Question: b 6 Multiply line 5 a by 9 2 . 3 5 % ( 0 . 9 2 3 5 ) . If less than

b

Multiply line a by If less than $ enter dotsdotsdotsdotsdotsdots

Add lines c and

Maximum amount of combined wages and selfemployment earnings subject to social security tax or

the portion of the railroad retirement tier tax for

a Total social security wages and tips total of boxes and on

Forms W and railroad retirement tier compensation. If

$ or more, skip lines through and go to line

b

Unreported tips subject to social security tax from Form

line dots

c

Wages subject to social security tax from Form line dots

d

Add lines ab and c

Subtract line from line If zero or less, enter here and on line and go to line dots.

cdots

Multiply the smaller of line or line by

Multiply line by

Selfemployment tax. Add lines and Enter here and on Schedule Form line

or Form SS Part I, line

Deduction for onehalf of selfemployment tax.

Multiply line by Enter here and on Schedule

For Paperwork Reduction Act Notice, see your tax return instructions.

Cat. No

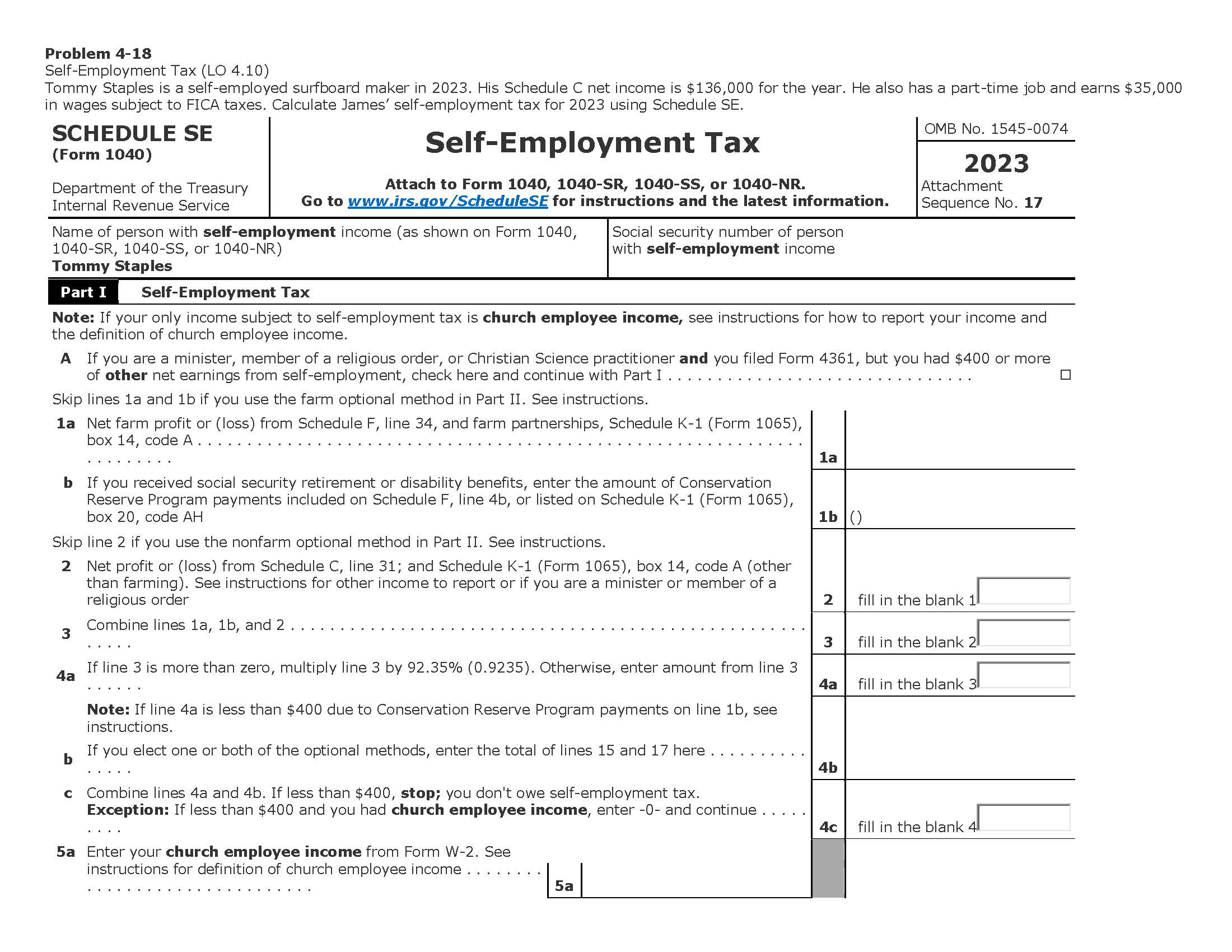

Schedule SE Form Problem

SelfEmployment Tax LO

Tommy Staples is a selfemployed surfboard maker in His Schedule C net income is $ for the year. He also has a parttime job and earns $

in wages subject to FICA taxes. Calculate James' selfemployment tax for using Schedule SE

SCHEDULE SelfEmployment Tax

Department of the Treasury

Attach to Form SRSS or NR

Internal Revenue Service

Go to govScheduleSE for instructions and the latest information.

OMB No

Attachment

Sequence No

Name of person with selfemployment income as shown on Form

Social security number of person

or

with selfemployment income

Tommy Staples

Part I SelfEmployment Tax

Note: If your only income subject to selfemployment tax is church employee income, see instructions for how to report your income and

the definition of church employee income.

A If you are a minister, member of a religious order, or Christian Science practitioner and you filed Form but you had $ or more

of other net earnings from selfemployment, check here and continue with Part I

Skip lines a and b if you use the farm optional method in Part II See instructions.

a Net farm profit or loss from Schedule F line and farm partnerships, Schedule KForm

box code A

b If you received social security retirement or disability benefits, enter the amount of Conservation

Reserve Program payments included on Schedule F line b or listed on Schedule KForm

box code AH

Skip line if you use the nonfarm optional method in Part II See instructions.

Net profit or loss from Schedule C line ; and Schedule KForm box code A other

than farming See instructions for other income to report or if you are a minister or member of a

religious order

Combine lines and

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock