Question: Av SE Styles St Pa Question One: Compulsory Mark knows he will need 13,850 in nine years. How much must he deposit today if the

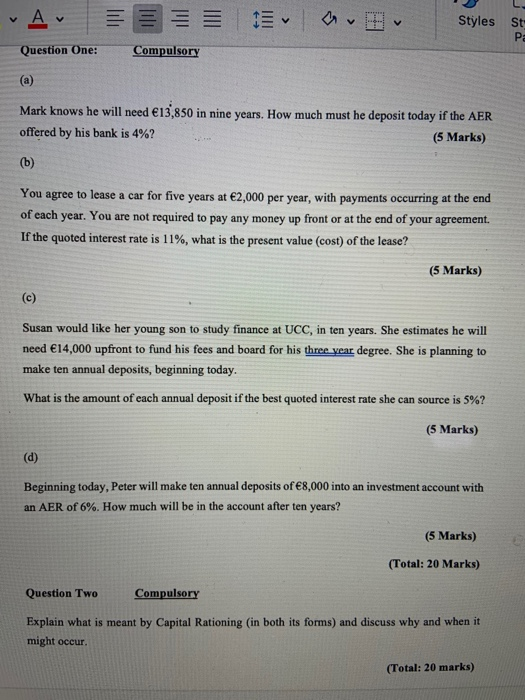

Av SE Styles St Pa Question One: Compulsory Mark knows he will need 13,850 in nine years. How much must he deposit today if the AER offered by his bank is 4%? (5 Marks) (b) You agree to lease a car for five years at 2,000 per year, with payments occurring at the end of each year. You are not required to pay any money up front or at the end of your agreement. If the quoted interest rate is 11%, what is the present value (cost) of the lease? (5 Marks) c) Susan would like her young son to study finance at UCC, in ten years. She estimates he will need 14,000 upfront to fund his fees and board for his three year degree. She is planning to make ten annual deposits, beginning today. What is the amount of each annual deposit if the best quoted interest rate she can source is 5%? (5 Marks) (d) Beginning today, Peter will make ten annual deposits of 8,000 into an investment account with an AER of 6%. How much will be in the account after ten years? (5 Marks) (Total: 20 Marks) Question Two Compulsory Explain what is meant by Capital Rationing (in both its forms) and discuss why and when it might occur. (Total: 20 marks) Av SE Styles St Pa Question One: Compulsory Mark knows he will need 13,850 in nine years. How much must he deposit today if the AER offered by his bank is 4%? (5 Marks) (b) You agree to lease a car for five years at 2,000 per year, with payments occurring at the end of each year. You are not required to pay any money up front or at the end of your agreement. If the quoted interest rate is 11%, what is the present value (cost) of the lease? (5 Marks) c) Susan would like her young son to study finance at UCC, in ten years. She estimates he will need 14,000 upfront to fund his fees and board for his three year degree. She is planning to make ten annual deposits, beginning today. What is the amount of each annual deposit if the best quoted interest rate she can source is 5%? (5 Marks) (d) Beginning today, Peter will make ten annual deposits of 8,000 into an investment account with an AER of 6%. How much will be in the account after ten years? (5 Marks) (Total: 20 Marks) Question Two Compulsory Explain what is meant by Capital Rationing (in both its forms) and discuss why and when it might occur. (Total: 20 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts