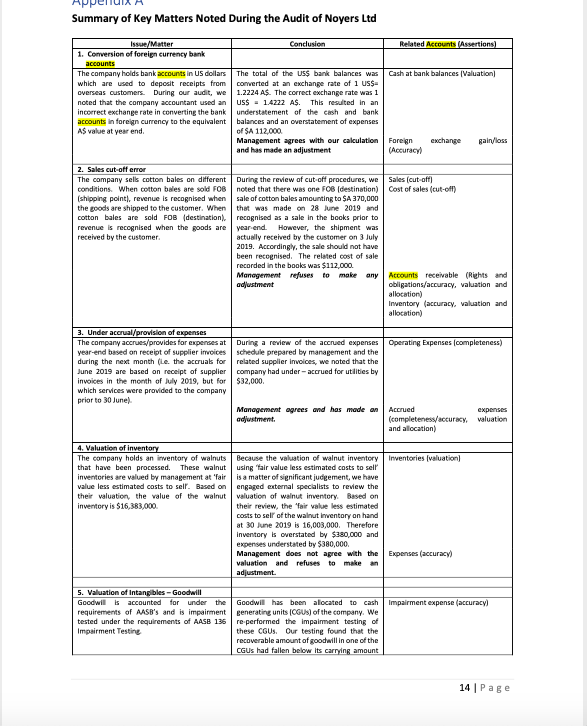

Question: I can get the answer for task 3 please Noyers Ltd Company Background The Entity Noyers Ltd, a company with its headquarters in Launceston, Tasmania,

I can get the answer for task 3 please

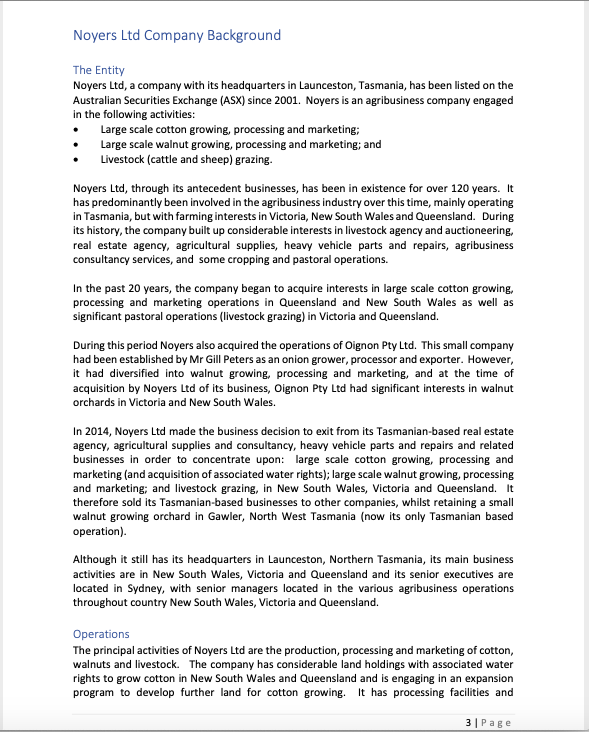

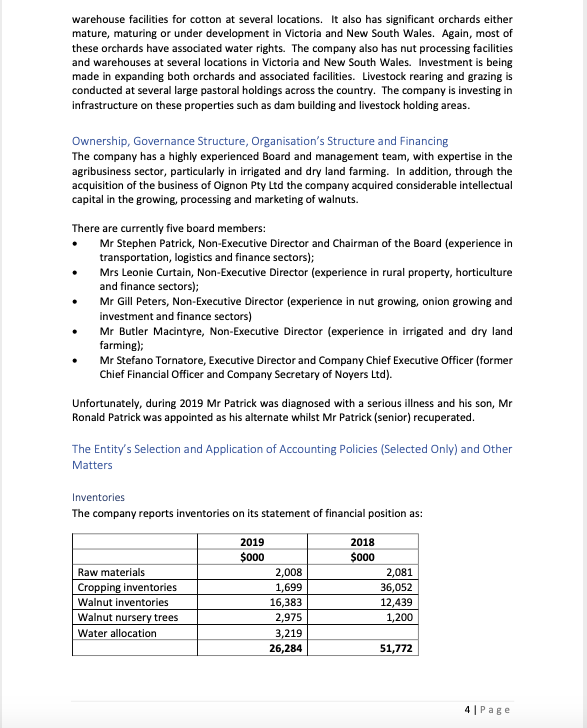

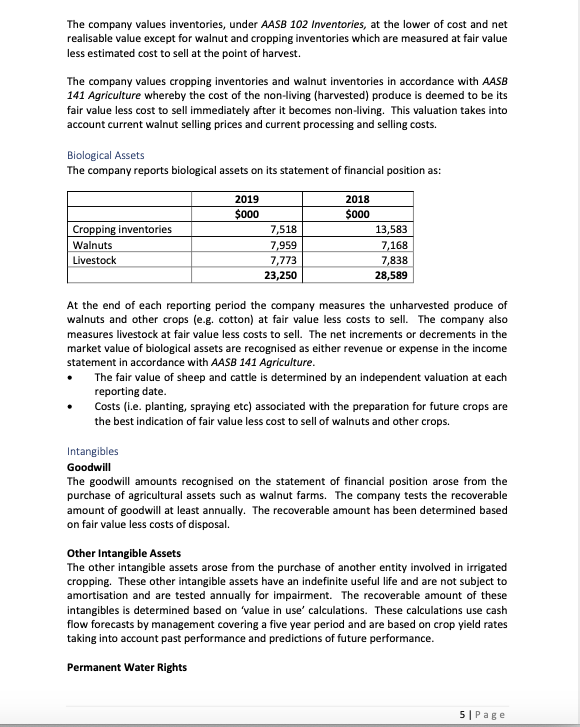

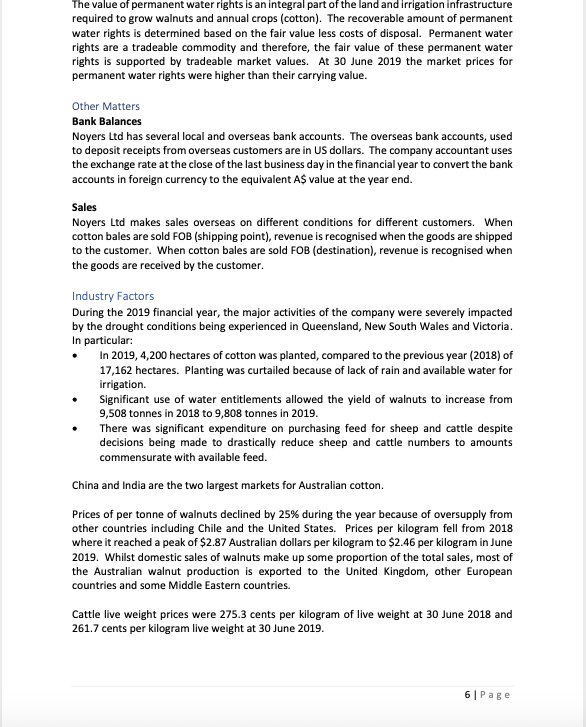

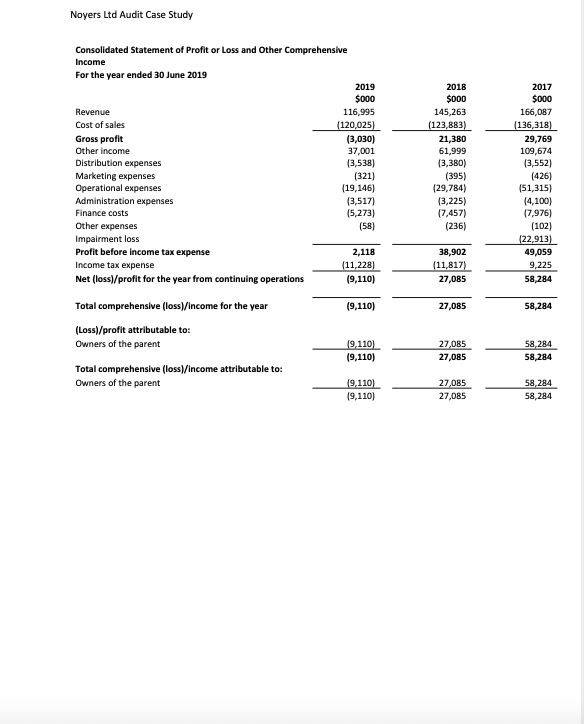

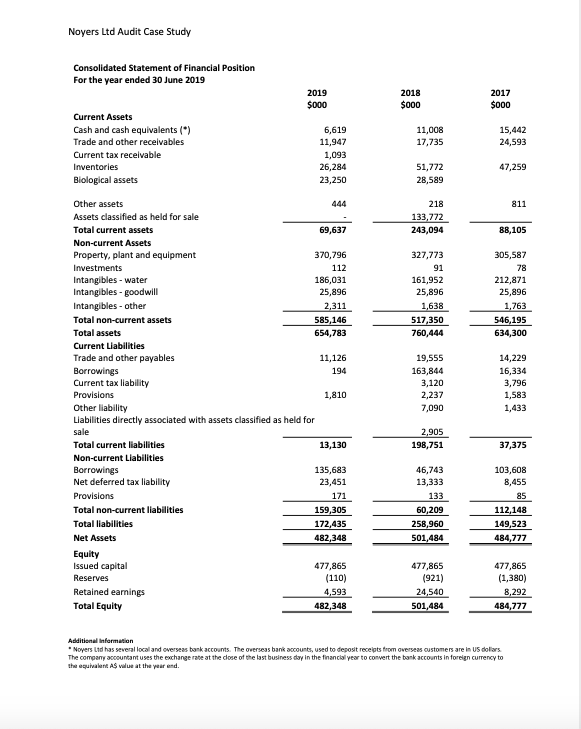

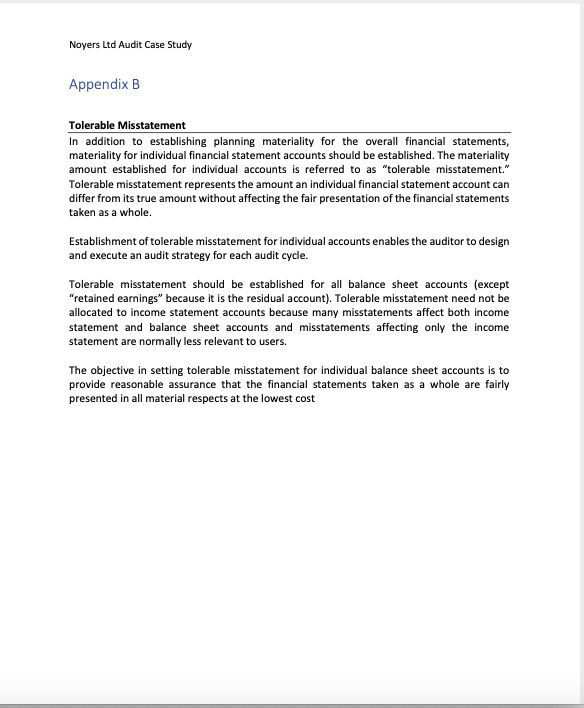

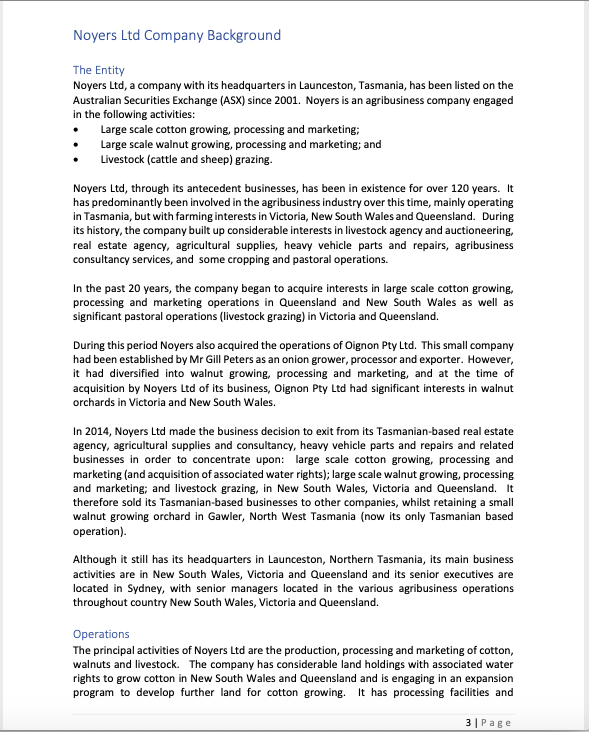

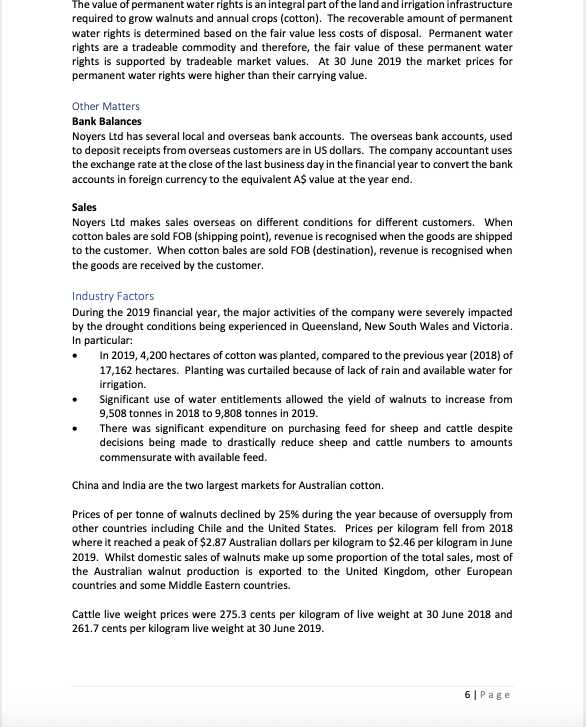

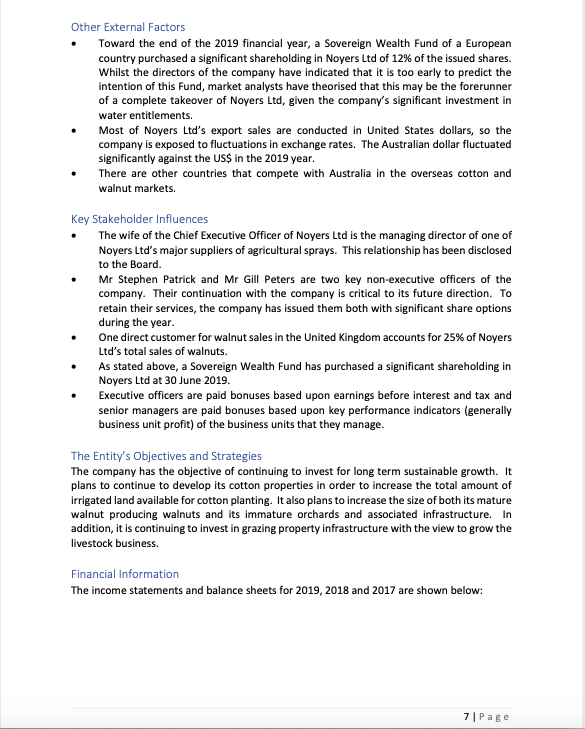

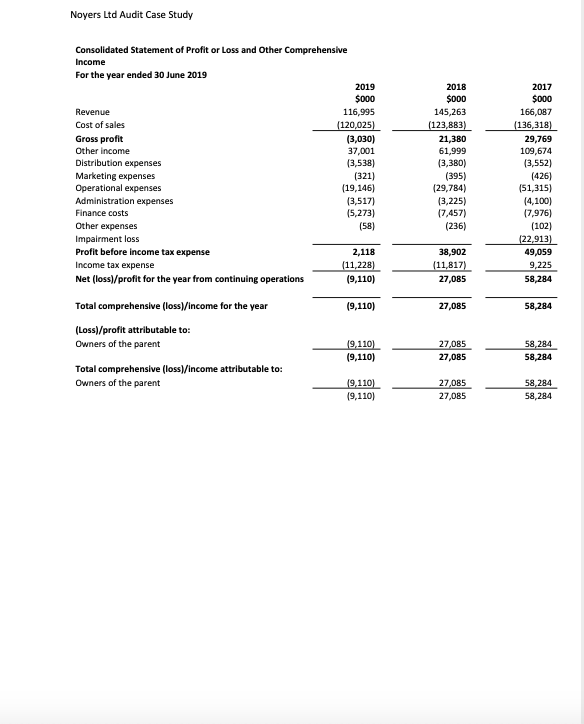

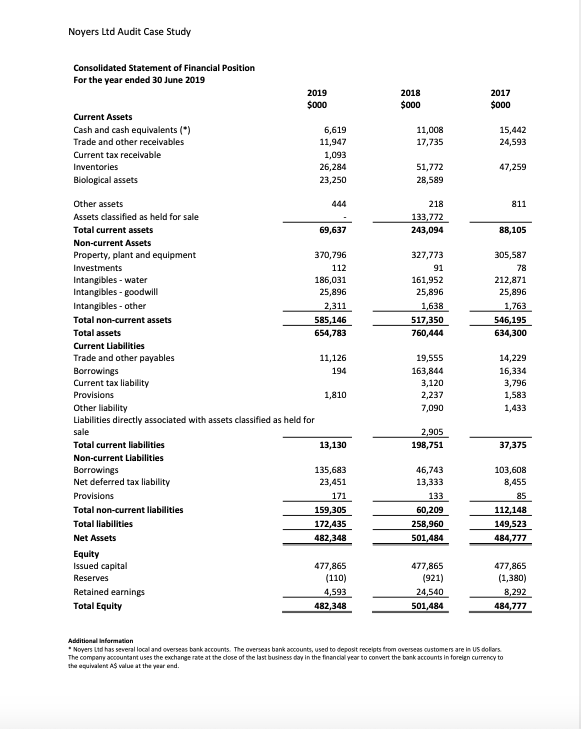

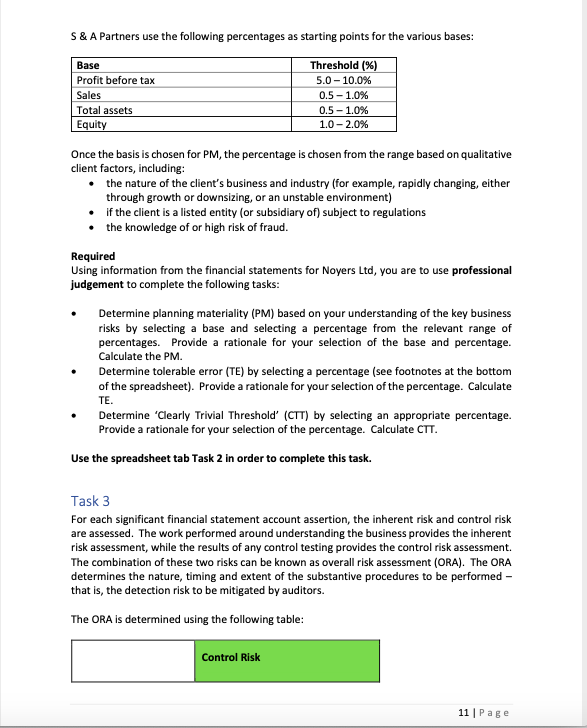

Noyers Ltd Company Background The Entity Noyers Ltd, a company with its headquarters in Launceston, Tasmania, has been listed on the Australian Securities Exchange (ASX) since 2001. Noyers is an agribusiness company engaged in the following activities: Large scale cotton growing, processing and marketing; Large scale walnut growing, processing and marketing; and Livestock (cattle and sheep) grazing- Noyers Led, through its antecedent businesses, has been in existence for over 120 years. It has predominantly been involved in the agribusiness industry over this time, mainly operating in Tasmania, but with farming interests in Victoria, New South Wales and Queensland. During its history, the company built up considerable interests in livestock agency and auctioneering, real estate agency, agricultural supplies, heavy vehicle parts and repairs, agribusiness consultancy services, and some cropping and pastoral operations. In the past 20 years, the company began to acquire interests in large scale cotton growing, processing and marketing operations in Queensland and New South Wales as well as significant pastoral operations (livestock grazing) in Victoria and Queensland. During this period Noyers also acquired the operations of Oignon Pty Ltd. This small company had been established by Mr Gill Peters as an onion grower, processor and exporter. However, it had diversified into walnut growing, processing and marketing, and at the time of acquisition by Noyers Ltd of its business, Oignon Pty Ltd had significant interests in walnut orchards in Victoria and New South Wales. In 2014, Noyers Led made the business decision to exit from its Tasmanian-based real estate agency, agricultural supplies and consultancy, heavy vehicle parts and repairs and related businesses in order to concentrate upon: large scale cotton growing, processing and marketing (and acquisition of associated water rights); large scale walnut growing, processing and marketing; and livestock grazing, in New South Wales, Victoria and Queensland. It therefore sold its Tasmanian-based businesses to other companies, whilst retaining a small walnut growing orchard in Gawler, North West Tasmania (now its only Tasmanian based operation) Although it still has its headquarters in Launceston, Northern Tasmania, its main business activities are in New South Wales, Victoria and Queensland and its senior executives are located in Sydney, with senior managers located in the various agribusiness operations throughout country New South Wales, Victoria and Queensland. Operations The principal activities of Noyers Ltd are the production, processing and marketing of cotton, walnuts and livestock. The company has considerable land holdings with associated water rights to grow cotton in New South Wales and Queensland and is engaging in an expansion program to develop further land for cotton growing. It has processing facilities and 3|Pagewarehouse facilities for cotton at several locations. It also has significant orchards either mature, maturing or under development in Victoria and New South Wales. Again, most of these orchards have associated water rights. The company also has nut processing facilities and warehouses at several locations in Victoria and New South Wales. Investment is being made in expanding both orchards and associated facilities. Livestock rearing and grazing is conducted at several large pastoral holdings across the country. The company is investing in Infrastructure on these properties such as dam building and livestock holding areas. Ownership, Governance Structure, Organisation's Structure and Financing The company has a highly experienced Board and management team, with expertise in the agribusiness sector, particularly in irrigated and dry land farming. In addition, through the acquisition of the business of Oignon Pty Ltd the company acquired considerable intellectual capital in the growing, processing and marketing of walnuts. There are currently five board members: Mr Stephen Patrick, Non-Executive Director and Chairman of the Board (experience in transportation, logistics and finance sectors); Mrs Leonie Curtain, Non-Executive Director (experience in rural property, horticulture and finance sectors); Mr Gill Peters, Non-Executive Director (experience in nut growing, onion growing and investment and finance sectors) Mr Butler Macintyre, Non-Executive Director (experience in irrigated and dry land farming); Mr Stefano Tornatore, Executive Director and Company Chief Executive Officer (former Chief Financial Officer and Company Secretary of Noyers Ltd). Unfortunately, during 2019 Mr Patrick was diagnosed with a serious illness and his son, Mr Ronald Patrick was appointed as his alternate whilst Mr Patrick (senior) recuperated. The Entity's Selection and Application of Accounting Policies (Selected Only) and Other Matters Inventories The company reports inventories on its statement of financial position as: 2019 2018 $000 SOOO Raw materials 2,008 2,081 Cropping Inventories 1,699 36,052 Walnut inventories 16,383 12,439 Walnut nursery trees 2,975 1,200 Water allocation 3,219 26,284 51,772 4 PageThe company values inventories, under AASB 102 Inventories, at the lower of cost and net realisable value except for walnut and cropping inventories which are measured at fair value less estimated cost to sell at the point of harvest. The company values cropping inventories and walnut inventories in accordance with AASB 141 Agriculture whereby the cost of the non-living (harvested) produce is deemed to be its fair value less cost to sell immediately after it becomes non-living. This valuation takes into account current walnut selling prices and current processing and selling costs. Biological Assets The company reports biological assets on its statement of financial position as: 2019 2018 $000 5000 Cropping inventories 7,518 13,583 Walnuts 7,959 7,168 Livestock 7,773 7,838 23,250 28,589 At the end of each reporting period the company measures the unharvested produce of walnuts and other crops (e.g. cotton) at fair value less costs to sell. The company also measures livestock at fair value less costs to sell. The net increments or decrements in the market value of biological assets are recognised as either revenue or expense in the income statement in accordance with AASB 141 Agriculture. The fair value of sheep and cattle is determined by an independent valuation at each reporting date. Costs (i.e. planting, spraying etc) associated with the preparation for future crops are the best indication of fair value less cost to sell of walnuts and other crops. Intangibles Goodwill The goodwill amounts recognised on the statement of financial position arose from the purchase of agricultural assets such as walnut farms. The company tests the recoverable amount of goodwill at least annually. The recoverable amount has been determined based on fair value less costs of disposal. Other Intangible Assets The other intangible assets arose from the purchase of another entity involved in irrigated cropping. These other intangible assets have an indefinite useful life and are not subject to amortisation and are tested annually for impairment. The recoverable amount of these intangibles is determined based on 'value in use' calculations. These calculations use cash flow forecasts by management covering a five year period and are based on crop yield rates taking into account past performance and predictions of future performance. Permanent Water Rights 5 |pageThe value of permanent water rights is an integral part of the land and irrigation infrastructure required to grow walnuts and annual crops (cotton). The recoverable amount of permanent water rights is determined based on the fair value less costs of disposal. Permanent water rights are a tradeable commodity and therefore, the fair value of these permanent water rights is supported by tradeable market values. At 30 June 2019 the market prices for permanent water rights were higher than their carrying value. Other Matters Bank Balances Noyers Ltd has several local and overseas bank accounts. The overseas bank accounts, used to deposit receipts from overseas customers are in US dollars. The company accountant uses the exchange rate at the close of the last business day in the financial year to convert the bank accounts in foreign currency to the equivalent A$ value at the year end. Sales Noyers Ltd makes sales overseas on different conditions for different customers. When cotton bales are sold FOB (shipping point), revenue is recognised when the goods are shipped to the customer. When cotton bales are sold FOB (destination), revenue is recognised when the goods are received by the customer. Industry Factors During the 2019 financial year, the major activities of the company were severely impacted by the drought conditions being experienced in Queensland, New South Wales and Victoria. In particular: In 2019, 4,200 hectares of cotton was planted, compared to the previous year (2018) of 17,162 hectares. Planting was curtailed because of lack of rain and available water for irrigation. Significant use of water entitlements allowed the yield of walnuts to increase from 9,508 tonnes in 2018 to 9,808 tonnes in 2019. There was significant expenditure on purchasing feed for sheep and cattle despite decisions being made to drastically reduce sheep and cattle numbers to amounts commensurate with available feed. China and India are the two largest markets for Australian cotton. Prices of per tonne of walnuts declined by 25% during the year because of oversupply from other countries including Chile and the United States. Prices per kilogram fell from 2018 where it reached a peak of $2.87 Australian dollars per kilogram to $2.46 per kilogram in June 2019. Whilst domestic sales of walnuts make up some proportion of the total sales, most of the Australian walnut production is exported to the United Kingdom, other European countries and some Middle Eastern countries. Cattle live weight prices were 275.3 cents per kilogram of live weight at 30 June 2018 and 261.7 cents per kilogram live weight at 30 June 2019. 6|PageOther External Factors Toward the end of the 2019 financial year, a Sovereign Wealth Fund of a European country purchased a significant shareholding in Noyers Lid of 12% of the issued shares. Whilst the directors of the company have indicated that it is too early to predict the intention of this Fund, market analysts have theorised that this may be the forerunner of a complete takeover of Noyers Ltd, given the company's significant investment in water entitlements. Most of Noyers Lid's export sales are conducted in United States dollars, so the company is exposed to fluctuations in exchange rates. The Australian dollar fluctuated significantly against the US$ in the 2019 year. There are other countries that compete with Australia in the overseas cotton and walnut markets. Key Stakeholder Influences The wife of the Chief Executive Officer of Noyers Ltd is the managing director of one of Noyers Ltd's major suppliers of agricultural sprays. This relationship has been disclosed to the Board. Mr Stephen Patrick and Mr Gill Peters are two key non-executive officers of the company. Their continuation with the company is critical to its future direction. To retain their services, the company has issued them both with significant share options during the year. One direct customer for walnut sales in the United Kingdom accounts for 25% of Noyers Ltd's total sales of walnuts. As stated above, a Sovereign Wealth Fund has purchased a significant shareholding in Noyers Ltd at 30 June 2019. Executive officers are paid bonuses based upon earnings before interest and tax and senior managers are paid bonuses based upon key performance indicators (generally business unit profit) of the business units that they manage. The Entity's Objectives and Strategies The company has the objective of continuing to invest for long term sustainable growth. It plans to continue to develop its cotton properties in order to increase the total amount of Irrigated land available for cotton planting. It also plans to increase the size of both its mature walnut producing walnuts and its immature orchards and associated infrastructure. In addition, it is continuing to invest in grazing property infrastructure with the view to grow the livestock business. Financial Information The income statements and balance sheets for 2019, 2018 and 2017 are shown below: 7|pageNoyers Ltd Audit Case Study Consolidated Statement of Profit or Loss and Other Comprehensive Income For the year ended 30 June 2019 2019 2018 2017 $000 $000 $000 Revenue 116,995 145,263 166,087 Cost of sales [120,025) (123,883) [136,318] Gross profit (3,030] 21,380 29,769 Other income 37,001 61,999 109,674 Distribution expenses (3,538] (3,380) (3,552] Marketing expenses (321] (395) (426] Operational expenses [19,146] (29,784) (51,315] Administration expenses (3,517) (3,225) [4,100] Finance costs (5,273) [7,457) (7,976] Other expenses (58) (236) (102] Impairment loss (22,913) Profit before income tax expense 2,118 38,902 19,059 Income tax expense [11,228) (11,817) 3,225 Net (loss)/profit for the year from continuing operations (9,110) 27,085 58,284 Total comprehensive (loss)/income for the year (9,110) 27,085 58,284 (Loss)/profit attributable to: Owners of the parent (9,110] 27,85 58,284 (9,110) 27,085 58,284 Total comprehensive (loss)/ income attributable to: Owners of the parent (9,110] 27,085 58,284 (9,110] 27,085 58,284Noyers Ltd Audit Case Study Consolidated Statement of Financial Position For the year ended 30 June 2019 2019 2018 2017 $000 $OOO Current Assets Cash and cash equivalents (*) 6,619 11,008 15,442 Trade and other receivables 11,947 17,735 24,593 Current tax receivable 1,093 Inventories 26,284 51,772 47,259 Biological assets 23,250 28,589 Other assets 444 218 811 Assets classified as held for sale 133,772 Total current assets 69,637 243,094 88,105 Non-current Assets Property, plant and equipment 370,796 327,773 305,587 Investments 112 91 78 Intangibles - water 186,031 161,952 212,871 Intangibles - goodwill 25,896 25,896 25,896 Intangibles - other 2,311 1,638 1,763 Total non-current assets 585,146 517,350 546,195 Total assets 654,783 760,444 634,300 Current Liabilities Trade and other payables 11,126 19,555 14,229 Borrowings 194 163,844 16,334 Current tax liability 3.120 3,796 Provisions 1,810 2,237 1,583 Other liability 7,090 1,433 Liabilities directly associated with assets classified as held for sale 2,905 Total current liabilities 13,130 198,751 37,375 Non-current Liabilities Borrowings 135,683 46,743 103,608 Net deferred tax liability 23,451 13,333 8,455 Provisions 171 133 85 Total non-current liabilities 159,305 60,209 112,148 Total liabilities 172,435 258,960 149,523 Net Assets 482,348 01,484 484,777 Equity Issued capital 477,865 477,865 477,865 Reserves 110) 921) (1,380 Retained earnings 4,593 24,540 8,292 Total Equity 482,348 501,484 484,777 Additional Information "Moyers Lid has several local and overseas back accounts. The overseas bank accounts, used to deposit receipts from overseas customers are in US dollars The company accountant uses the exchange rate at the close of the last business day in the financial year to convert the bank accounts In foreign currency to the equivalent AS value at the year end.Other S & A Partners is an Australian accounting firm with offices located in each of the major cities. The firm has just been appointed to conduct the 30 June 2019 audit for Noyers Ltd. Appropriate client acceptance and quality assurance procedures under Australian Auditing Standards have been conducted by S & A Partners for the audit of Noyers. You are employed by $ & A Partners and the team that you are a member of has been assigned, by the audit partner, a number of tasks to complete in the audit of Noyers Ltd for the year ended 30 June 2019. Task 1 Required Using the information provided about Noyers Lid and appropriate research regarding the Industry and other economic factors: a. Assess the key business risks of Noyers Ltd from the information available to you (at least six (6) need to be identified); b. Explain the implications of each risk identified on the financial statements; c. Identify the related financial statement accounts at risk. d. Identify the related management assertion (refer to ASA 315) most at risk for each financial statement account identified as being at risk. e. Justify your identification of the management assertion at risk. Use the spreadsheet template tab Task 1 in order to complete this task. Task 2 Materiality assessment requires an auditor to make judgements about the size of misstatements that would be considered 'material' to the users of the financial statements. The auditor will design procedures in order to identify and correct errors or irregularities that would have a material effect on the financial report and affect the decision making of the users of the financial report. Materiality is used in determining audit procedures, sample selections, and evaluating differences from client records to audit results. It is the maximum amount of misstatement, individually or in aggregate, that can be accepted in the financial report. In selecting the base figure to be used to calculate materiality, an auditor should consider the key drivers of the business. They should ask, "What are the end users (i.e. shareholders, banks etc.] of the accounts going to be looking at?" For example, will shareholders be interested in profit figures that can be used to pay dividends and increase share price? 5 & A Partners' audit methodology dictates that one planning materiality (PM) amount is to be used for the financial report as a whole (that is, rather than separate PMs for the income statement and the balance sheet). The basis selected is the one determined to be the key driver of the business. 10 | Page5 & A Partners use the following percentages as starting points for the various bases: Base Threshold (%) Profit before tax 5.0-10.0% Sales 0.5 - 1.0% Total assets 0.5 - 1.0% Equity 1.0-2.0% Once the basis is chosen for PM, the percentage is chosen from the range based on qualitative client factors, including: the nature of the client's business and industry (for example, rapidly changing, either through growth or downsizing, or an unstable environment) If the client is a listed entity (or subsidiary of) subject to regulations . the knowledge of or high risk of fraud. Required Using information from the financial statements for Noyers Ltd, you are to use professional judgement to complete the following tasks: Determine planning materiality (PM) based on your understanding of the key business risks by selecting a base and selecting a percentage from the relevant range of percentages. Provide a rationale for your selection of the base and percentage. Calculate the PM. Determine tolerable error (TE) by selecting a percentage (see footnotes at the bottom of the spreadsheet). Provide a rationale for your selection of the percentage. Calculate TE. Determine 'Clearly Trivial Threshold' (CTT) by selecting an appropriate percentage. Provide a rationale for your selection of the percentage. Calculate CTT. Use the spreadsheet tab Task 2 in order to complete this task. Task 3 For each significant financial statement account assertion, the inherent risk and control risk are assessed. The work performed around understanding the business provides the inherent risk assessment, while the results of any control testing provides the control risk assessment. The combination of these two risks can be known as overall risk assessment (ORA). The ORA determines the nature, timing and extent of the substantive procedures to be performed - that is, the detection risk to be mitigated by auditors. The ORA is determined using the following table: Control Risk 11 | PageHigh Medium Low High Lowest Lower Medium Inherent Risk Medium Lower Medium Higher Low Medium High Highest There is an inverse relationship between the ORA and detection risk (DR). Required (Spreadsheet tab Task 3 identifies six financial statement accounts and related assertions assessed as being at risk for Noyers Ltd. Note that the control risk for these accounts/assertions has already been assessed by other members of the audit engagement team as indicated in spreadsheet tab Task 3.) a. From the information that you have available to you about Noyers Ltd, assess the inherent risk for each of these five account/assertions (high, medium or low). Justify your assessment of the inherent risk level for each of the five account/assertions. C . Applying the qualitative audit risk model described above, determine overall risk assessment for each account/assertion and then determine the acceptable level of detection risk. Use the spreadsheet tab Task 3 in order to complete this task. Task 4 This task requires you to respond to the overall risk assessment of identified significant accounts by developing audit tests. In practice, this phase requires an auditor to prepare an audit program, which outlines the audit tests (tests of controls and substantive tests) to be undertaken to reduce the risk of material misstatement to an acceptable level. If control risk is assessed as less than high, then tests of controls are undertaken to gather evidence of their existence and operational efficiency. Assessment of controls and testing their operational efficiency is outside the scope of this case study and thus, we require you to focus on substantive tests in this task. You will note that the information for Noyers Ltd includes some information regarding the accounting policies and treatment applied by Noyers Ltd for some accounts identified as likely at risk of material misstatement. Required 12 | PageNoyers Ltd Audit Case Study Spreadsheet tab Task 4 identifies eight financial statement accounts and related assertions assessed as being at risk for Noyers Ltd. For each of these eight financial statement accounts and related assertions: a. Develop one appropriate audit objective; and b. Develop one appropriate audit procedure for that audit objective. (Note: Each audit objective and procedure must be specific to Noyers Ltd) Use the spreadsheet tab Task 4 in order to complete this task. Task 5 This task requires you to carry errors found during the audit to the summary of audit differences. The errors in recorded amounts an judgemental differences encountered during the audit for which the client has not made a correction will need to be summarised to evaluate the materiality of their aggregate effect on the financial statements and their effect they may have on the overall conclusion (audit opinion)- To enable you to complete the audit process, you are provided with a summary of key issues identified during the course of the audit, related discussions with management and resulting conclusions (refer to Appendix A below). Required a. Consider each of the findings provided in the additional information (See Appendix A below) and prepare a summary of audit differences (SADs) and identify/assess the overall impact of the unadjusted audit differences, assuming that the client has adjusted for the differences agreed with the auditor and NOT adjusted for the differences not agreed with the auditor (your assessment should show the impact of each difference on the current assets, non-current assets, current liabilities, non- current liabilities and the profit/loss for the year). Compare the net result with the materiality figures and assess the impact of the unadjusted differences on the audit report. c. Determine the type of audit report that should be prepared under Australian Auditing Standards (Note, you do not prepare the audit report, just determine the type of audit report that should be prepared). Reference this section with the relevant Audit Standard. Use the spreadsheet tab Task 5 in order to complete this task.Summary of Key Matters Noted During the Audit of Noyers Ltd Issue/Matter Conclusion Related Accounts (Assertions] 1. Comversion of foreign currency bank accounts The company holds bank accounts in US dollars | The total of the US$ bank balances was Cash at bank balances (Valuation) which are used to deposit receipts from converted at an exchange rate of 1 US$- overseas customers. During our audit, we 1.2224 A$. The correct exchange rate was 1 noted that the company accountant used an US$ = 1.4222 AS. This resulted in an incorrect exchange rate in converting the bank understatement of the cash and bank accounts In foreign currency to the equivalent balances and an overstatement of expenses AS value at year end of SA 112,090. Management agrees with our calculation Foreign exchange Rainloss and has made an adjustment (Accuracy) 2. Sales cut off error The company sells cotton bales on different | During the review of cut off procedures, we Sales [out-off) conditions. When cotton bales are sold FOG noted that there was one FOU [destination) Cost of sales (cut-off) [shipping point), revenue is recognised when sale of cotton bales amounting to SA 370,000 the goods are shipped to the customer. When that was made on 28 June 2019 and cotton bales are sold FOB (destination), recognised as a sale in the books prior to revenue is recognised when the goods are year end. However, the shipment was received by the customer. actually received by the customer on 3 July 2019. Accordingly, the sale should not have been recognised, The related cost of sale recorded in the books was $112,000. Management refuses to make any Accounts receivable (Rights and adjustment obligations/accuracy, valuation and allocation) Inventory (accuracy, valuation and allocation) 3. Under accrual/provision of expenses The company accrues/provides for expenses at | During a review of the accrued expenses Operating Expenses [completeness) year-end based on receipt of supplier invoices schedule prepared by management and the during the next month (Le. the accruals for related supplier invoices, we noted that the June 2019 are based on receipt of supplier invoices in the month of July 2019, but for company had under - accrued for utilities by $32,000. which services were provided to the company prior to 30 June) Management agrees and has made an Accrued adjustment. (completenes/accuracy, valuation and allocation 4. Valuation of inventory The company holds an inventory of walnuts Because the valuation of walnut inventory | Inventories [valuation] that have been processed. These walnut using "fair value less estimated costs to sell' inventories are valued by management at 'fair is a matter of significant judgement, we have value less estimated costs to sell. Based on engaged external specialists to review the their valuation, the value of the walnut valuation of walnut inventory. Based on inventory is $16,383,000. their review, the 'fair value less estimated costs to self of the walnut inventory on hand at 30 June 2019 is 16,003,000, Therefore Inventory is overstated by $380,000 and expenses understated by $380,000. Management does not agree with the Expenses (accuracy) valuation and refuses to make adjustment 5. Valuation of Intangibles - Goodwill Goodwill is accounted for under the Goodwill has been allocated to cash Impairment expense (accuracy) requirements of AASD's and is impairment generating units [CQUS) of the company. We tested under the requirements of AASE 136 re performed the impairment testing of Impairment Testing these CGUs. Our testing found that the recoverable amount of goodwill in one of the CGUs had fallen below its carrying amount 14 | PageNoyers Ltd Audit Case Study and therefore should be impaired $20,000. Management has agreed with the testing Goodwill (valuation) and has made the adjustment requiredNoyers Ltd Audit Case Study Appendix B Tolerable Misstatement In addition to establishing planning materiality for the overall financial statements, materiality for individual financial statement accounts should be established. The materiality amount established for individual accounts is referred to as "tolerable misstatement." Tolerable misstatement represents the amount an individual financial statement account can differ from its true amount without affecting the fair presentation of the financial statements taken as a whole. Establishment of tolerable misstatement for individual accounts enables the auditor to design and execute an audit strategy for each audit cycle. Tolerable misstatement should be established for all balance sheet accounts (except "retained earnings" because it is the residual account). Tolerable misstatement need not be allocated to income statement accounts because many misstatements affect both income statement and balance sheet accounts and misstatements affecting only the income statement are normally less relevant to users. The objective in setting tolerable misstatement for individual balance sheet accounts is to provide reasonable assurance that the financial statements taken as a whole are fairly presented in all material respects at the lowest cost

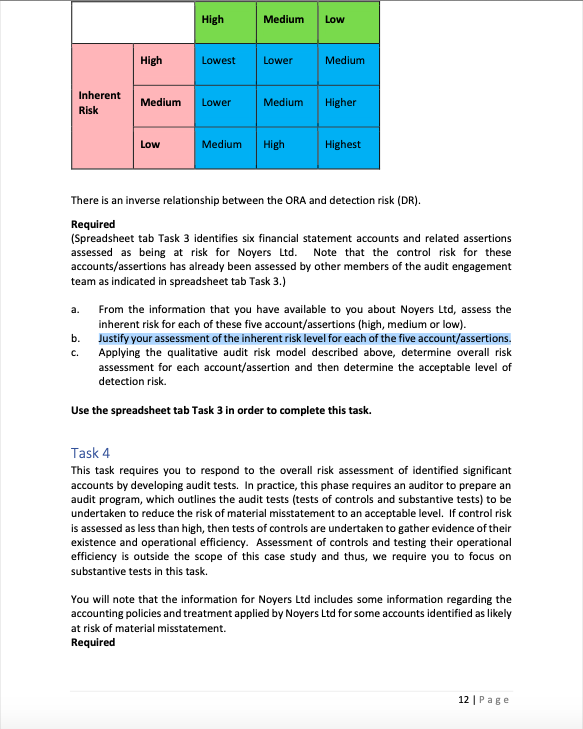

Step by Step Solution

There are 3 Steps involved in it

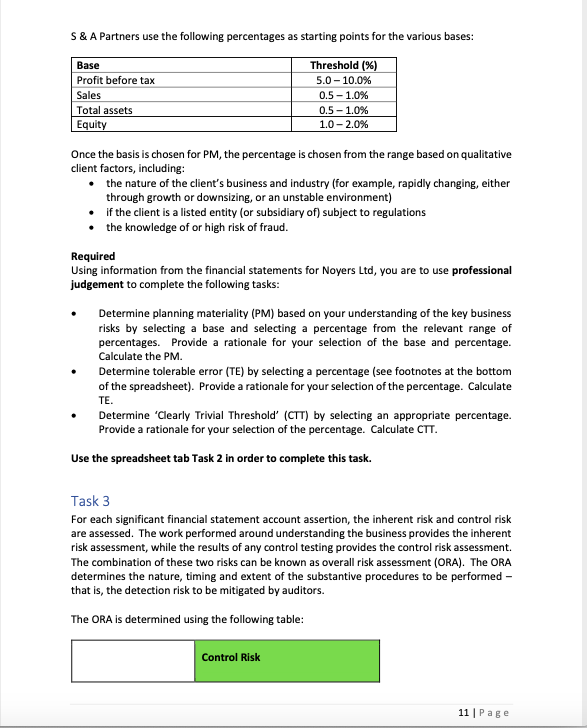

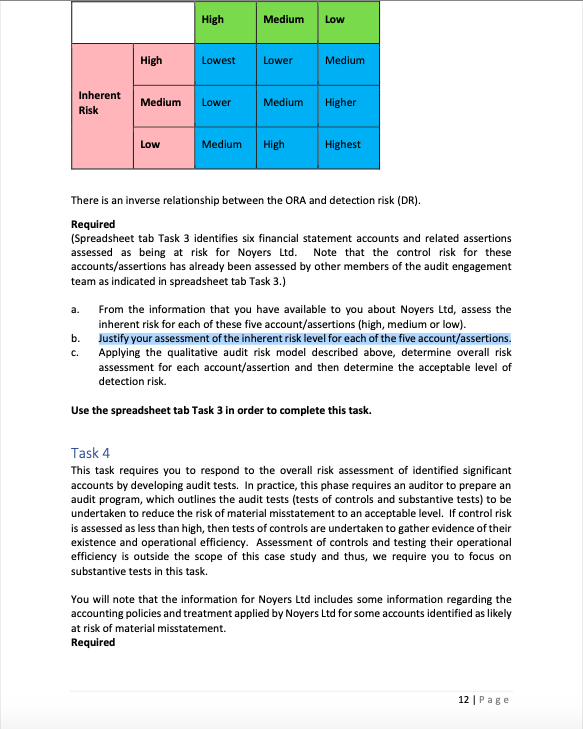

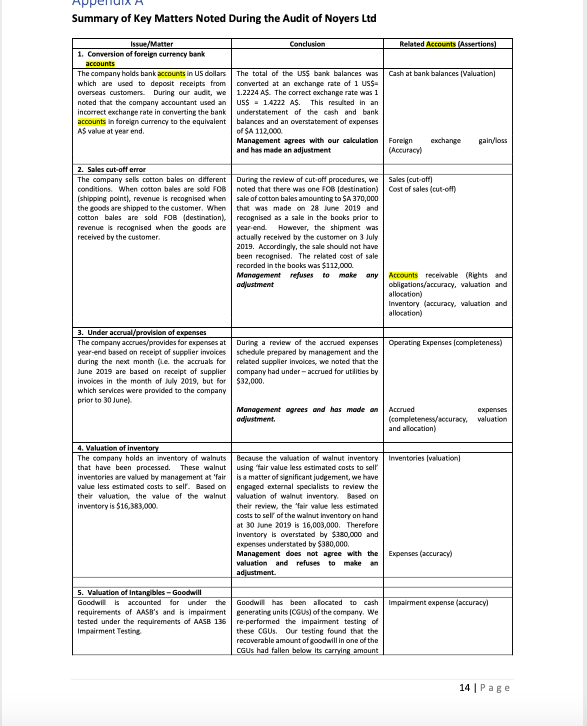

Get step-by-step solutions from verified subject matter experts