Question: Axys Ltd is trying to finalize a dividend policy for its shareholders. Two different options have been proposed by the management team: 1) A

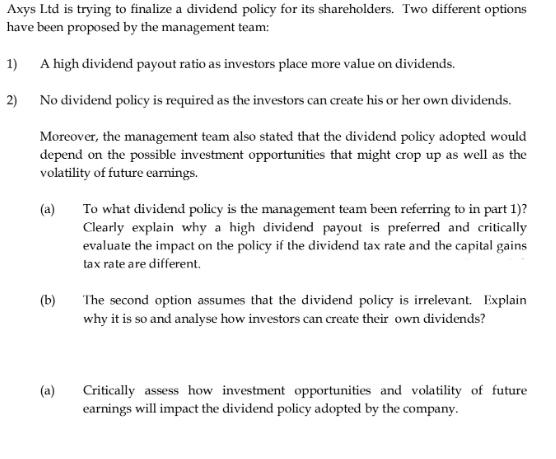

Axys Ltd is trying to finalize a dividend policy for its shareholders. Two different options have been proposed by the management team: 1) A high dividend payout ratio as investors place more value on dividends. 2) No dividend policy is required as the investors can create his or her own dividends. Moreover, the management team also stated that the dividend policy adopted would depend on the possible investment opportunities that might crop up as well as the volatility of future earnings. (a) (b) (a) To what dividend policy is the management team been referring to in part 1)? Clearly explain why a high dividend payout is preferred and critically evaluate the impact on the policy if the dividend tax rate and the capital gains tax rate are different. The second option assumes that the dividend policy is irrelevant. Explain why it is so and analyse how investors can create their own dividends? Critically assess how investment opportunities and volatility of future earnings will impact the dividend policy adopted by the company.

Step by Step Solution

3.44 Rating (163 Votes )

There are 3 Steps involved in it

a The management team is referring to a high dividend payout ratio in part 1 which means that the company would pay out a high percentage of its incom... View full answer

Get step-by-step solutions from verified subject matter experts