Question: 1. Rates of Return 1) Arithmetic average return: rn = (ri+ r2+ r3...+ m) /n 2) Geometric average return: g, = [(1 +ri)(1 +

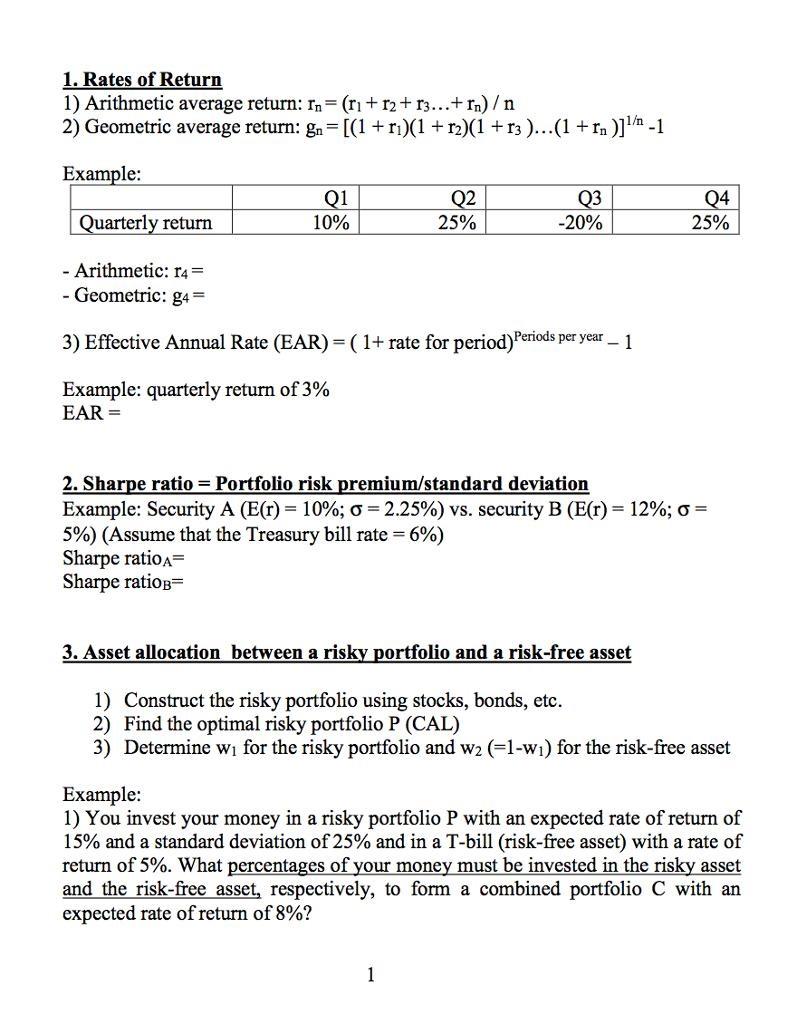

1. Rates of Return 1) Arithmetic average return: rn = (ri+ r2+ r3...+ m) /n 2) Geometric average return: g, = [(1 +ri)(1 + r2)(1 +r3 )...(1 + rn )]n -1 Example: Q1 Q2 25% Q3 Q4 Quarterly return 10% -20% 25% - Arithmetic: r4 = - Geometric: g4 = 3) Effective Annual Rate (EAR) = ( 1+ rate for period) Periods per year- 1 Example: quarterly return of 3% EAR = 2. Sharpe ratio = Portfolio risk premium/standard deviation Example: Security A (E(r) = 10%; o= 2.25%) vs. security B (E(r) = 12%; o = 5%) (Assume that the Treasury bill rate 6%) Sharpe ratioA= Sharpe ratiop= 3. Asset allocation between a risky portfolio and a risk-free asset 1) Construct the risky portfolio using stocks, bonds, etc. 2) Find the optimal risky portfolio P (CAL) 3) Determine wi for the risky portfolio and w2 (=1-w1) for the risk-free asset Example: 1) You invest your money in a risky portfolio P with an expected rate of return of 15% and a standard deviation of 25% and in a T-bill (risk-free asset) with a rate of return of 5%. What percentages of your money must be invested in the risky asset and the risk-free asset, respectively, to form a combined portfolio C with an expected rate of return of 8%? 1

Step by Step Solution

3.37 Rating (153 Votes )

There are 3 Steps involved in it

1 Arithmetic return ... View full answer

Get step-by-step solutions from verified subject matter experts