Question: AutoSave O A A 9 5 . C ... Francisco _Ruelas_Depreciation and Asset Disposal Concept Check Home Insert Draw Page Layout Formulas Data Review View

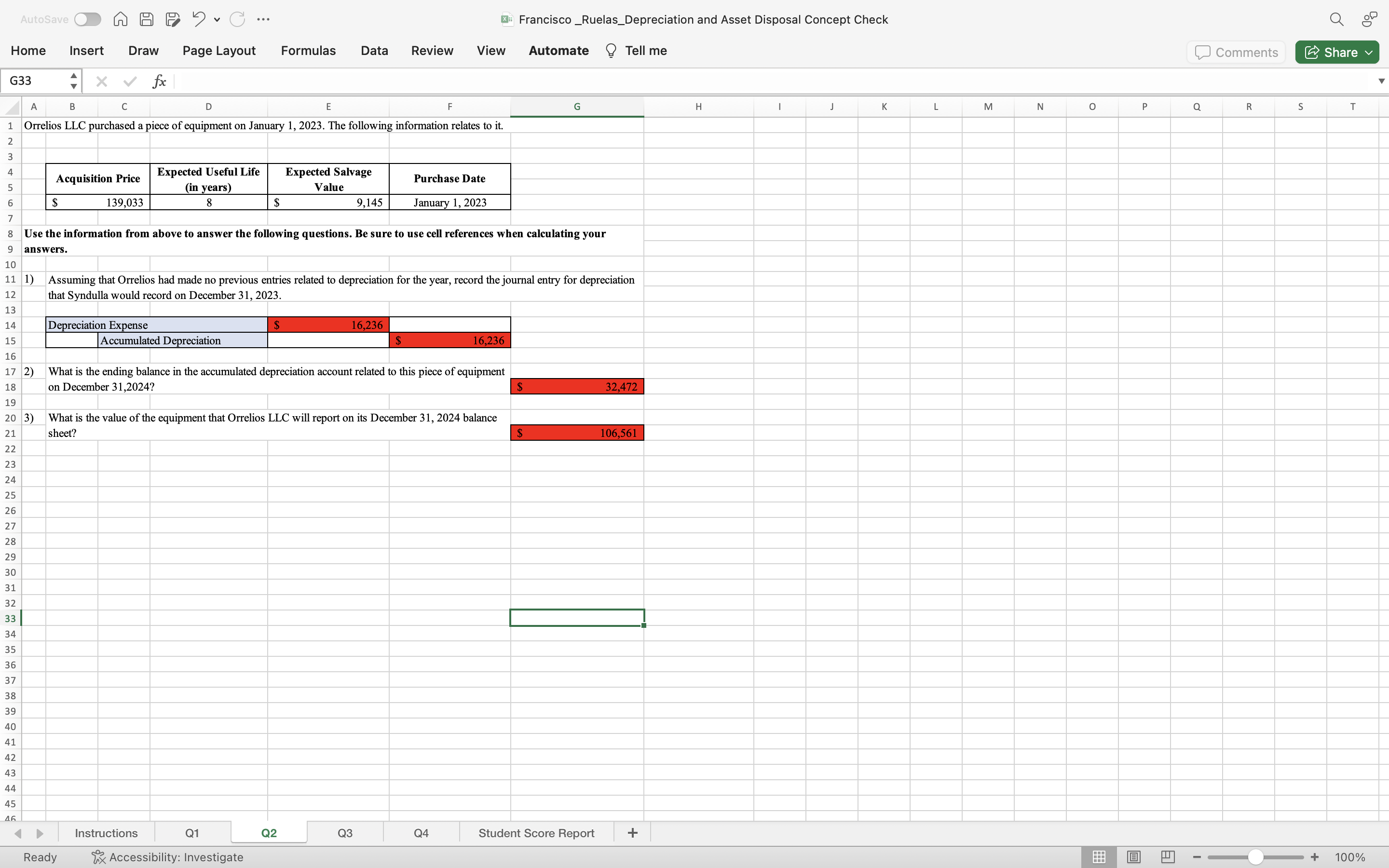

AutoSave O A A 9 5 . C ... Francisco _Ruelas_Depreciation and Asset Disposal Concept Check Home Insert Draw Page Layout Formulas Data Review View Automate ? Tell me Comments Share G33 + X V fx B C D E G H J K L M N 0 P Q R S T Orrelios LLC purchased a piece of equipment on January 1, 2023. The following information relates to it. UI A W N Acquisition Price Expected Useful Life Expected Salvage Purchase Date (in years) Value 139,033 9,145 January 1, 2023 8 Use the information from above to answer the following questions. Be sure to use cell references when calculating your 9 answers 10 1) Assuming that Orrelios had made no previous entries related to depreciation for the year, record the journal entry for depreciation 12 that Syndulla would record on December 31, 2023. 13 14 Depreciation Expense 16,236 15 Accumulated Depreciation 16,236 16 17 2) What is the ending balance in the accumulated depreciation account related to this piece of equipment 18 on December 31,2024? 32,472 19 20 3) What is the value of the equipment that Orrelios LLC will report on its December 31, 2024 balance 21 sheet? 106,561 22 23 24 25 26 27 28 29 30 38 39 40 Instructions Q1 Q2 Q3 Q4 Student Score Report + Ready Accessibility: Investigate + 100%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts