Question: B. 11 C. 10.5 D. 13.5 21. Continue from the previous questions, if the fraction of the asset portfolio invested in the zero-coupon bonds is

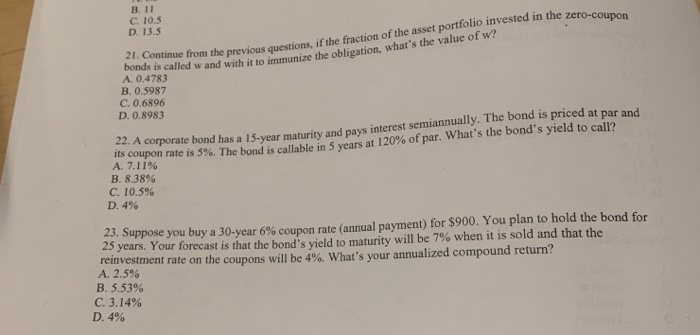

B. 11 C. 10.5 D. 13.5 21. Continue from the previous questions, if the fraction of the asset portfolio invested in the zero-coupon bonds is called w and with it to immunize the obligation, what's the value of w? A. 0.4783 B. 0.5987 C. 0.6896 D. 0.8983 22. A corporate bond has a 15-year maturity and pays interest semiannually. The bond is priced at par and its coupon rate is 5 %. The bond is callable in 5 years at 120% of par. What's the bond's yield to call? A. 7.11% B. 8.38% C. 10.5 % D. 4% 23. Suppose you buy a 30-year 6% coupon rate (annual payment) for $900. You plan to hold the bond for 25 years. Your forecast is that the bond's vield to maturity will be 7 % when it is sold and that the reinvestment rate on the coupons will be 4 %. What's your annualized compound return? A. 2.5 % B. 5.53% C. 3.14% D. 4%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts