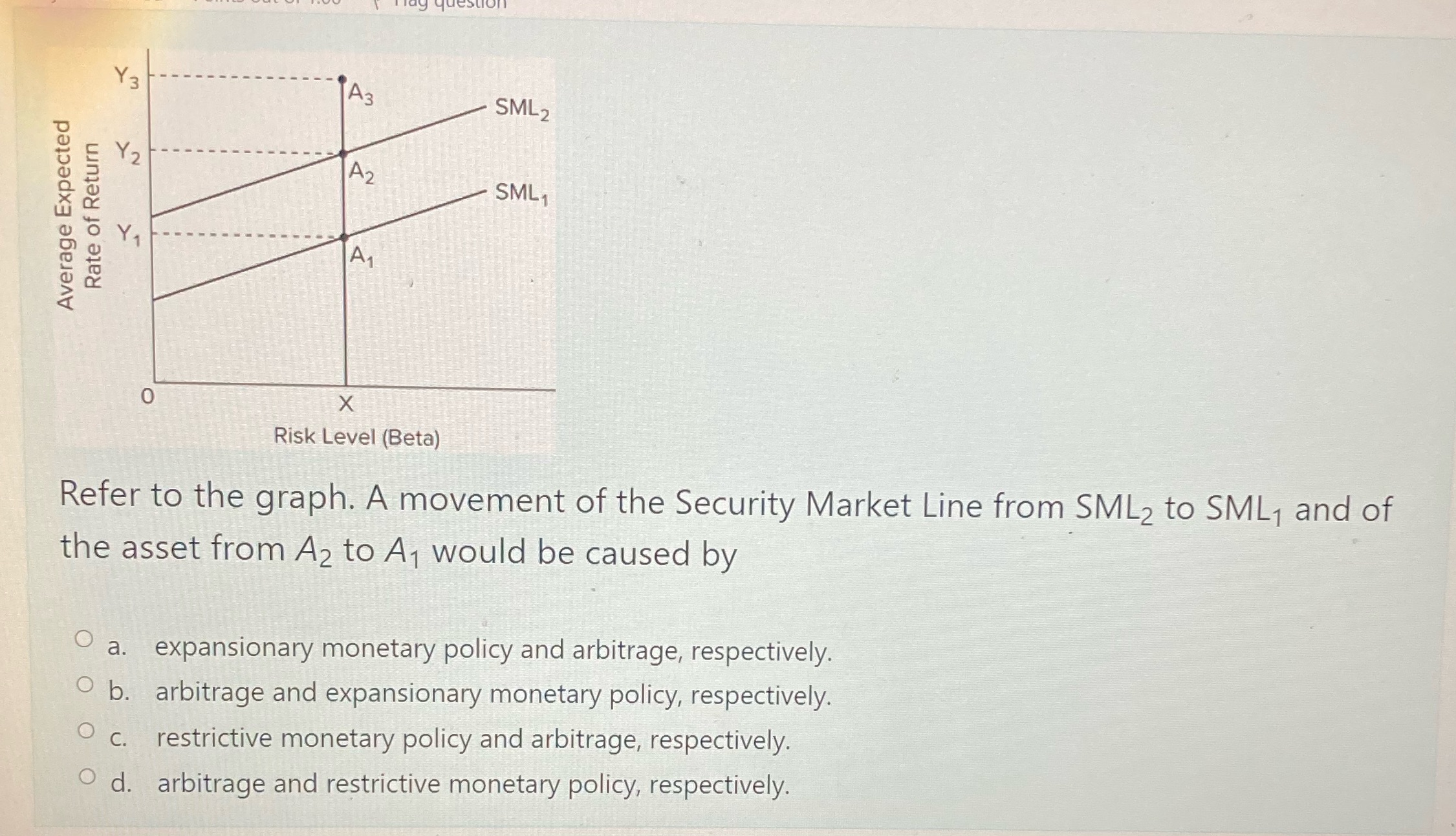

Question: Average Expected Rate of Return Y3 Y 1 0 1 A3 A A X Risk Level (Beta) SML 2 SML Refer to the graph.

Average Expected Rate of Return Y3 Y 1 0 1 A3 A A X Risk Level (Beta) SML 2 SML Refer to the graph. A movement of the Security Market Line from SML to SML and of the asset from A2 to A would be caused by O a. expansionary monetary policy and arbitrage, respectively. O b. arbitrage and expansionary monetary policy, respectively. restrictive monetary policy and arbitrage, respectively. arbitrage and restrictive monetary policy, respectively. O C. O d.

Step by Step Solution

There are 3 Steps involved in it

The detailed answer for the above question is provided below Based on the given informati... View full answer

Get step-by-step solutions from verified subject matter experts