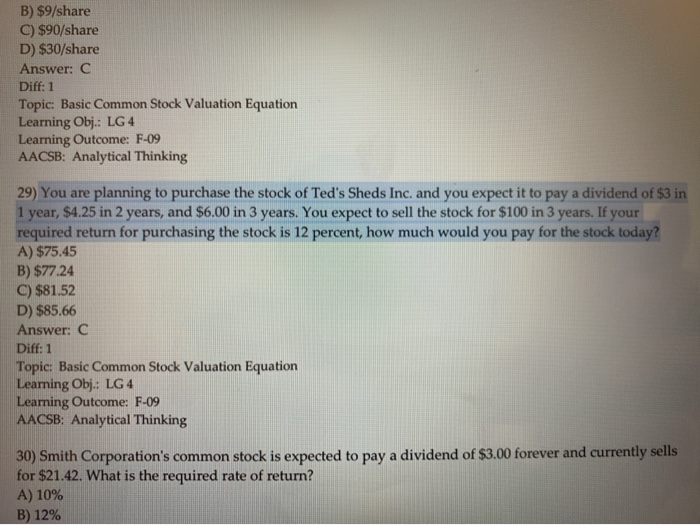

Question: B) $9/share C) $90/share D) $30/share Answer: C Diff: 1 Topic: Basic Common Stock Valuation Equation Learning Obj: LG 4 Learning Outcome: F-09 AACSB: Analytical

B) $9/share C) $90/share D) $30/share Answer: C Diff: 1 Topic: Basic Common Stock Valuation Equation Learning Obj: LG 4 Learning Outcome: F-09 AACSB: Analytical Thinking 29) You are planning to purchase the stock of Ted's Sheds Inc. and you expect it to pay a dividend of $3 in year, $4.25 in 2 years, and $6.00 in 3 years. You expect to sell the stock for $100 in 3 years. If your required return for purchasing the stock is 12 percent, how much would you pay for the stock today? A) $75.45 B) $77.24 C) $81.52 D) $85.66 Answer: C Diff: 1 Topic: Basic Common Stock Valuation Equation Learning Obj: LG 4 Learning Outcome: F-09 AACSB: Analytical Thinking 30) Smith Corporation's common stock is expected to pay a dividend of $3.00 forever and currently sells for $21.42. What is the required rate of return? A) 10% B) 12%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts