Question: b) (11 marks) - Need help with Lifetime cost analysis of skinny-bar with a proposed selling price ONLY. I have shared calculations from requirement 1

b)(11 marks) - Need help with Lifetime cost analysis of skinny-bar with a proposed selling price ONLY. I have shared calculations from requirement 1 and part a of this question for reference.

Need help for a lifetime cost analysis of Skinny-Bar and propose a selling price for this new product based on BBCC's markup policy. The overhead costs, the batch size, the machine hours per batch, the number of inspections per batch, set up times and the number of product lines should be based on the activity-based analysis prepared in requirement 1 using the batch size for the The-Bar product. Direct labour hours per batch is 22.5. Product costs are based on one product line. Lifetime research and development costs are $900,000 for the Skinny-Bar. Use the activity rates calculated in requirement 1 as well. Compare the proposed price with the selling price set at the time of the initial introduction of this product. Discuss the adequacy of this new proposed price.

Activity Based analysis from Requirement - 1

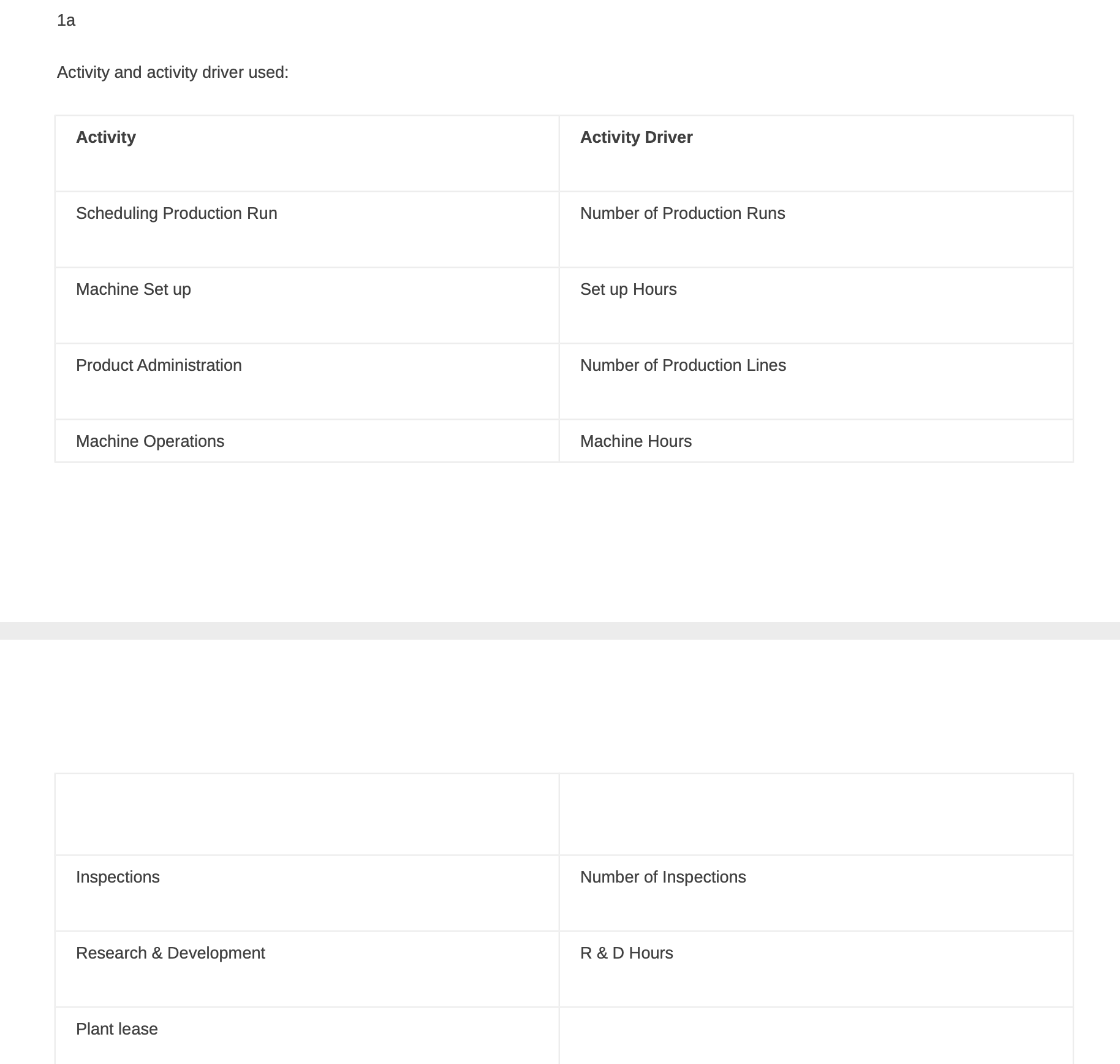

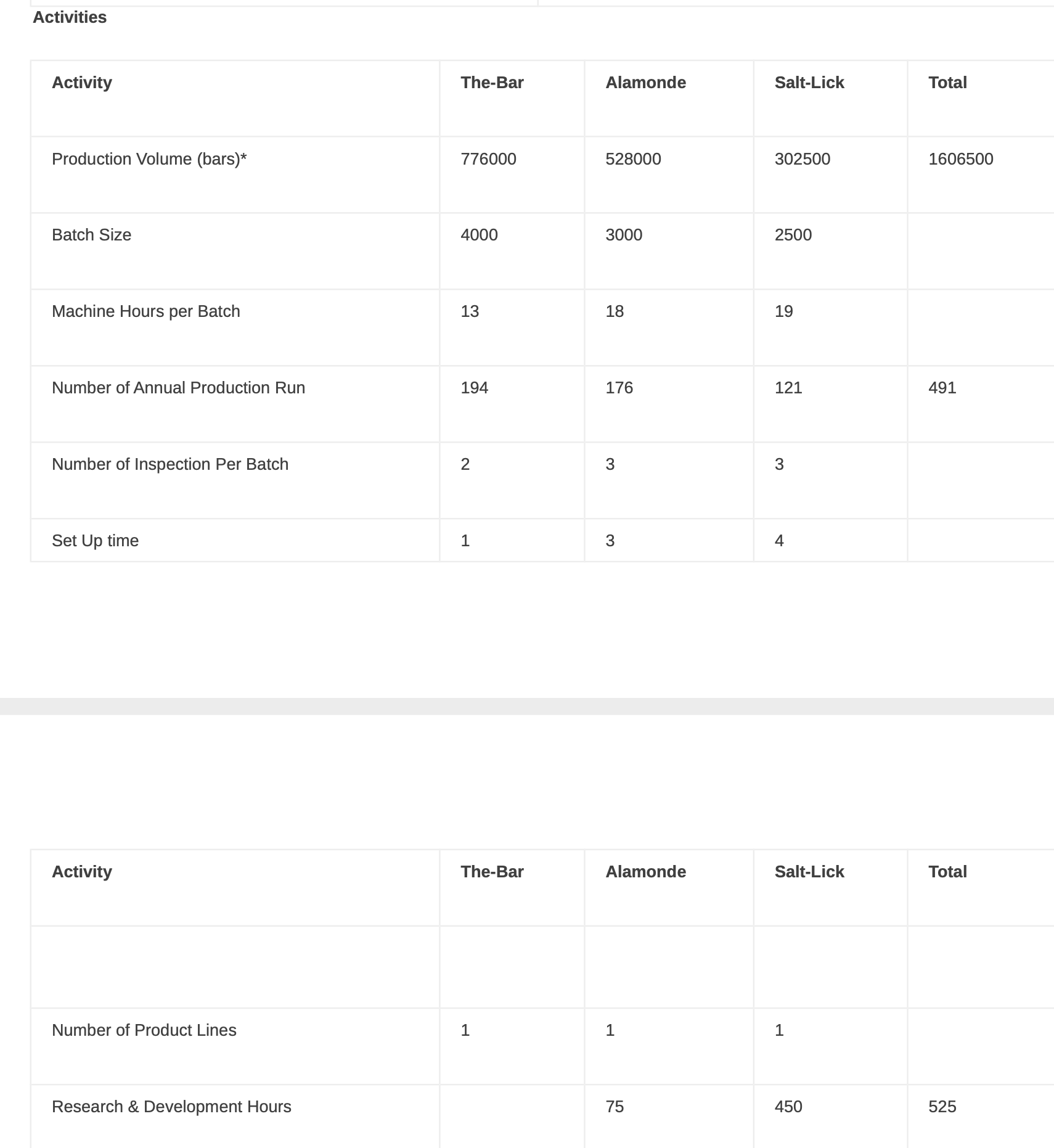

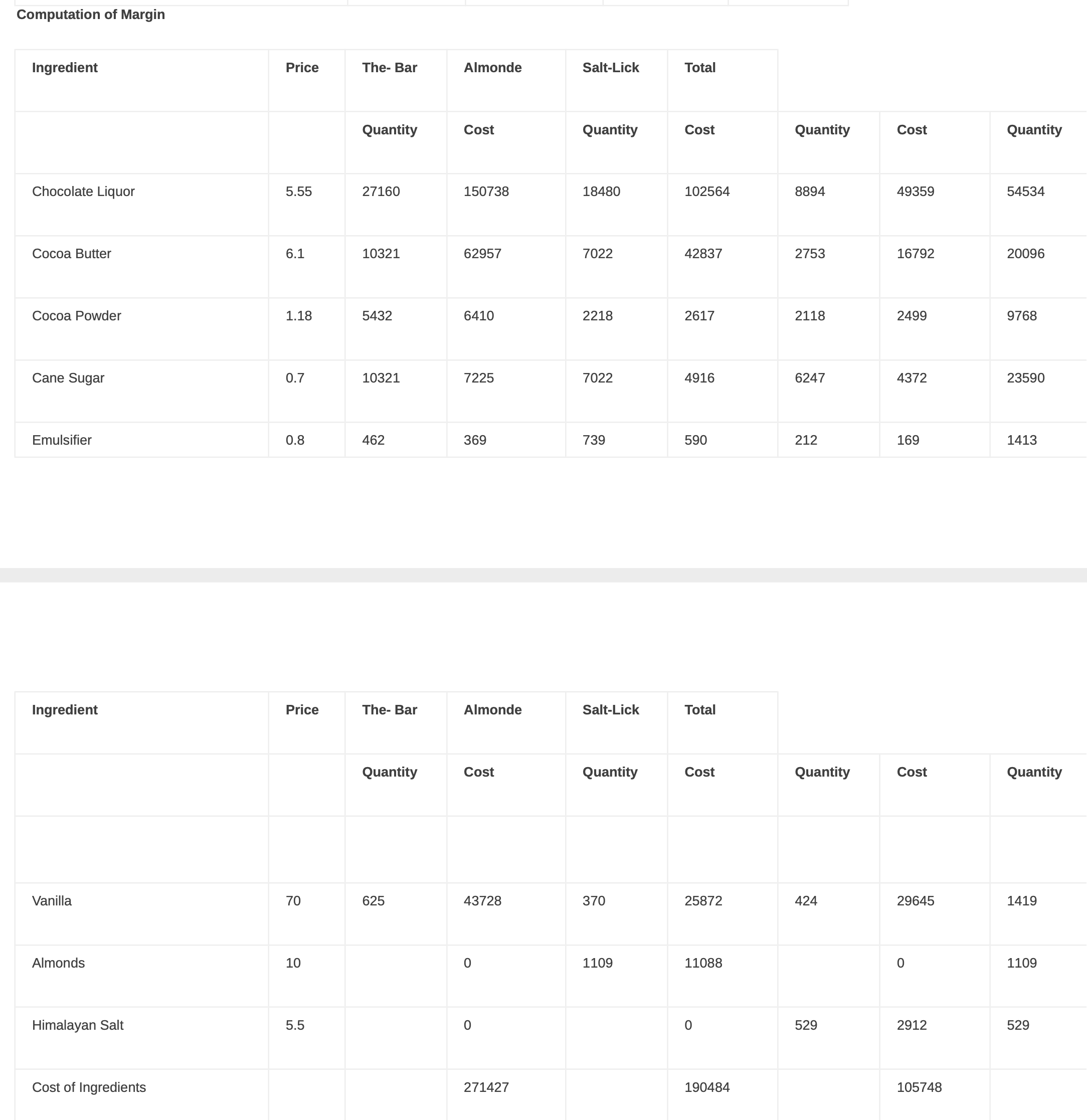

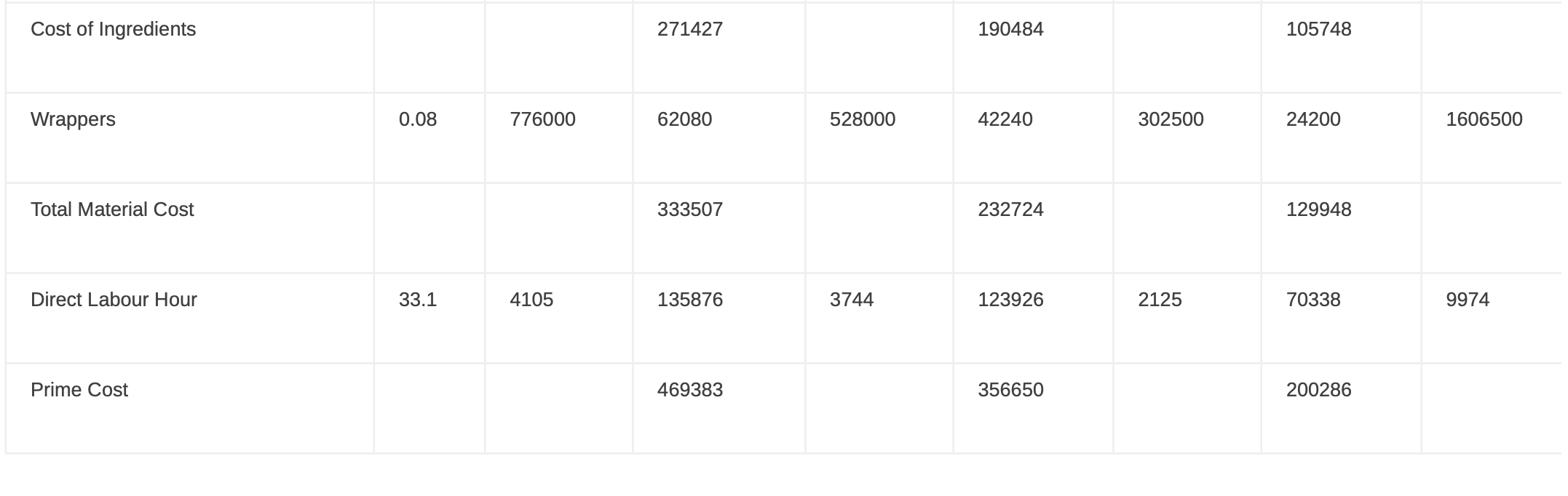

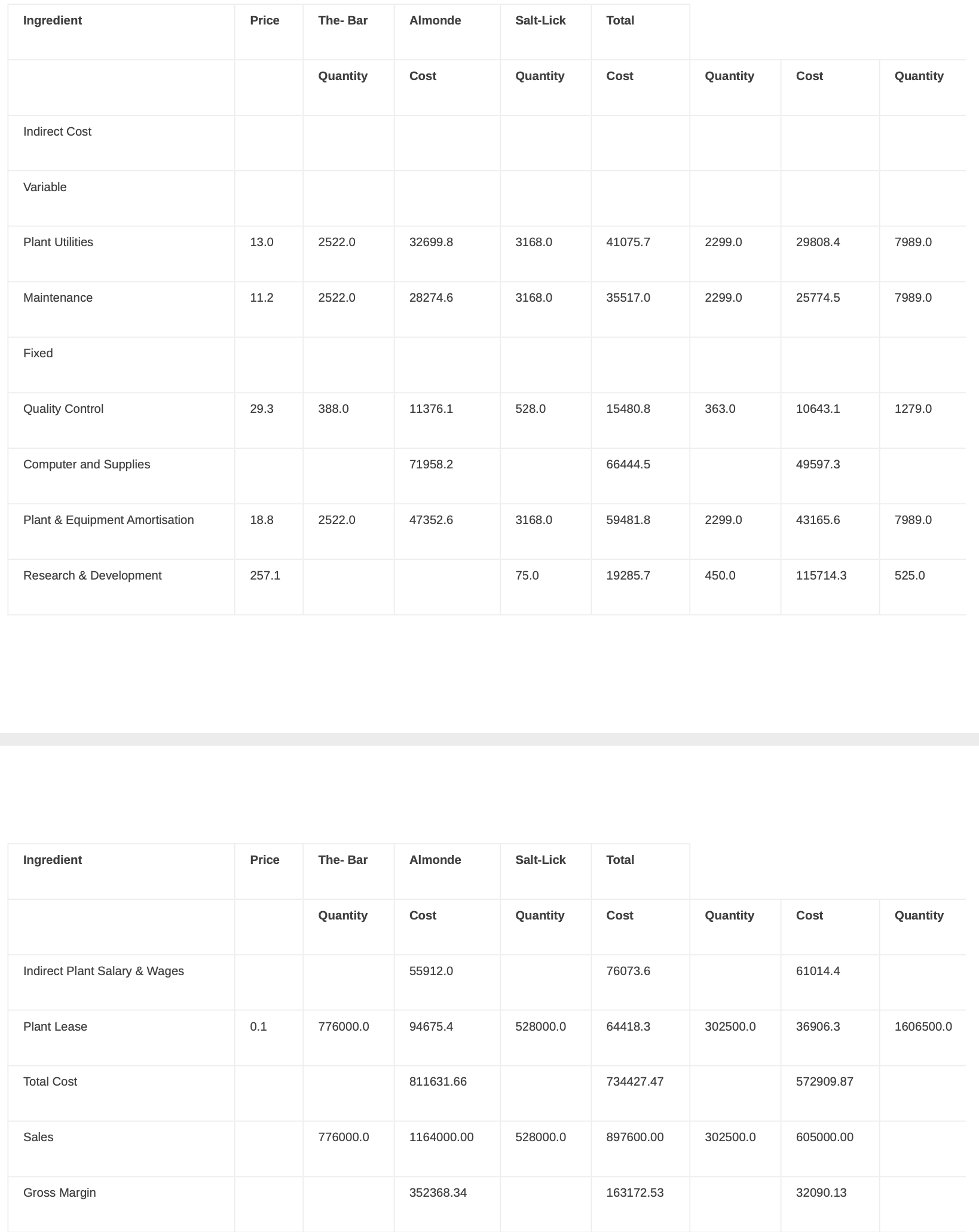

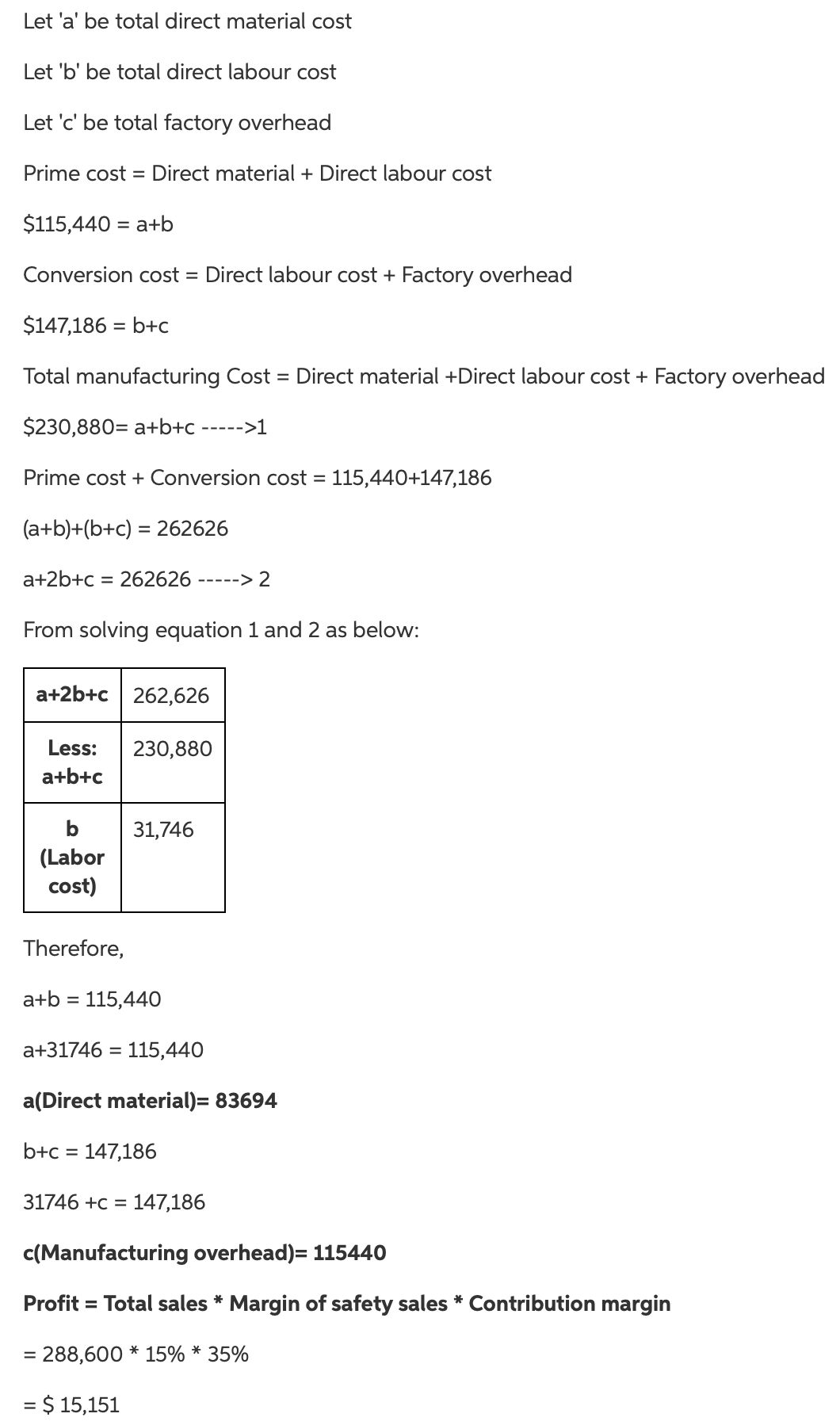

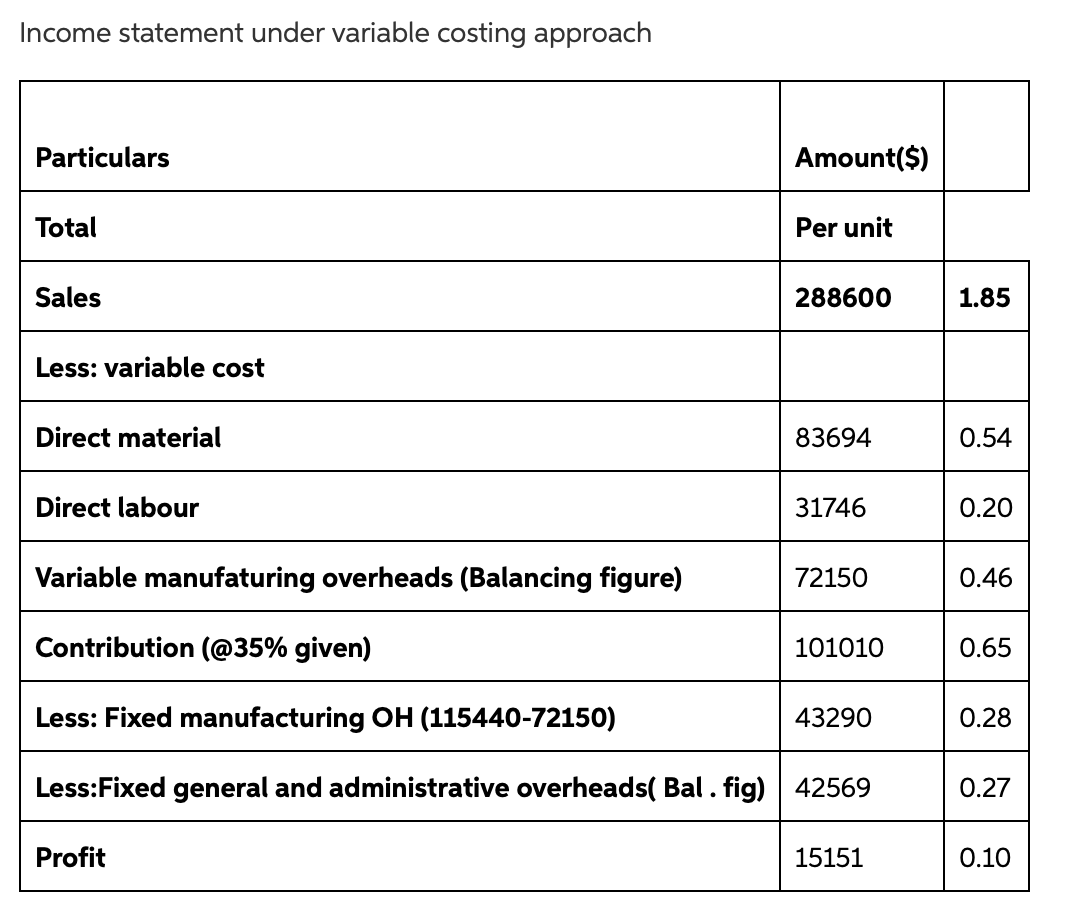

1a Activity and activity driver used: Activity Activity Driver Scheduling Production Run Number of Production Runs Machine Set up Set up Hours Product Administration Number of Production Lines Machine Operations Machine Hours Inspections Number of Inspections Research & Development R & D Hours Plant lease Activities Activity The-Bar Alamonde Salt-Lick Total Production Volume (bars)* 776000 528000 302500 1606500 Batch Size 4000 3000 2500 Machine Hours per Batch 13 18 19 Number of Annual Production Run 194 176 121 491 Number of Inspection Per Batch 2 3 3 Set Up time 1 3 4 Activity The-Bar Alamonde Salt-Lick Total Number of Product Lines 1 1 1 Research & Development Hours 75 450 525Computation of Margin Ingredient Price The- Bar Almonde Salt-Lick Total Quantity Cost Quantity Cost Quantity Cost Quantity Chocolate Liquor 5.55 27160 150738 18480 102564 8894 49359 54534 Cocoa Butter 6.1 10321 62957 7022 42837 2753 16792 20096 Cocoa Powder 1.18 5432 6410 2218 2617 2118 2499 9768 Cane Sugar 0.7 10321 7225 7022 4916 6247 4372 23590 Emulsifier 0.8 462 369 739 590 212 169 1413 Ingredient Price The- Bar Almonde Salt-Lick Total Quantity Cost Quantity Cost Quantity Cost Quantity Vanilla 70 625 43728 370 25872 424 29645 1419 Almonds 10 O 1109 11088 0 1109 Himalayan Salt 5.5 529 2912 529 Cost of Ingredients 271427 190484 105748Cost of Ingredients Wrappers Total Material Cost Direct Labour Hour Prime Cost 008 331 776000 4105 271427 62080 333507 135876 469383 528000 3744 190484 42240 232724 123926 356650 302500 2125 105748 24200 129948 70338 200286 1606500 9974 Ingredient Price The- Bar Almonde Salt-Lick Total Quantity Cost Quantity Cost Quantity Cost Quantity Indirect Cost Variable Plant Utilities 13.0 2522.0 32699.8 3168.0 41075.7 2299.0 29808.4 7989.0 Maintenance 11.2 2522.0 28274.6 3168.0 35517.0 2299.0 25774.5 7989.0 Fixed Quality Control 29.3 388.0 11376.1 528.0 15480.8 363.0 10643.1 1279.0 Computer and Supplies 71958.2 66444.5 49597.3 Plant & Equipment Amortisation 18.8 2522.0 47352.6 3168.0 59481.8 2299.0 43165.6 7989.0 Research & Development 257.1 75.0 19285.7 450.0 115714.3 525.0 Ingredient Price The- Bar Almonde Salt-Lick Total Quantity Cost Quantity Cost Quantity Cost Quantity Indirect Plant Salary & Wages 55912.0 76073.6 61014.4 Plant Lease 0.1 776000.0 94675.4 528000.0 64418.3 302500.0 36906.3 1606500.0 Total Cost 811631.66 734427.47 572909.87 Sales 776000.0 1164000.00 528000.0 897600.00 302500.0 605000.00 Gross Margin 352368.34 163172.53 32090.13Let 'a' be total direct material cost Let 'b' be total direct labour cost Let 'c' be total factory overhead Prime cost = Direct material + Direct labour cost $115,440 = a+b Conversion cost = Direct labour cost + Factory overhead $147,186 = b+c Total manufacturing Cost = Direct material +Direct labour cost + Factory overhead $230,880: a+b+c ----- >1 Prime cost + Conversion cost = 115,440+147,186 (a+b)+(b+c) = 262626 a+2b+c = 262626 ----- > 2 From solving equation 1 and 2 as below: Less: 230,880 a+b+c b 31,746 (Labor cost) Therefore, a+b = 115,440 a+31746 = 115,440 a(Direct material): 33694 b+c = 147,186 31746 +c = 147,186 C(Manufacturing overhead): 115440 Prot = Total sales * Margin of safety sales * Contribution margin = 288,600 * 15% * 35% = $ 15,151 Income statement under variable costing approach Particulars Amount($) Total Per unit Sales 288600 1.85 Less: variable cost Direct material 83694 0.54 Direct labour 31746 0.20 Variable manufaturing overheads (Balancing figure) 72150 0.46 Contribution (@35% given) 101010 0.65 Less: Fixed manufacturing OH (115440-72150) 43290 0.28 Less:Fixed general and administrative overheads( Bal . fig) 42569 0.27 Profit 15151 0.10