Question: AutoSave OFF 5 = Home View Insert Draw Page Layout Formulas Data Review Calibri (Body) 11 A A = = = BIU CA E Paste

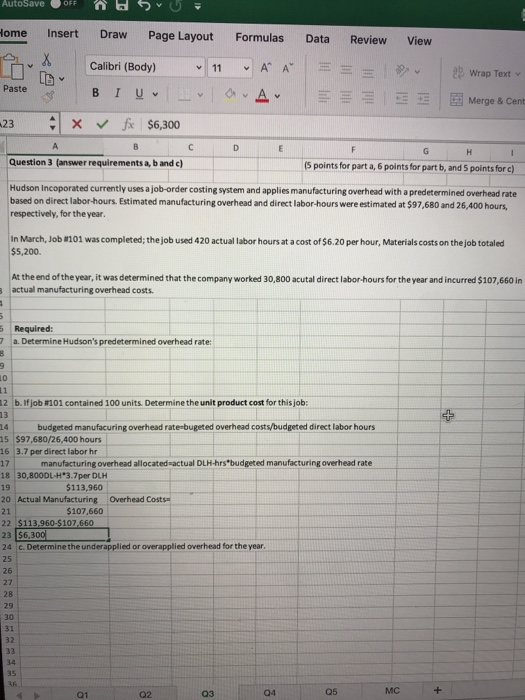

AutoSave OFF 5 = Home View Insert Draw Page Layout Formulas Data Review Calibri (Body) 11 A A = = = BIU CA E Paste 2 Wrap Text Merge & Cent 23 x fx $6,300 A B Question 3 (answer requirements a, b and c) C D (5 points for part a, 6 points for part b, and 5 points for c) Hudson Incoporated currently uses a job-order costing system and applies manufacturing overhead with a predetermined overhead rate based on direct labor-hours. Estimated manufacturing overhead and direct labor hours were estimated at $97,680 and 26,400 hours, respectively, for the year. In March, Job 101 was completed; the job used 420 actual labor hours at a cost of $6.20 per hour, Materials costs on the job totaled $5,200. At the end of the year, it was determined that the company worked 30.800 acutal direct labor hours for the year and incurred $107,660 in actual manufacturing overhead costs. 5 Required: 7a. Determine Hudson's predetermined overhead rate: 12 b. If job #101 contained 100 units. Determine the unit product cost for this job: budgeted manufacuring overhead rate-bugeted overhead costs/budgeted direct labor hours 15 $97,680/26,400 hours 16 3.7 per direct labor hr manufacturing overhead allocated actual DLH-hrs budgeted manufacturing overhead rate 18 30,800DL-H3.7per DLH $113,960 20 Actual Manufacturing Overhead Costs $107,660 22 $113.960-$107,660 23 $6,300 24 c. Determine the underapplied or overapplied overhead for the year. 19 01 02 03 04 05 MC +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts