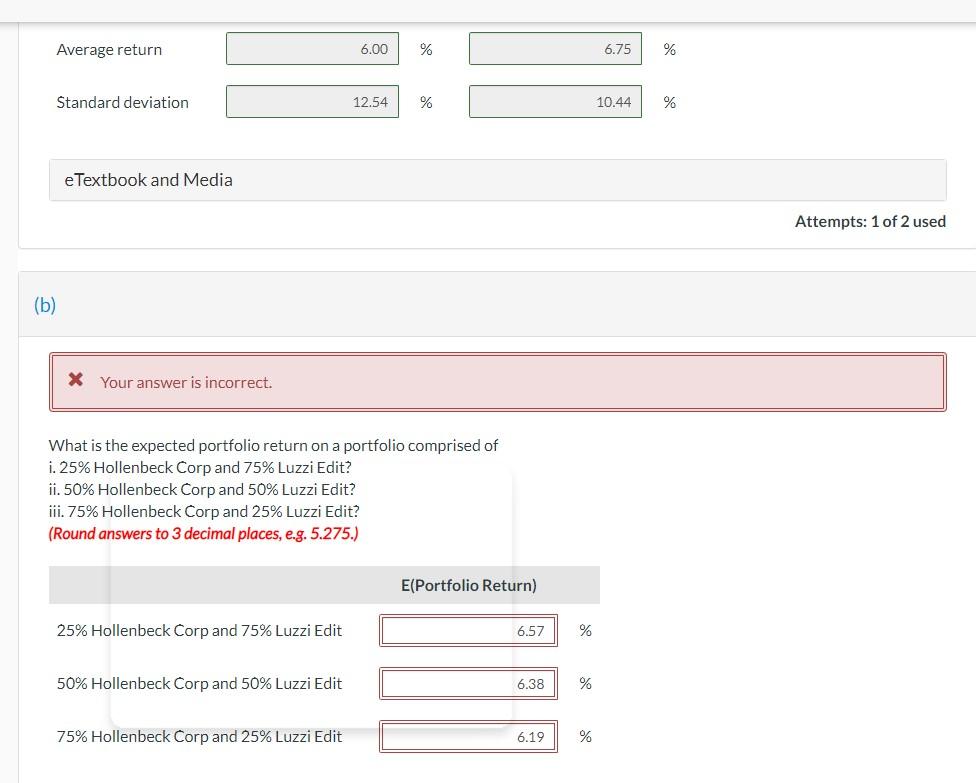

Question: Average return % Standard deviation % eTextbook and Media * Your answer is incorrect. What is the expected portfolio return on a portfolio comprised of

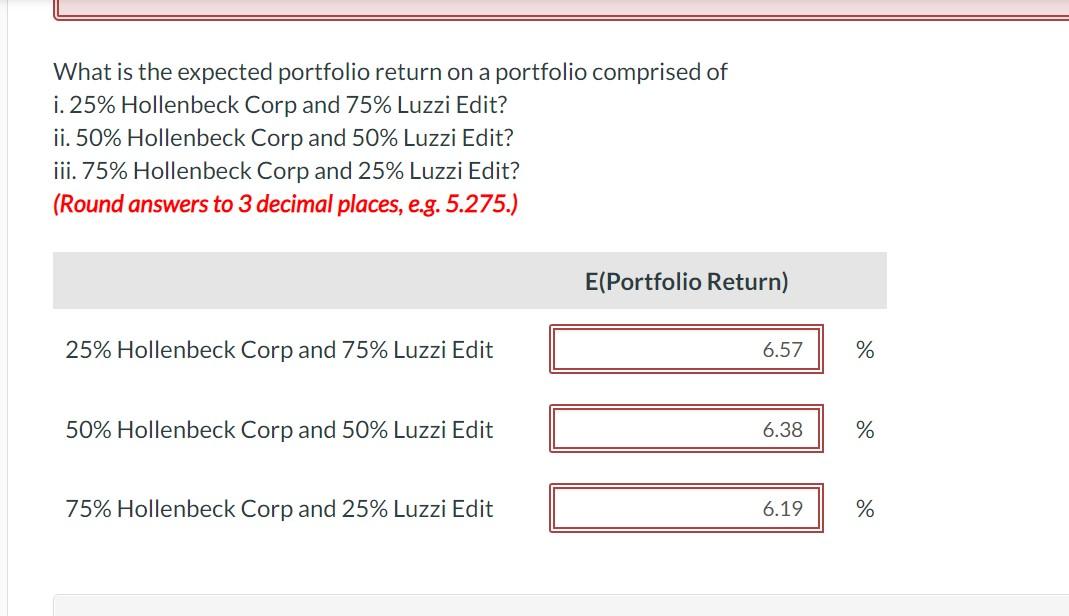

Average return % Standard deviation % eTextbook and Media * Your answer is incorrect. What is the expected portfolio return on a portfolio comprised of i. 25% Hollenbeck Corp and 75% Luzzi Edit? ii. 50% Hollenbeck Corp and 50% Luzzi Edit? iii. 75% Hollenbeck Corp and 25% Luzzi Edit? (Round answers to 3 decimal places, e.g. 5.275.) E(Portfolio Return) 25% Hollenbeck Corp and 75% Luzzi Edit 6.57 50% Hollenbeck Corp and 50% Luzzi Edit 6.38 75% Hollenbeck Corp and 25% Luzzi Edit 6.19 (b) 6.00 12.54 % % % 6.75 % 10.44 % Attempts: 1 of 2 used What is the expected portfolio return on a portfolio comprised of i. 25% Hollenbeck Corp and 75% Luzzi Edit? ii. 50% Hollenbeck Corp and 50% Luzzi Edit? iii. 75% Hollenbeck Corp and 25% Luzzi Edit? (Round answers to 3 decimal places, e.g. 5.275.) E(Portfolio Return) 25% Hollenbeck Corp and 75% Luzzi Edit 6.57 50% Hollenbeck Corp and 50% Luzzi Edit 6.38 75% Hollenbeck Corp and 25% Luzzi Edit 6.19 % % % Average return % Standard deviation % eTextbook and Media * Your answer is incorrect. What is the expected portfolio return on a portfolio comprised of i. 25% Hollenbeck Corp and 75% Luzzi Edit? ii. 50% Hollenbeck Corp and 50% Luzzi Edit? iii. 75% Hollenbeck Corp and 25% Luzzi Edit? (Round answers to 3 decimal places, e.g. 5.275.) E(Portfolio Return) 25% Hollenbeck Corp and 75% Luzzi Edit 6.57 50% Hollenbeck Corp and 50% Luzzi Edit 6.38 75% Hollenbeck Corp and 25% Luzzi Edit 6.19 (b) 6.00 12.54 % % % 6.75 % 10.44 % Attempts: 1 of 2 used What is the expected portfolio return on a portfolio comprised of i. 25% Hollenbeck Corp and 75% Luzzi Edit? ii. 50% Hollenbeck Corp and 50% Luzzi Edit? iii. 75% Hollenbeck Corp and 25% Luzzi Edit? (Round answers to 3 decimal places, e.g. 5.275.) E(Portfolio Return) 25% Hollenbeck Corp and 75% Luzzi Edit 6.57 50% Hollenbeck Corp and 50% Luzzi Edit 6.38 75% Hollenbeck Corp and 25% Luzzi Edit 6.19 % % %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts