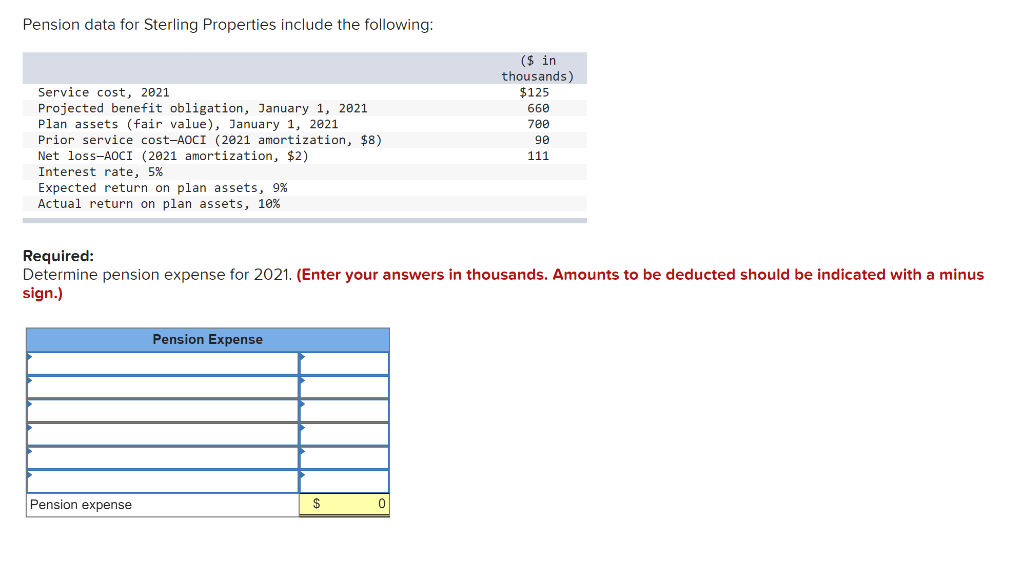

Question: AVAILABLE ACCOUNTS FOR THIS ASSIGNMENT Pension data for Sterling Properties include the following: Service cost, 2021 Projected benefit obligation, January 1, 2021 Plan assets (fair

AVAILABLE ACCOUNTS FOR THIS ASSIGNMENT

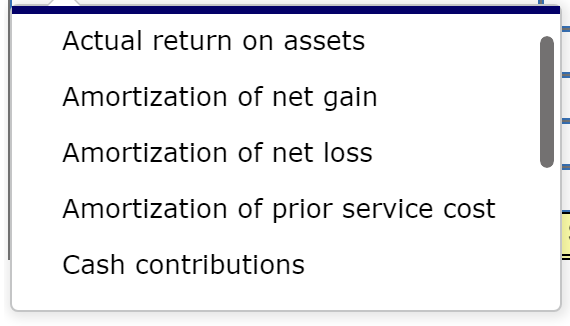

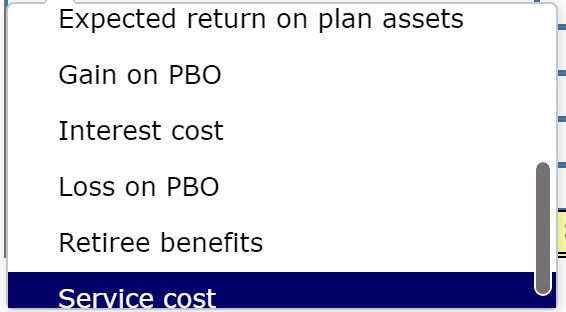

Pension data for Sterling Properties include the following: Service cost, 2021 Projected benefit obligation, January 1, 2021 Plan assets (fair value), January 1, 2021 Prior service cost-AOCI (2021 amortization, $8) Net loss-AOCI (2021 amortization, $2) Interest rate, 5% Expected return on plan assets, 9% Actual return on plan assets, 10% ($ in thousands) $125 660 700 90 111 Required: Determine pension expense for 2021. (Enter your answers in thousands. Amounts to be deducted should be indicated with a minus sign.) Pension Expense Pension expense $ 0 Actual return on assets Amortization of net gain Amortization of net loss Amortization of prior service cost Cash contributions Expected return on plan assets Gain on PBO Interest cost Loss on PBO Retiree benefits Service cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts