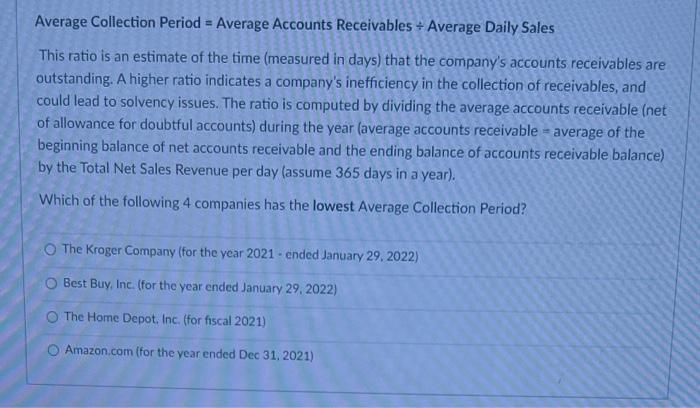

Question: Average Collection Period = Average Accounts Receivables Average Daily Sales This ratio is an estimate of the time (measured in days) that the company's accounts

Average Collection Period = Average Accounts Receivables Average Daily Sales This ratio is an estimate of the time (measured in days) that the company's accounts receivables are outstanding. A higher ratio indicates a company's inefficiency in the collection of receivables, and could lead to solvency issues. The ratio is computed by dividing the average accounts receivable (net of allowance for doubtful accounts) during the year (average accounts receivable = average of the beginning balance of net accounts receivable and the ending balance of accounts receivable balance) by the Total Net Sales Revenue per day (assume 365 days in a year). Which of the following 4 companies has the lowest Average Collection Period? The Kroger Company (for the year 2021 - ended January 29, 2022) Best Buy, Inc. (for the year ended January 29, 2022) The Home Depot, Ine. (for fiscal 2021) Amazon.com (for the vear ended Dec 31, 2021)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts