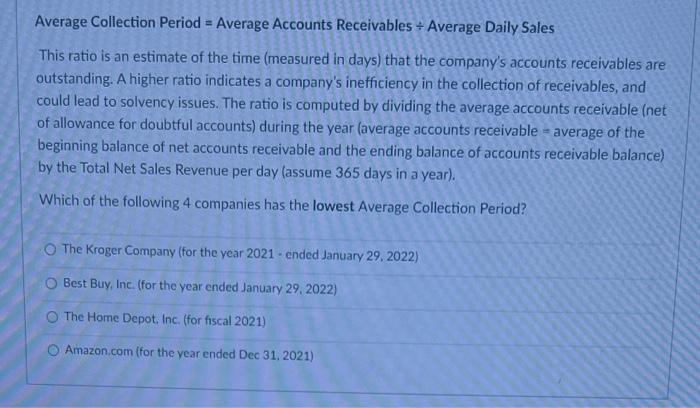

Question: Average Collection Period = Average Accounts Receivables - : Average Daily Sales This ratio is an estimate of the time ( measured in days )

Average Collection Period Average Accounts Receivables : Average Daily Sales

This ratio is an estimate of the time measured in days that the companys accounts receivables are outstanding. A higher ratio indicates a companys inefficiency in the collection of receivables, and could lead to solvency issues. The ratio is computed by dividing the average accounts receivable net of allowance for doubtful accounts during the year average accounts receivable average of the beginning balance of net accounts receivable and the ending balance of accounts receivable balance by the Total Net Sales Revenue per day assume days in a year

Which of the following companies has the lowest Average Collection Period?

Group of answer choices

Walmart Inc. for the year ended January

Exxon Mobile Corporation for the year

Costco Wholesale Corporation for the year ended Aug

Apple, Inc. for the year ended Sep

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock