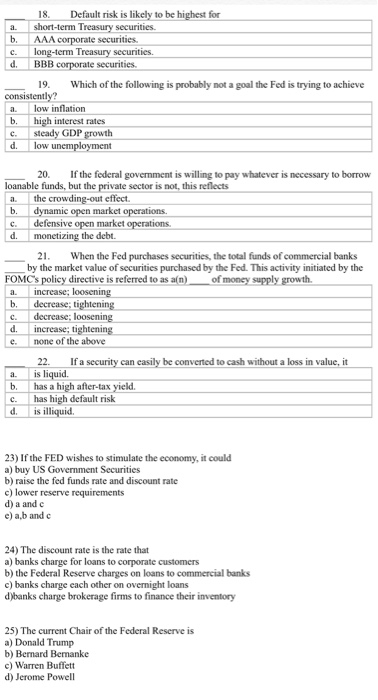

Question: b. 18. Default risk is likely to be highest for short-term Treasury securities AAA corporate securities. c. long-term Treasury securities. d. BBB corporate securities. 19.

b. 18. Default risk is likely to be highest for short-term Treasury securities AAA corporate securities. c. long-term Treasury securities. d. BBB corporate securities. 19. Which of the following is probably not a goal the Fed is trying to achieve consistently? low inflation high interest rates steady GDP growth d. low unemployment b. c d. 20. If the federal government is willing to pay whatever is necessary to borrow loanable funds, but the private sector is not, this reflects the crowding-out effect. b. dynamic open market operations, defensive open market operations. monetizing the debt. 21. When the Fed purchases securities, the total funds of commercial banks by the market value of securities purchased by the Fed. This activity initiated by the FOMC's policy directive is referred to as an) of money supply growth. increase; loosening b. decrease; tightening decrease loosening d. increase; tightening e. none of the above 22. If a security can casily be converted to cash without a loss in value, it is liquid b. has a high after-tax yield has high default risk d. is illiquid. C a c. 23) If the FED wishes to stimulate the economy, it could a) buy US Government Securities b) raise the fed funds rate and discount rate c) lower reserve requirements d) a and c e) a,b and c 24) The discount rate is the rate that a) banks charge for loans to corporate customers b) the Federal Reserve charges on loans to commercial banks c) banks charge each other on overnight loans d)banks charge brokerage firms to finance their inventory 25) The current Chair of the Federal Reserve is a) Donald Trump b) Bernard Beranke c) Warren Buffett d) Jerome Powell

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts