Question: + Automatic Zoom Question 1 Assume that the CAPM holds. Consider a stock market that consists of only two risky securities, Stock 1 and Stock

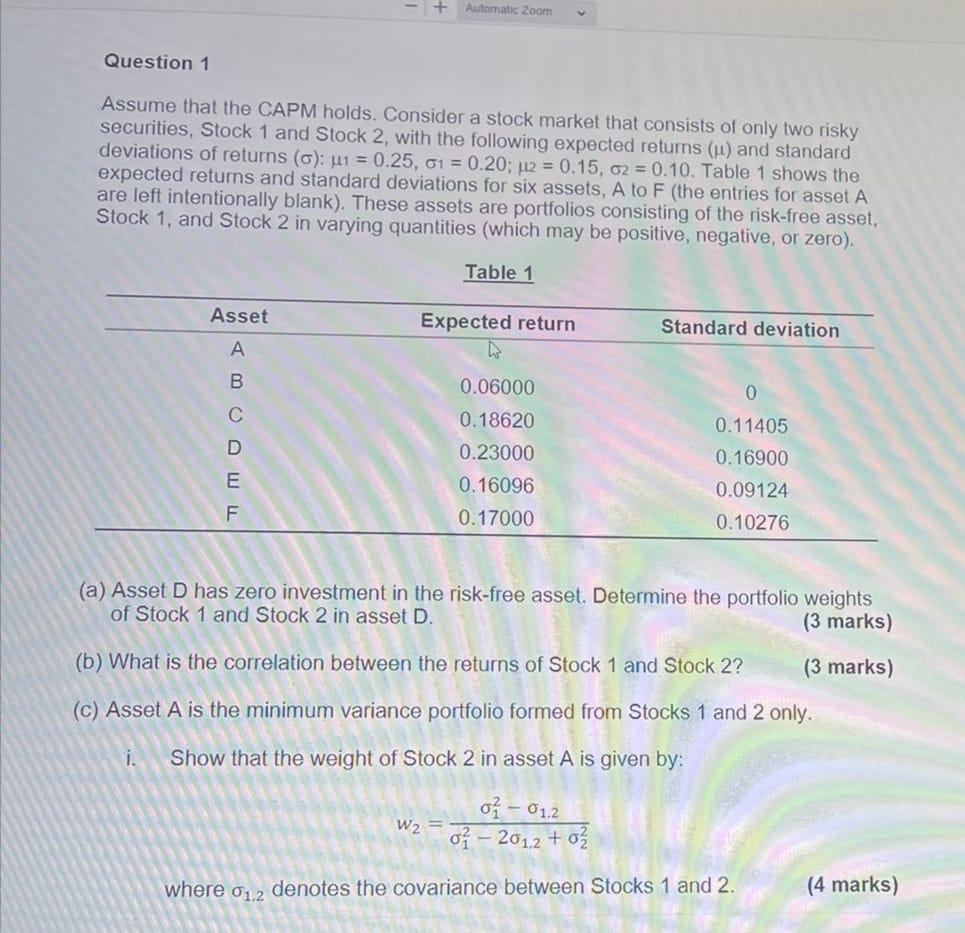

+ Automatic Zoom Question 1 Assume that the CAPM holds. Consider a stock market that consists of only two risky securities, Stock 1 and Stock 2, with the following expected returns (L) and standard deviations of returns (o): ut = 0.25, 01 = 0.20; 112 = 0.15, 02 = 0.10. Table 1 shows the expected returns and standard deviations for six assets, A to F (the entries for asset A are left intentionally blank). These assets are portfolios consisting of the risk-free asset, Stock 1, and Stock 2 in varying quantities (which may be positive, negative, or zero). Table 1 Asset Expected return Standard deviation A B 0.06000 0 - 0.18620 0.23000 0.16096 0.17000 E 0.11405 0.16900 0.09124 0.10276 (a) Asset D has zero investment in the risk-free asset. Determine the portfolio weights of Stock 1 and Stock 2 in asset D. (3 marks) (b) What is the correlation between the returns of Stock 1 and Stock 2? (3 marks) (c) Asset A is the minimum variance portfolio formed from Stocks 1 and 2 only. 1. Show that the weight of Stock 2 in asset A is given by: o - 01.2 W2 of - 2012 + 0 where 01.2 denotes the covariance between Stocks 1 and 2. (4 marks) + Automatic Zoom Question 1 Assume that the CAPM holds. Consider a stock market that consists of only two risky securities, Stock 1 and Stock 2, with the following expected returns (L) and standard deviations of returns (o): ut = 0.25, 01 = 0.20; 112 = 0.15, 02 = 0.10. Table 1 shows the expected returns and standard deviations for six assets, A to F (the entries for asset A are left intentionally blank). These assets are portfolios consisting of the risk-free asset, Stock 1, and Stock 2 in varying quantities (which may be positive, negative, or zero). Table 1 Asset Expected return Standard deviation A B 0.06000 0 - 0.18620 0.23000 0.16096 0.17000 E 0.11405 0.16900 0.09124 0.10276 (a) Asset D has zero investment in the risk-free asset. Determine the portfolio weights of Stock 1 and Stock 2 in asset D. (3 marks) (b) What is the correlation between the returns of Stock 1 and Stock 2? (3 marks) (c) Asset A is the minimum variance portfolio formed from Stocks 1 and 2 only. 1. Show that the weight of Stock 2 in asset A is given by: o - 01.2 W2 of - 2012 + 0 where 01.2 denotes the covariance between Stocks 1 and 2. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts